Category: "Banking & Financial Services"

China's central bank injects cash into market

July 28th, 2017China's central bank on Friday continued to pump money into the interbank market via reverse repos to ensure stable liquidity.

The People's Bank of China (PBOC) conducted 100 billion yuan (nearly 15 billion U.S. dollars) of seven-day reverse repos with an interest rate of 2.45 percent, and 40 billion yuan of 14-day reverse repos with an interest rate of 2.6 percent.

Offset by 100 billion yuan of maturing operations, the move resulted in a net injection of 40 billion yuan.

In Friday's interbank market, the overnight Shanghai Interbank Offered Rate, which measures the cost at which banks lend to one another, rose 2.92 basis points to 2.8152 percent.

There was a total of 280 billion yuan of net cash injections for financial institutions from Monday to Friday, down from 510 billion yuan a week ago.

The PBOC has increasingly relied on open-market operations for liquidity, rather than cuts in interest rates or reserve requirement ratios, to maintain a stable money market.

China set the tone of its monetary policy in 2017 as prudent and neutral, keeping an appropriate liquidity level but avoiding excessive injections.

Alipay, WeChat, UnionPay have big plans to gain larger share of growing market

February 8th, 2017Titans clash over mobile payments

The competition in China's mobile payment market is growing tougher with the standardization of China UnionPay's quick-response code technology in December. The head-to-head digital hongbao wars between the two dominant players WeChat and Alipay during the Spring Festival holidays provides one piece of evidence. Behind the cutthroat turf war, both of the platforms have broader ambitions, including creating tailored financial products based on their collections of big data. In the near future, the industry will also be subject to tighter regulations.

It was not so long ago that the red envelopes, or hongbao, that people handed out during the Spring Festival holidays were actual red envelopes.

But over the last few years, many of the red envelopes stuffed with cash have existed only virtually on online payment platforms.

During this year's Spring Festival, a record of 46 billion electronic hongbao were sent and received via Chinese mobile social platform WeChat, which is operated by Tencent Technology Co, the Xinhua News Agency reported on Saturday. The figure was up 43 percent year-on-year.

Internet giants such as Tencent have promoted the use of virtual hongbao to expand their stakes in China's fast-growing mobile payment market, as local shoppers are now using their smartphones to pay for everything from taxi fares to medical expenses.

In 2016, China's third-party payment market is estimated to reach 20.3 trillion yuan ($2.96 trillion), up 45 percent from 2015, according to research firm Enfodesk. It projected that the market will grow by more than 20 percent annually to 33 trillion yuan by 2018.

The huge market base has lured a number of companies, making the turf war for China's mobile payment market more cutthroat.

Early market entrants including WeChat and Alipay, which are run by Tencent and Alibaba respectively, have developed swipe-and-go payment systems based on quick-response (QR) codes. The two companies, which together control more than 70 percent of the market, have strived to secure their predominant position by spending heavily on discounts.

As a result, the use of credit cards has declined, rattling the country's bank card association.

On December 12, 2016, China UnionPay announced its own standards for QR code payments. The move was followed by promotional campaigns involving more than 20,000 stores from December to February, a peak time for shopping.

Latecomer

It is not the first time that China UnionPay stepped up efforts to tap the mobile payment market. In December 2015, the bank card association rolled out its near-field communication (NFC)-based Quick Pass mobile payment tool, which enables consumers to make payments by tapping their smartphones against payment terminals.

But the NFC-based technology was not as popular as QR codes.

"That's probably why UnionPay developed its own QR code last year," said Li Yi, a research fellow at the Internet Research Center under the Shanghai Academy of Social Sciences.

Li was not optimistic that commercial banks would be able to break in. "WeChat and Alipay have a lock on the huge market thanks to an early entrance," he told the Global Times on Monday.

But UnionPay still stands a chance in the mobile payment market because its technology is safer and more trustworthy, Li noted.

An employee from a commercial bank, who preferred not to be identified, agreed. "UnionPay also has an advantage in large payment transactions because WeChat and Alipay are more frequently used in payment of small amount," the bank employee told the Global Times on Monday.

For example, the two digital wallets account for around 80 percent of the mobile payment market which are under 5,000 yuan, according to the employee.

However, Liu Dingding, an independent Internet industry analyst, pointed out that the cooperation between UnionPay and commercial banks is crucial to the bank card association's goal of getting to the top.

Currently, UnionPay and the commercial banks have a "strange bedfellows" relationship, Liu said.

"UnionPay is looking to promote QR code with banks, but the logistics behind major banks' moves are different - they seek to expand the user base of their own mobile applications so that they can engage with clients directly, which means banks may also cooperate with WeChat and Alipay if UnionPay's promotion has not achieved their desired result," Liu told the Global Times on Sunday.

Broader ambitions

To date, the battles in the mobile payment market between the two tech giants, Alibaba and Tencent, have also intensified.

Head-to-head against WeChat's hongbao-grabbing activities during the Spring Festival, Alipay continued last year's collection of five good fortune games with the introduction of augmented reality technology. Participants can split a 200 million yuan prize by scanning the street-side "fu" signs, or the Chinese character of fortune, that are ubiquitous during the holidays.

To attract users, the two digital wallets are also locked in a competition for offline payment points for businesses such as restaurants, supermarkets and department stores. Therefore, both platforms turned to third-party services providers who specialize in "offline promotion" and merchants services for potential offline business growth.

For example, WeChat announced in April a plan to attract third-party services providers with more than 300 million yuan in investments. Alipay also plans to provide 1 billion yuan in rewards to third-party services providers over the next three years.

But behind the tit-for-tat competition, both Alipay and WeChat have broader ambitions.

One is the collection of big data related to transactions, which enable those platforms to invent and tailor financial services such as marketing strategies, investment and loans to their clients, Liu said.

Tencent has been struggling with how to generate revenues based on its huge consumer bases. In an interview with Caixin magazine in January, Huang Li, director of WeChat Payment, refused to elaborate on the business blueprint for the platform, only noting that the company is considering a strategy "as a whole."

Regulatory controls

In the near future, the country's third-party payment market will face greater regulatory control.

In January, the People's Bank of China (PBC) announced a new regulation that requires third-party payment companies to deposit clients reserve funds in bank accounts that do not generate interest. The new rules are intended to ensure institutions do not put the money into "risky" financial services. It is expected to takes effect in April.

An Alibaba spokesperson refused to comment on the policy's effect on its business. He said that the company "welcomes the policy and will actively impose it."

According to a report published by research firm TrendForce, following the policy implementation, major domestic payment providers, including Alibaba and Tencent, will suffer a blow, as the policy prevents them from using the funds to generate interest income or grow their business.

But Li disagreed. "Large-scale firms do not rely on interest from client funds. So the new measures will only hurt small third-payment firms."

Yet the policy is likely to tip the scales in UnionPay's favor, Li noted.

China's finance industry embraces change

November 10th, 2016

Bank of China chairman Tian Guoli speaks at the Bank of China - Bloomberg Global M&A Summit on Tuesday.

Mergers and acquisitions have accelerated the transformation of China's financial industry, according to leaders in the field.

Vice chairman and president of China Investment Corporation, Tu Guangshao told the Bank of China – Bloomberg Global M&A Summit on Tuesday that the sector was changing.

"The expansion from trade finance to acquisition finance will provide a strategic opportunity for development of the Chinese financial sector," Tu said.

"Acquisition finance requires financial institutions to adjust the content of services they provide, improve their product systems, increase the effectiveness of their organizational structures and put risk management well in place," he continued.

Zhu Min, former deputy managing director of the International Monetary Fund, said M&A is a crucial engine for post-crisis economic growth.

He said it will lead the global economy out of the gloom through supply-side restructuring.

In the first half of 2016, the volume of cross-border mergers and acquisitions led by Chinese buyers reached $149.2 billion, exceeding the total volume in 2015. The amount accounted for 23 percent of the total volume of global cross-border M&A, up from 6 percent in the same period last year, according to Tian Guoli, chairman of Bank of China.

"As the cross-border M&A by Chinese companies has entered a new stage, it is pushing forward the transformation and upgrading of China's financial sector," he said.

Bank of China has established an investment and loan linkage mechanism via diversified platforms and has 600 branches in 47 countries and regions.

"During the process of promoting industrial upgrade through cross-border M&A, Chinese companies should also pay close attention to potential risks to avoid shortsighted, irrational acquisitions that are seeking instant benefits," Tian said.

Certain M&A projects were overpriced and had problems with post-acquisition integration of businesses, he added.

Tens of Thousands of Jobs Go as China’s Biggest Banks Cut Costs

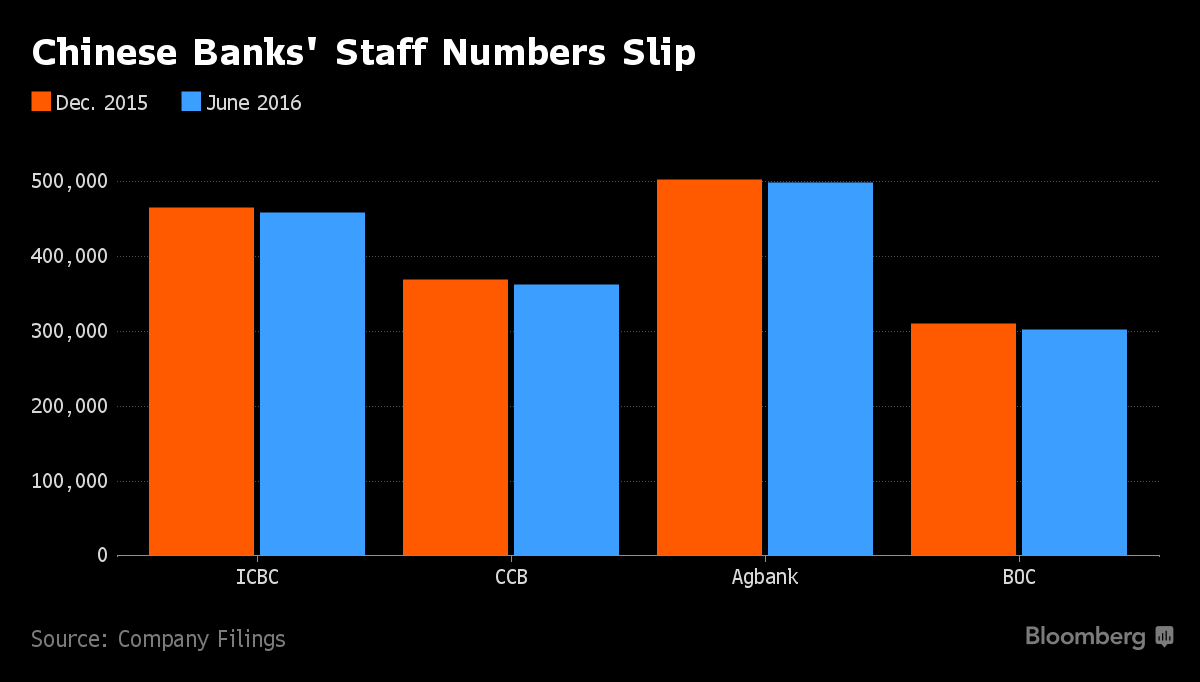

September 12th, 2016China’s four biggest banks reported that staff numbers fell by the most in at least six years in the first half, highlighting the possibility that employment has peaked at the firms that are the world’s biggest providers of banking jobs.

A decline of 1.5 percent from the end of last year left 1.62 million workers at Agricultural Bank of China Ltd., Industrial & Commercial Bank of China Ltd., China Construction Bank Corp. and Bank of China Ltd., earnings filings showed. Agricultural Bank, the No. 1 bank employer, saw its number of employees slip below half a million.

While a fall in the first half is not unusual, the 25,000-job decline is the biggest since at least 2010 and analysts at firms including BOC International Holdings Ltd. and DBS Vickers Hong Kong Ltd. say changes to how banking is done will limit prospects for increases.

“Chinese banks went through years of expansion, adding physical outlets that helped to push their staff numbers to a peak,” said Polar Zhang, a Beijing-based bank analyst at BOC International. He expects the workforce to “dwindle” on technological advances and cost cutting.

Chinese lenders take four of the top five slots for employment by listed banks around the world, ahead of the likes of Wells Fargo & Co., HSBC Holdings Plc, JPMorgan Chase & Co. and Citigroup Inc., data compiled by Bloomberg show. Russia’s Sberbank PJSC is in the top five.

Economic Slowdown

Lenders from Citigroup to Deutsche Bank AG have cut staff and costs in revamps since the global financial crisis.

While Chinese banks have avoided the multi-billion dollar fines for compliance breaches that have weighed on their international counterparts, they’re under pressure from an economic slowdown and a rising quantity of bad loans. Margins are falling as the government deregulates the industry and online and mobile players like Zhejiang Ant Small & Micro Financial Services Group -- also known as Ant Financial -- and Tencent Holdings Ltd. eat into their businesses.

Chinese lenders have generally reduced numbers by not replacing staff who leave, according to Shujin Chen, a Hong Kong-based analyst at DBS Vickers Hong Kong. Workers are departing in search of better pay, she said, adding that banks would need less staff as artificial intelligence and online and mobile transactions played a bigger role and lenders developed robots that would interact with customers.

Besides a reduced number of workers, the first-half data also pointed to pressure on pay. The big four banks’ combined staff compensation costs -- including salaries, bonuses, allowances and post-employment benefits -- fell 2.6 percent from a year earlier. At the mid-sized China Minsheng Banking Corp., the decline was 22 percent.

Flat revenue and rising pressure on asset quality means “banks have been pushing even harder in cost optimization,” Wei Hou, a Hong Kong-based analyst at Sanford C. Bernstein & Co., wrote in a note.

— With assistance by Jun Luo

Banking Layoffs Continue in China as Salaries Slashed in First Half

September 9th, 2016The departures come as the banking industry struggles against strong financial headwinds.

China’s biggest banks have eliminated thousands of jobs in the past six months to June 2016, as the nation’s banking industry, despite avoiding the huge fines for compliance breaches that weighed on their Western peers, has seen a challenging year amid a sluggish economy, lower interest margins and top-down financial reforms.

Big banks in China have announced almost 1.62 million new job cuts this year, and thousands more are expected, as the wave of lay-offs that began in 2013 shows no sign of abating.

So far, 10 out of the 16 listed mainland banks have reported a headcount drop. The top six listed banks, which reported their weakest profit growth in a decade, have cut a combined total of 34,691 jobs in the first half of the year, the semi-annual reports of the banks showed. This marks the biggest scale of employee departure ever recorded in China’s banking sector, which has expanded uninterrupted over the past 10 years.

Salaries are also going down

According to several media reports, many banks have been easing staff for different reasons, with China Merchants Bank scaling back the most, cutting 10 per cent of its workforce. Bank of China said its headcount at the end of June 2016 had decreased by 6,881 to a total of 303,161 employees. Agricultural Bank, the nation’s biggest bank employer, lost 4,023 staff while Industrial and Commercial Bank of China cut back by 7,635. China Construction Bank also shed 6,721 staff to 362,462.

Besides a reduced number of workers, salaries are also going down as Chinese banks’ profits slid 3.5 per cent on the year, while the four state-owned banks reported profit growth below one per cent. In addition, the first-half data showed that Industrial and Commercial Bank of China, Agricultural Bank of China and China Construction Bank reduced their salary expenses, including salaries, bonuses, allowances and post-employment benefits, by 1.6 percent, 2.9 percent, and 2.18 percent respectively.

Compensation structures are generally different in Chinese banks compared to their Western peers. For example, the average annual income for a mid-level banker can typically range between $100,000 to $125,000 while similar international counterparts offer more than double those salaries. They also offer longer holidays and fewer travel curbs, while Chinese staff can only get five days annual leave and must request approval from authorities before being allowed travel abroad.

KPMG listens to graduates and changes hiring process

August 4th, 2016Streamlining its recruitment processes for millennials makes good business sense for KPMG, as it proves the professional services firm has listened to feedback, says a spokesperson.

The comments come after news that KPMG has cut back on its recruitment processes for millennials, as Recruiter reported earlier this week. The firm has condensed its traditional three-stage recruitment process of first interview, assessment centre and final interview into a single day.

KPMG’s new streamlined approach, known as Launch Pad, also enables students to gain new skills, network with existing KPMG staff and partners, as well as their peers.

The firm’s move follows research carried out with market research company High Fliers Research that showed millennials were frustrated by lengthy recruitment processes (34%) and poor communication from their potential employer (43%), with over half complaining they did not receive any feedback when applying for a role.

A KPMG spokesperson told Recruiter in a statement it made good business sense for the firm to listen to views and feedback about graduate recruitment, and transform its practices to show graduates of all ages the firm listens to their feedback and adapts processes.

This is especially important, the spokesperson added, due to the “fierce” competition for the very best graduates, “even more so now big businesses are competing with smaller start-ups as well as their traditional competitors”.

The spokesperson said the new process provides more certainty to candidates about what will happen and when.

“Successful candidates will receive a job offer more quickly so that they can then focus on their studies and university life without needing to attend further interviews.

“There’s also the opportunity to learn a new skill. This will help them to determine whether KPMG is the right fit for them.”

The programme is being rolled out now for 2017 graduate trainees, while the firm will be running Launch Pad recruitment events around the country from October 2016.

Insurers, banks post sharp drops

July 29th, 2016Shanghai stocks ended nearly flat yesterday, with falls seen in financial and insurance firms.

The Shanghai Composite Index edged up 0.1 percent to close at 2,994.32 points.

Banks were vulnerable following investor concerns that curbs on their investment in wealth-management products might restrict capital flow.

China Everbright Bank lost 1.55 percent to 3.82 yuan (57 US cents), and China Merchants Bank shed 1.32 percent to 17.14 yuan.

China Life Insurance Co fell 1.35 percent and Ping An Insurance Group lost 1.04 percent after the China Insurance Regulatory Commission said local insurers' combined profits plunged more than 54 percent in the first half due to lower investment return despite growing premium income.

Airlines gained as oil prices declined, with China Eastern Airlines adding 1.29 percent to 7.01 yuan and China Southern Airlines jumping 1.85 percent to close at 8.54 yuan.

Central bank drains 220 bln yuan from market

May 6th, 2016China's central bank drained 220 billion yuan (33.85 billion U.S. dollars) from the market this week to ensure stable money supply.

This follows a drain of 290 billion yuan from the financial system last week.

The People's Bank of China (PBOC) conducted 360 billion yuan in seven-day reverse repurchase agreements (repo) this week, a process in which central banks purchase securities from banks with an agreement to resell them in the future.

With 580 billion yuan's worth of repos maturing this week, the PBOC ended up draining a net 220 billion yuan from money markets.

On Friday's interbank market, the benchmark overnight Shanghai Interbank Offered Rate (Shibor), which measures the cost at which Chinese banks lend to one another, was down by 0.1 basis points to 2 percent.

The Shibor for seven-day loans fell 0.3 basis point to 2.326 percent. The Shibor for three-month loans dropped 0.2 basis point to 2.894 percent.

China’s Haier to Buy GE Appliance Business for $5.4 Billion

January 15th, 2016By LAURIE BURKITT, JOANN S. LUBLIN And DANA MATTIOLI

Updated Jan. 15, 2016 5:17 a.m. ET

BEIJING— General Electric Co. agreed to sell its appliance unit for $5.4 billion to Chinese manufacturer Haier Group, which is looking to expand its products into homes around the world.

GE and Haier announced the deal Friday, saying the companies will cooperate world-wide to expand their reach in health care, advanced manufacturing and the industrial sectors.

The deal will help Haier sell refrigerators, washing machines and other appliances that are already popular in China overseas after years of struggling to gain a stronger foothold in the U.S. and elsewhere. Haier said it will have the rights to use the GE brand for appliances for 40 years.

The acquisition also enables GE to focus on its industrial business—jet engines and power turbines instead of washing machines and even finance.

“Haier has a good track record of acquisitions and of managing brands,” GE’s chairman and chief executive officer Jeff Immelt said in a news release. “Haier has a stated focus to grow in the U.S., build their manufacturing presence here, and to invest further in the business.”

Advertisement

Qingdao Haier Co., a Shanghai- listed company in which Haier owns 41%, will acquire the GE appliance unit, Haier said. It said the deal “establishes a model for cross-border investment and cooperation between China and the United States.”

The deal, which values GE Appliances at 10 times the last 12 months of earnings before interest, taxes, depreciation and amortization, according to GE, was reported earlier by The Wall Street Journal.

It marks the third major overseas acquisition by Chinese companies this week.

RELATED

China’s Haier Nears Deal to Buy GE Appliance Business

A consortium of investors including China National Chemical Corp. on Sunday agreed to buy KraussMaffei Group for 925 million euros ($1 billion), one of the largest Chinese takeovers of a German company. Two days later, Chinese conglomerate Dalian Wanda Group Co. agreed to acquire production and finance company Legendary Entertainment for $3.5 billion in cash, the largest China-Hollywood deal to date.

GE has been running an auction for the century-old appliance business since it abandoned a $3.3 billion sale to Sweden’s Electrolux AB in December. The U.S. Justice Department had sued to block that transaction, saying the combination of the two companies would hurt competition for cooktops and ranges. Haier is unlikely to face the same antitrust hurdles as Electrolux because of its small presence in the U.S.

In seeking a fresh buyer, GE executives wanted “a better deal” than they had gotten from Electrolux, one person familiar with the matter said. GE also stands to receive a $175 million breakup fee from Electrolux.

The Chinese appliance maker outbid other foreign corporate bidders for the Louisville, Ky.-based business, according to a person close to the deal.

Haier has struggled to compete in the U.S. While it calls itself the biggest appliance maker in terms of unit sales, Haier is mainly known in the U.S. for niche products such as compact refrigerators and window air-conditioning units.

The privately held company has also been expanding its range of products and retail partners in the U.S. Last August, Haier said it would invest $72 million to expand its 15-year-old refrigerator plant in Camden, S.C.

The GE transaction, however, will vault the Chinese company past Electrolux and other rivals in the U.S. market for white goods, which is currently led by Whirlpool. Sales for the GE Appliances and Lighting division, of which appliances is the lion’s share, were $8.4 billion in 2014.

Haier held talks with GE in 2008 to buy the U.S. firm’s appliance unit. In 2010, a Haier executive said the company didn’t buy at the time because the price for the unit was too high. Haier also made an unsuccessful bid for Maytag Corp. in 2004, but lost out to Whirlpool.

Since then, Haier has been vying for more U.S. retail partners, tapping major advertising agencies in an effort to become a household name. Haier held a 29.8% market share of major household appliance sales in China last year, compared with 5.6% in the U.S., according to market research firm Euromonitor.

For Haier, which had $32.6 billion in revenue world-wide in 2014, growth overseas is critical. Profit margins from the company’s refrigerators and washing machines in China are razor-thin due to increased competition at home, where online shopping has sparked price wars, pushing down prices in the electronics and appliances sector.

Another drag on business is that fewer people in China are buying new homes and thus need fewer new appliances.

The deal will broaden Haier’s customer base and distribution channels. It will also sharpen its credibility in the U.S., where “Chinese brands are perceived as low quality,” said Klaus Meyer, a business professor at China Europe International Business School in Shanghai.

Based in China’s northeastern coastal city of Qingdao, Haier is one of China’s legacy state-owned enterprises. Haier’s chief executive, Zhang Ruimin, was the general manager when the company started in 1984 as a successor to a loss-making refrigerator factory that had been opened in 1949, when Chairman Mao Zedong founded modern China.

Mr. Zhang, now 67, has become somewhat of a legend in business circles back home, building a no-nonsense demeanor when he, as newly appointed chairman in 1985, grasped a sledgehammer, smashing a faulty refrigerator to demonstrate zero tolerance for shoddy products at the factory.

Within his first decade as chairman, he transformed Haier, creating China’s largest appliance maker and becoming the first businessman appointed to China’s Central Committee, one of the Communist Party’s highest decision-making bodies.

Mr. Zhang built the brand by investing in a cartoon in the 1990s called the “Haier Brothers,” creating mascots that generations in China came to recognize long after the airing of the more than 200 episodes. Today, Haier has become one of the China most valuable brands, worth $1.9 billion in 2015, according to media agencies Millward Brown and WPP, which calculated the value using the company’s financial data and consumer survey data.

GE Appliances will keep its headquarters in Louisville, Ky, the companies said.

Haier said in a statement to the Shanghai Stock Exchange if the deal ceases due to failure to obtain approvals from antitrust regulators, Chinese regulators or Qingdao Haier’s shareholders, Qingdao Haier will be required to pay $200 million to $400 million to GE as compensation.

GE’s assets Haier is acquiring had a book value of 1.84 billion dollars as of the end of 2014.

—Ted Mann in New York and Rose Yu in Shanghai contributed to this article.

17 banks have fund-manager licenses revoked

December 24th, 2015The China Banking Regulatory Commission has revoked the private fund-manager licenses of 17 commercial banks, over what sources said were legal concerns.

A person close to the CBRC said on Wednesday the specific reason could be that they had violated certain conditions under the Law on Commercial Banks, which does not allow lenders to operate integrated securities investment operations.

Instead, they have to set up subsidiary companies to engage in the business, but only after undergoing close government examination and approval.

The 17 are believed to include China Everbright Bank, Ping An Bank, SPD Bank, China Minsheng Bank, Bank of Ningbo, Bank of Beijing and China Zheshang Bank.

Five of these banks registered departmental general managers with the Asset Management Association of China as their qualified private fund managers, while the 12 others named their chairmen, according to Caixin Media.

Nine of the banks applied as securities investment managers, four as private equity investment firms, and four as other types of investment operations.

All private equity and securities investment funds are required to register with the Asset Management Association to gain licenses.

The Asset Management Association declined to comment on the issue.

Huang Peng, a partner at Beijing-based Guantao Law Firm, said commercial banks conducting such investment business remain controversial, both in China and overseas.

Some have suggested that banks running simultaneous lending and investment operations could increase the risk of moral hazard, while others have said it is feasible, as long as different departments manage the businesses separately.

Anbang raises bank stake

January 27th, 2015Anbang Insurance Group Co raised its stake in China Minsheng Banking Corp Ltd to 19.28 percent last week, according to a disclosure published on Monday by the Hong Kong Stock Exchange.

For Anbang, which is spending more on real estate and financial services investments, it was the ninth share increase in the country's biggest private lender over the last three months.

China Minsheng shares gained 1 percent in Shanghai trading to close at 10.49 yuan ($1.75). The stock has gained about 70 percent over the last three months.

In December 2014, the Beijing-based insurer raised its stake in Chinese property firm Financial Street Holdings Co to 20 percent, while increasing its shareholding in China Merchants Bank Co Ltd to 10 percent.

Big five banks plan bond sales to boost capital

August 15th, 2014

A Bank of China branch in Yichang, Hubei province. China's top five banks will raise 128 billion yuan ($20.8 billion) over a two-week period.

China's top five banks will raise 128 billion yuan ($20.8 billion) in a two-week bond offering spree following a yearlong hiatus, as regulators signal a willingness for lenders to aggressively tap fixed-income markets.

The country's banking regulator began phasing in new higher capital adequacy requirements last year, in line with global rules known as Basel III, and aggressive implementation of the third Basel accord is a key element of China's plan to fortify banks against risks from a slowing economy.

China Construction Bank Corp and Agricultural Bank of China Ltd, the country's second and third-largest banks, respectively, have announced plans to raise 50 billion yuan worth of Basel III-compliant Tier 2 capital via domestic bond issues on Friday.

Bank of Communications Co Ltd, the country's fifth-biggest lender, plans to raise 28 billion yuan on Monday.

The issues follow two large offerings last week, the first from the country's top five banks since early 2013 and China's transition to Basel III.

Industrial and Commercial Bank of China Ltd and Bank of China, the country's largest and fourth-largest lenders, together offered 50 billion yuan of bonds last week.

The flurry of offerings shows Chinese regulators have signed off on the giant deals despite their potential drain on market liquidity, and are comfortable with the new Basel III-compliant bond structure, sources told IFR Asia, a Thomson Reuters publication.

China's economy showed further signs of softening in July despite a burst of government stimulus measures, and banks have tightened lending to risky areas such as the property sector.

The government embarked on a massive credit-fueled economic stimulus program from 2008 to 2010 to pull the economy through the global financial crisis. Many analysts expect a large portion of bank loans extended during that time to turn sour.

The fundraising spree still leaves China's top lenders lagging regional counterparts.

Asian banks (excluding Japan and Australia) have raised more than $32 billion in Basel III compliant securities to date, which includes $26 billion issued in 2014, in local and international markets, according to Moody's data.

Steven Chan, a banking analyst at Maybank Kim Eng, a Singapore-based research firm said the amount being raised was small viewed against the assets of China's top lenders. "It's very small compared with the trillions of assets," he said.

China's big State-owned banks have announced plans to raise $43.5 billion in on- and offshore Tier 2 capital by the end of 2015.

Agricultural Bank of China plans to sell 50 billion yuan of Tier 2 securities, Bank of Communications is in for 40 billion yuan and China Construction Bank for 60 billion yuan. ICBC is eyeing a total of 60 billion yuan, while Bank of China will make a play for the same.

All that makes for a total of 270 billion yuan in Basel III compliant bonds that will hit the market - more than from any other single country.

Lenders are issuing to replace old-style Tier 2 bonds that are about to mature and hold yields down, Chan said.

"If you don't repay bondholders, the yield will increase automatically, so the best way is to issue bonds at a similar or lower rate to repay the earlier one."

A total of 93 billion yuan of subordinated bonds from China's commercial banks will mature next year, according to China Central Depository & Clearing, a State-owned clearinghouse for onshore bonds.

China unveils support for insurance industry

August 14th, 2014The Chinese government on Wednesday unveiled measures to develop the insurance industry, vowing to raise premium incomes to 5 percent of GDP by 2020.

The package, announced on the State Council website, let the insurance industry play a bigger role in the fledgling social security network.

The second of its kind since 2006, the package could see citizens paying an average of 3,500 yuan (565 U.S. dollars) per capita in premiums by 2020.

Commercial insurance will become the primary undertaker of individual and household programs and an important supplier of corporate pensions and health insurance.

The insurance will be given a bigger role in the prevention and relief of disasters and accidents through the introduction of catastrophe insurance products.

Insurance funds will be encouraged to invest in bonds and equities to support major infrastructure projects, urban renewal and urbanization.

The government will encourage the house-for-pension insurance experiment and launch a pilot program to introduce compulsory insurance for environmental pollution, food safety, medical accidents and campus safety.

Zhao Xianghuai, an analyst with Guotai Junan Securities, believes the package will open more space for China's insurance industry, which had a total assets worth 9.4 trillion yuan by the end of June this year.

"The package has elevated the position of the insurance industry and created new room for development," Zhao said.

Boosted by the announcement, Chinese insurers rose across the board on the stock markets, with New China Life Insurance Co., Ltd. leading the gains, up 3.57 percent to 25.27 yuan.

ZTE banks on patents to expand

April 22nd, 2014ZTE Corp, a leading Chinese telecom equipment and smartphone manufacturer, aims to increase its presence in international markets and establish itself as a multinational firm through boosting the number of its patents.

"We've made the development of intellectual property rights our company's core strategy, especially when expanding to overseas markets," said Guo Xiaoming, vice-president of the company, which is based in Shenzhen, Guangdong province.

Guo said that if a company doesn't have a solid foundation in intellectual property rights, it will be very difficult to establish itself in overseas markets, especially in matured markets such as the United States and Europe.

"We've been putting the development of intellectual property rights on top of our company's agenda. We've also been investing heavily in research and development," he told a media briefing on Monday.

Guo said ZTE invests about 10 percent of its annual sales on research and development every year. It has injected more than 40 billion yuan ($6.42 billion) on R&D over the past five years.

According to a report from the World Intellectual Property Organization in March, ZTE filed 2,309 Patent and Cooperation Treaty applications in 2013, becoming the world's second largest patent filer.

Panasonic Corp of Japan – with 2,881 published applications — was the top applicant last year. ZTE was the top applicant in 2011 and 2012, while Panasonic headed the applicants' list in 2009 and 2010.

Rather than the quantity of patents, Guo said ZTE eyes their quality.

"The cost of filing a patent in Western countries is quite high — usually 50,000 to 80,000 yuan for each application. We only file those inventions that have the biggest potential in monetization," he said.

Privately funded banks to be launched

March 12th, 2014Ten private companies will launch five banks that are entirely funded by private capital in Tianjin, Shanghai, Guangdong Province and Zhejiang Province as part of a pilot program, Shang Fulin, head of the China Banking Regulatory Commission, said Tuesday.

The establishment of the private banks, which was approved by the central government in January, is considered a vital step in the country's financial reform and its opening-up of the banking sector to private capital.

Internet giants Tencent Holdings and Alibaba Group will be among the 10 companies approved to participate in the pilot program, Shang said, adding that the five private banks should have differentiated market positioning.

Shang did not provide details about the names of the five banks, or the amount invested in them.

The website of People's Daily quoted Shang as saying on Monday that the 10 companies will also include Fosun International, a real estate conglomerate, and Chint Electrics Co, an electrical equipment maker.

Each bank must have two private investors, Shang said, and they will be allowed to open for business when they have made sufficient preparations.

The private bank that Tencent plans to initiate will specialize in providing products for the burgeoning online finance sector, a staff member of Tencent told the Global Times Tuesday on condition of anonymity.

"Tencent will utilize its advantages in the Internet service industry, and [launch] online financial products based on the services provided by the traditional banking sector," the source said.

The staff member said the bank will be located in Qianhai, a district of Shenzhen in South China's Guangdong Province. Qianhai was approved by the State Council in 2010 as a test ground for the free cross-border flow of the yuan and financial innovations.

A staff member of Alibaba, which is a partner in Yu'ebao, one of the country's most popular online money market funds, told the Global Times Tuesday that Alibaba is working with China Wanxiang Holdings Co to apply for a private bank license.

"Now our application materials are still being reviewed," said the staff member, who wished to remain anonymous.

Wanxiang Holdings is part of China's biggest auto parts company Wanxiang Group, which is based in Hangzhou, East China's Zhejiang Province.

The Alibaba source declined to comment on the location or market positioning of the bank.

Dong Dengxin, director of the Finance and Securities Institute at Wuhan University of Science and Technology, told the Global Times Tuesday that the private banks will offer loans of up to 1 million yuan ($162,879) that will mature in less than two years.

The banks' major customers will be those that have difficulty in getting loans from large commercial banks, Dong said, such as small and micro-sized businesses. That is why the new program will not have a disruptive impact on the banking sector or influence the interest rate, he said.

According to Shang, the private banks will be regulated in the same way as large commercial banks, but their performance will be more market-based.

Milestones in opening up to private investment

May 23, 2012 The State Council required sectors including railways, telecoms and banking to draw up detailed rules for encouraging private investment.

May 26, 2012 The China Banking Regulatory Commission (CBRC) said it would encourage greater private investment in the banking sector, without imposing restrictive or other additional conditions.

Jun 19, 2013 The State Council said China should set up private banks and financial lease companies that bear the burden of risk on their own.

Mar 11, 2014 CBRC chief Shang Fulin said China will set up five private banks on a trial basis.

Private banks to be on the rise

January 29th, 2014Since China Minsheng Bank Corp became the first private bank in 1996, the government has not approved any others, although it has allowed a small amount of private capital to be invested in commercial banks. This will soon change as the government opens up the financial sector to private enterprises.

China now has five State-owned commercial banks, three policy banks, 12 joint-stock banks, 144 city commercial banks, 47 foreign capital banks and numerous banks in towns and rural areas. The introduction of private banks will introduce more competition to the industry to the benefit of private businesses strapped for capital.

Until now, the names of more than 40 private bank applicants have gained pre-approval from the State Administration for Industry and Commerce. However, the success of Minsheng, which was founded at a time when loans for small and medium-sized enterprises were relatively undeveloped, is unlikely to be repeated today given the many financial products fighting for customers' attention. Some private banks are bound to fail if they do not have a sound risk-control system.

With the opening up of the banking industry to private capital after 14 years of hiatus. The biggest change in the policy is that private enterprises have seen their status elevated from "equity participator" to "initiator", according to the guidelines issued by the State Council in July that encourages more private capital to enter the financial industry.

Private banks that are filing for approval fall into two categories. First, there are enterprises or business associations that seek easier financing channels for the industry. For instance, Suning Commerce Group Co Ltd, a leading home appliance retailer, was the first listed company to announce its plans to apply for permission to launch a private bank. Other public corporations have also formed groups to create their own private banks.

The second category is more ambitious. This sector is the Internet companies that want to build a line of services on their own financial platforms, such as Tencent Technology (Shenzhen) Co Ltd.

Companies aiming to get a pieces of the pie in private banking cover a wide range of industries including e-commerce, real estate, food, garments, electrical equipment, technology and aviation.

Why does private banking look so enticing?

The Chinese banking industry has been enjoying lucrative profitability. According to the half-year profit statements of 2,467 A-share companies in 2013, the total net profits of the 16 listed banks amounted to 619.1 billion yuan ($102.1 billion). up 13.54 percent from the same period last year, accounting for 54.3 percent of total A-share profits. Although profit margins in banks have been decreasing in recent years, the large net profits still have a great appeal to private businesses.

Private banks can ease the difficulties in financing and acquiring loans by private enterprises. According to a study conducted by Qianzhan Industry Research, a Beijing-based research group, a mere 1.3 percent of small and medium-sized enterprises could conduct direct financing. Others accumulate capital through bank loans and private capitalization. However, because of their relatively low credibility, high management costs and banks' preferences for large-scale companies, only 10 percent of SMEs have access to bank credit. It is predicted that SMEs will need 17.5 trillion yuan in capitalization in 2014.

Possible bankruptcy

Severe competition in the banking sector stands in contrast with the private sector's enthusiasm. The profits in the banking industry are highly concentrated. Among the 16 listed banks, the profits of the top five State-owned banks made up 75.5 percent of the total profits in 2012. The total assets of city commercial banks accounted for a mere 9.4 percent of the total assets held by banking financial institutions.

Experts have been applauding the opening up of the banking sector to private capital. However, there are bound to be risks ahead.

Jin Liqun, chairman of the sovereign wealth fund, China Investment Corp, said some of the private banks are bound to go bankrupt.

State-owned banks are not going to go bust because customers are assured their deposits will be safely managed because the central Party and the government will not cheat their own people, said Jin. Private banks, on the other hand, face the risk of bankruptcy. But people don't have to be overly concerned because development comes with risks, he added.

"Deposit insurance needs to be put in place to protect customers' interests in case of bankruptcy," said Jin. "I heard of opposition from large banks that claim the insurance system is nothing but a burden because they are not going to go bankrupt. However, these banks have been given government protection to be exempt from bankruptcy, which attracts customers to put their money into their accounts. What is the cost of establishing an insurance system compared with their vested interests?"

Experts also warn that the current enthusiasm may not pay off.

"Private companies should remain cool-headed before they enter the industry," said Ba Shusong, deputy director-general of the Financial Research Institute of the State Council Development Research Center. He cited a case in Taiwan in which 16 private banks gained approval in 1992, but where only six remain.

Generally speaking, banks see no profits within the first three years after their establishment. Companies should wait until the industry has undergone consolidation before they try their luck.

BEA and DBS open FTZ outlets

January 8th, 2014Bank of East Asia and DBS Bank were the first among overseas lenders that officially opened their sub-branches in the Shanghai free trade zone yesterday, as they were attracted by potential opportunities in China's latest financial reform test bed.

In addition, at least six foreign banks have received the nod from the China Banking Regulatory Commission to prepare for a new outlet in the FTZ. They include Citi, HSBC, Hang Seng Bank, Deutsche Bank, United Overseas Bank and ANZ. The FTZ will allow overseas banks to introduce new services and expand more rapidly in the country, said Geoffrey Choi, assurance leader of financial services at Ernst & Young for China.

Pudong Development Bank earns $6.7b in 2013

January 6th, 2014Shanghai Pudong Development Bank's net profit jumped 19.8 percent year on year to nearly 41 billion yuan ($6.7 billion) in 2013, according to a filing to the Shanghai Stock Exchange late Friday.

The financial institution is the first listed commercial bank in China to disclose its 2013 results, Shanghai Securities News reported on Saturday.

Earnings per share stood at 2.195 yuan, up 19.8 percent from a year ago, according to the statement. Operating revenue stood at just over 100 billion yuan, up 20.61 percent year on year.

The lender's total assets reached 3.68 trillion yuan, up 17 percent from a year earlier. Its total liabilities stood at 3.47 trillion yuan, up 17.1 percent from a year ago.

The lender's non-performing loans ratio was at 0.74 percent, 0.16 percentage points higher than that at the end of 2012.

Its outstanding deposits totaled 2.42 trillion yuan by the end of 2013, up 13.41 percent from a year earlier. Outstanding loans reached 1.77 trillion yuan, up 14.37 percent from the end of 2012.

Bankers concerned over credit risks of SMEs

December 24th, 2013Chinese bankers are concerned about credit risks connected to enterprises that are affected by the nationwide campaigns to eliminate outdated industrial capacity and curb local government financing vehicles, said a report released on Monday.

The report, based on a survey by the Chinese Banking Association and Pricewaterhouse Coopers, which polled 1,604 bankers across 31 provinces and municipalities, said 54.5 percent of the surveyed bankers said they believe adjusting the nation's industrial structures may increase credit risks to China's banking system.

Also, 31.6 percent said they believe that nonperforming loan risks are most likely to involve micro-sized and small enterprise loans. Among the bankers, 61.3 percent said the Yangtze River Delta is most likely to face the pressure of increasing NPLS, since the region is host to micro-sized and small company enterprise hubs, which face systemic risks.

Market insiders said loans to micro-sized and small enterprises have been increasingly disputed in the banking industry. While some lenders think such loans may offer new growth opportunities, others have shunned applications for such loans.

"Leaders of banks are torn over the risks of loans" to smaller companies, said a source with a Shanghai-based, State-owned bank.

On the one hand, governments at various levels encourage support from the financial sector to small enterprises to help them grow, and such loans may indeed help them out during hard times.

On the other hand, it is quite risky to make loans under current conditions. In many cases, the applicants do not have guarantees, and they are seeking unsecured loans, said the source, who declined to be identified due to the sensitivity of the matter.

NPLs have been rising in recent months, and they climbed by the largest amount in the third quarter, according to data from the China Banking Regulatory Commission.

Bad bank loans outstanding increased by 24.1 billion yuan ($3.96 billion) to 563 billion yuan at the end of September. But due to swift overall loan growth in the third quarter, Chinese banks' NPL ratios ticked up only slightly.

The system-wide NPL ratio reached 0.97 percent, compared with 0.96 percent at the end of June, the commission said.

About 43 percent of polled bankers said they have been closely watching the risks exposed to debts of local government financing vehicles.

On Dec 10, the central government announced that the performance evaluation of local government officials will no longer be based primarily on economic growth, but rather on sound financial management.

"The change is credit-positive for local governments as well as the central government, because reduced incentives to promote economic growth at all costs will instill fiscal discipline and curb the rapid rise in contingent, quasi-government debt," said Debra Roane, vice-president and senior credit officer of the sub-sovereign group at Moody's Investors Service in a note.

The new evaluation criteria should lead to greater discipline in borrowing. Local officials will be held accountable for their investment and borrowing decisions, including those related to LGFVs, and their handling of these decisions will be a key factor in promotions, said Roane.

The National Audit Office's initial survey of government debt revealed that LGFV debt alone amounted to 10.7 trillion yuan at the end of 2010, or 27 percent of GDP, of which 6.7 trillion yuan was classified as direct debt of local governments.

Moreover, estimates by the International Monetary Fund show a much greater increase and level of debt operationally outside the general government budget.

Banks to sink or swim with removal of rate caps

December 18th, 2013Deposit and loan margins will likely narrow, though not as much as expected, after the central bank removed a cap on deposit rates as part of its interest rate liberalization, central bank governor Zhou Xiaochuan told Caijing magazine on Tuesday.

Zhou said loan rates likely will rise, along with deposit rates, but uncertainties remain as to whether the rate margin will widen or narrow.

What is certain is that after the liberalization, risk premiums will stay little changed across sectors, and money will be spent more efficiently.

Zhou's comments came after Beijing wrapped up its annual Central Economic Work Conference. A communique issued in the wake of the meeting listed interest rate liberalization as one of the six top economic priorities for next year. In its 60-point blueprint guiding China's reforms over the next decade, Beijing promised the liberalization will be completed by 2020.

The People's Bank of China, the central bank, has been loosening its control over interest rates in recent years as a key part of China's broader market-oriented financial reform. The last remaining control is a ceiling on deposit rates, which analysts believe distorts fund pricing and shelters banks from competition.

The average interest rate margin at Chinese banks was 2.63 percent at the end of September, according to China Banking Regulatory Commission data.

The rate was up slightly over the 2.59 percent seen in the previous quarter.

Zhang Qi, an economist with Haitong Securities Co Ltd, predicted lenders would struggle in the post-liberalization era.

"For lenders, making money will not be as easy," he said.

Zhou said that, barring a crisis, the central bank has no incentive to give financial institutions any special treatment, indicating that it won't shelter banks that are struggling to compete. "In normal times, we hope banks will provide better financial services to the society through competition."

A thinner interest rate margin likely will take a toll on Chinese lenders, whose balance sheets already are laden with bad loans stemming from China's 4 trillion yuan ($654.12 billion) stimulus to save the economy at the height of the financial crisis in 2008.

Chinese banks' share prices already had dropped last year, despite their healthy earnings, as investors feared the effects of interest rate liberalization.

The bank shares' average price-to-earnings ratio, a key measure of valuation, is about 6, compared with 11 in the entire A-share market.

To help the State-owned lenders get through a rough patch, Beijing has been making efforts to strengthen its balance sheets.

In August, Premier Li Keqiang promised to extend a pilot plan to sell bonds backed by bank loans. The bonds will be traded for the first time on exchanges. The move is expected to help banks unload problematic loans.

Last week, China Cinda Asset Management Co Ltd raised 2.5 billion yuan at its listing in Hong Kong, and a bulk of the money will be spent buying up bad assets from the banking industry.

Cinda is one of the four bad debt managers founded in 1999 by Beijing to clear up bad loans from China's State-owned banks. The other three also are expected to raise funds in the near term.

China to inaugurate Shanghai FTZ on Sept. 29

September 25th, 2013China will officially launch the pilot free trade zone (FTZ) in Shanghai on Sept. 29, taking a solid step forward to boost reforms in the world's second-largest economy.

Preparation work is going smoothly, sources with the Shanghai municipal government said on Tuesday.

Covering almost 29 square kilometers, the zone will be created modeled on existing free trade businesses in the country's economic hub -- Waigaoqiao Free Trade Zone, Waigaoqiao Free Trade Logistics Park, Yangshan Free Trade Port Area and Pudong Airport Comprehensive Free Trade Zone.

Chinese Premier Li Keqiang said earlier this month that for the pilot FTZ, a negative list approach will be explored and priority will be given to easier investment and greater openness.

China's legislature has given the green light to the State Council, or the Cabinet, to modify laws related to foreign enterprises in the zone.

As authorized by the National People's Congress Standing Committee, the State Council will suspend administrative approvals covering foreign-funded enterprises, Chinese-foreign equity joint ventures and contractual joint ventures.

The State Council approved the pilot Shanghai FTZ on July 3. In the pilot zone, goods can be imported, processed and re-exported without the intervention of customs authorities.

China Life-AMP JV takes shape

September 4th, 2013Australian fund house AMP Capital could be selling its range of equity, fixed income and multi-asset mutual funds to Chinese investors by February through its new joint-venture with China’s largest insurance company.

AMP will have a 15% stake in the Bejing-based JV, China Life AMP Management, with China Life controllling the remainder. Pending approval from the China Securities Regulatory Commission (CSRC), the JV will begin operations within the next six months, says Anthony Fasso, international CEO and head of global clients for AMP Capital, which oversees A$131 billion ($117.9 billion) in AUM.

Eventually, China Life AMP may consider multiple avenues to invest in the mainland, such as through the qualified foreign institutional investor (QFII) programme, although there are no firm plans at the moment, Fasso tells AsianInvestor.

The firms are focused on receiving authorisation from the CSRC to begin operations in Beijing, he adds.

At the moment, foreign financial institutions can only acquire up to 49% of a JV on the mainland. However, under proposed regulations by the Closer Economic Partnership Arrangement, foreign firms could own over 50% of a JV, allowing them to take a controlling stake.

If passed, this could have a significant impact for firms such as AMP. The firm declined to elaborate on potentially increasing stakes in the future.

“It’s been talked about for some time across many industries but I haven’t seen an update on it,” says Fasso. “We’re happy with the stake we have with the right partner.”

This JV marks the first time a foreign fund house will have partnered a Chinese insurance firm, and follows a new law coming into effect in June allowing mainland insurers to run and sell mutual funds.

Meanwhile, it offer AMP Capital a different means of distribution from the typical channels offered by Chinese banks.

Foreign fund houses seeking to set up an office on the mainland previously partnered with Chinese banks, securities firms or trust companies. The funds are dispensed through the banks’ platforms, which are becoming increasingly crowded.

The big four – Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China and China Construction Bank – account for 70% of fund sales on the mainland.

Insurers, which have large sales forces with both retail and institutional investors, long-term relationships with their clients and extensive data, are an appealing alternative.

“Our mutual funds are primarily aimed at retail investors, so historically they’ve been sold via bank channels,” Fasso says, adding that China Life, with one of the largest distribution platforms in the world, will “open up a broader geographic footprint” for AMP Capital.

“[Chinese insurers] have never sold mutual funds before, so it’s going to take time [before it takes off],” he notes. “But this is a very exciting platform to be involved in.

“Chinese investors are still becoming used to investing in mutual funds. There’s still low penetration. But as they become more sophisticated, they are looking for more choice, particularly around fixed income, equities and multi-asset funds,” Fasso says.

AMP and China Life executives are now working on staffing up the firm’s office in Beijing with executives in sales and marketing, client services, registry and record-keeping, compliance, risk management, finance, operations and regulatory issues.

Once the office is set up with staff later this year, CSRC will do an inspection and then award full authorisation.

Boost for private capital in banking industry

August 14th, 2013Rules remove capital adequacy ratio requirements, limits of equity investment for financial institutions

The Chinese government is loosening its reins on private capital's entry into the banking industry to encourage more lending to small businesses, according to a draft of new rules released by the China Banking Regulatory Commission.

In a statement dated Aug 9, the commission said it has revised rules regarding administrative licenses for Chinese lenders and is seeking feedback from the public until Sept 9.

According to the rules, it has removed the capital adequacy ratio requirements and upper limits of equity investment for domestic financial institutions that will initiate the establishment of a commercial bank.

Instead, it added a requirement that the initiator must possess a good social reputation, have no record of illegal behavior and have no big issues regarding improper internal management.

Zhou Dewen, the chairman of the Wenzhou Small and Medium-sized Enterprises Development Association, said the new rules will further open the door for private capital to enter the financial field because it lowers the threshold for private companies.

He said a large proportion of private capital is in the hands of individuals instead of with an organization that has registered at an administration for industry and commerce, therefore the removal of the previous requirements would facilitate such capital to enter the banking business.

"We noticed the new rules have also added some restrictions, such as private players only using their own capital to hold banking shares, instead of purchasing shares on behalf of others. This is necessary for containing the risks of private banks," Zhou said.

The new rules also loosened the requirements for banks wanting to set up branches in China and overseas by removing the standards for banks' allocated capital for their branch operations during the application.

Lower thresholds to establish a bank in China would encourage some large financial institutions to extend their footprint in small, medium-sized and regional banking services and thus promote financial support for small businesses, said Guo Tianyong, director of the Research Center of the Chinese Banking Industry at the Central University of Finance and Economics.

He said the commission has also increased the capital adequacy requirements for banks' overseas institutions, to prevent overseas risks from spreading to domestic sectors.

On Monday, the State Council, China's cabinet, vowed to improve financial support to small businesses, in a statement released on its website, while the economy continues to falter and the government is curbing over-rapid credit expansion.

The development of small financial institutions will be further encouraged to improve financial services to small businesses - and the threshold at which small companies can raise funds directly on the capital markets will be lowered, it said.

"We would encourage large and medium-sized banks to develop special institutions and outlets for lending to small businesses at a faster pace and improve the scale and standardization of such lending," said the State Council.

The commission figures show that only 45 percent of the total shares of joint-stock commercial banks were in private hands at the end of 2012.

China is stepping up its efforts to get private enterprises into more businesses, said Standard & Poor's Ratings Services in a report published on Monday.

"For the third time since the Asian financial crisis, the country is in the midst of another major push to get private enterprises into more businesses," said Standard & Poor's credit analyst KimEng Tan. "If the reformers prove to be third-time lucky then strong economic growth could continue to be a key sovereign-rating support for the foreseeable future."

Millennium BCP opens new branch to enhance business opportunities

June 21st, 2013The Portuguese bank Millennium BCP (Banco Comercial Português S.A.) yesterday celebrated its new branch in the territory, located at the Finance and IT Center of Macau building, in Avenida Comercial de Macau. In a launching ceremony held yesterday at MGM Macau, the CEO of BCP, Nuno Amado, emphasized the new branch “has more space and provides an excellent environment to further develop businesses.”

With branches in Macau, China, Angola, Mozambique and Poland, the Millennium BCP is hoping to enhance business opportunities within Portuguese-speaking countries. “This new branch allows the further development of BCP not only in Macau, but also in other countries we are represented in,” Amado explained. Nuno Amado revealed there are two main goals and areas of business behind the new branch launch: “We wish to develop our operations within the triangle China-Africa-Portugal, as we have a language and history in common. We also intend to see the Renminbi market evolve, since it is a business which is not that developed yet, so I believe we should focus on this area.” Moreover, he added that “there are more and more Chinese companies investing in Macau, so this is definitely an area where BCP could evolve.”

The CEO of Banco Comercial Português S.A. emphasized that the Macau branch recorded “a significant growth” in 2012, almost tripling the results of the previous year. Following such results, the bank plans to increase its workforce.

“We need to recruit more staff and we are able to expand by having these new facilities,” he added.

Furthermore, Nuno Amado highlighted the role of the Macau branch as a platform “to promote business opportunities between Chinese enterprises and companies in Portugal, Brazil, Angola and Mozambique.” Building a bridge between the East and the West seems to be one of the challenges the Macau branch is ready and willing to face.

The new branch launch ceremony included a ribbon cutting formality with the presence of several personalities, such as Wan Sin Long, a board member of the Monetary Authority of Macau, Vítor Sereno, the Consul General of Portugal in Macau and Hong Kong, the director of Banco Comercial Português S.A., José João Pãozinho, the Senior Assistant Director-General of Economic Affairs Department of Liaison Office of the Central People’s Government in the Macau and Conceição Lucas, the Executive Director of BCP, among others.

Results of Millennium BCP in Macau tripled in 2012

The results of the Portuguese bank Millennium BCP in Macau have tripled in 2012, the director of Banco Comercial Português S.A., José João Pãozinho, revealed yesterday. During the new branch launching ceremony, held yesterday at MGM Macau, the director of BCP announced the bank made MOP 177.7 million in profit, more than MOP 11 billion in deposits and MOP 10 billion in loans. According to José João Pãozinho, “the results have tripled” compared to numbers from the previous year. In his opinion, the great results are mainly the outcome of “a significant growth in the credit portfolio and good results in terms of clients’ deposits.” He concluded saying that “the branch registered extraordinary results following the development of a business platform that Portuguese companies have put in place in Macau and China”.

China HSBC April services PMI falls to lowest in nearly 2 years

May 8th, 2013Growth in China's services sector slowed sharply in April to its lowest point since August 2011, a private sector survey showed on Monday, in fresh evidence that economic revival will remain modest and may be facing wider risks.

The HSBC services Purchasing Managers' Index (PMI) fell to 51.1 in April from 54.3 in March, with new order expansion the slowest in 20 months and staffing levels in the service sector decreasing for the first time since January 2009.

The HSBC services PMI follows a similar survey by China's National Bureau of Statistics, which found non-manufacturing activity eased to 54.5.

"The cooling of service sector activity in April likely reflected the knock-on effect of slower manufacturing growth, the impact of property tightening measures and the spreading bird flu," said HSBC's China chief economist Qu Hongbin.

A reading above 50 indicates activity in the sector is accelerating, while one below 50 indicates it is slowing.

Two separate PMIs last week showed that China's manufacturing sector growth had slowed, suggesting the country's exports engine is running into headwinds from the euro zone recession and sluggish growth in the United States.

In the latest survey, the sub-index measuring new business orders dropped sharply to a 20-month low of 51.5 in April, with only 15 percent of survey respondents reporting an increased volume of new orders that month, HSBC said.

"Again, this started to bite employment growth. All these are likely to add some risk to China's growth in 2Q, as there's still a bumpy road towards sustaining growth recovery," Qu said.

The employment sub-index decreased to 49.6 in April, the first net reduction in staff numbers since January 2009, although HSBC said job losses were marginal, partially caused by firms down-sizing and employee resignations.

Employment is a decisive factor shaping government thinking because it is crucial for social stability. The services sector accounted for 46 percent of China's gross domestic product in 2012, as big as the country's better-known manufacturing industry.

At the depth of the global financial crisis in 2008/2009, an estimated 20 million rural migrant workers lost their jobs, prompting Beijing to unveil a 4 trillion yuan stimulus package to shore up the economy and provide employment.

China's annual economic growth dipped to 7.4 percent in the third quarter, slowing for seven quarters in a row and leaving the economy on course for its weakest showing since 1999.

The government has set a 2013 growth target of 7.5 percent, a level Beijing deems sufficient for job creation while providing room to deliver reforms to the economy.

Q&A on China’s Monetary Policy and Financial Reform

March 28th, 2013The People’s Bank of China (PBOC) announced on March 16 that it had re-appointed Zhou Xiaochuan as the chief of China’s central bank, making Zhou the longest-serving central bank chief since the establishment of the People’s Republic of China. The re-appointment of Zhou, who has held the position since 2002, signals the country’s bid to ensure policy continuity amid current global uncertainties, while deepening the country’s on-going financial reform.

Before the reassignment, Zhou and three other deputy governors of the PBOC attended a press conference regarding China’s monetary policy and financial reform on March 13. Selected questions and answers from the press conference can be found below.

Q: What kind of monetary policy will China’s central bank adopt?

A: China’s monetary policy mainly seeks to accomplish the following four objectives:

* Keeping low inflation

* Facilitating economic growth

* Encouraging employment

* Balancing international payments

* Where the four objectives are unable to be accomplished simultaneously, the central bank needs to adopt a monetary policy that can draw a balance among the four purposes.

In the Government Work Report presented by Premier Wen Jiabao, he suggests the country set its 2013 GDP growth at 7.5 percent, and the target for inflation (as measured by the CPI) at 3.5 percent. Meanwhile, the broad money supply (M2), which covers cash in circulation and all deposits, is suggested to grow by 13 percent.

The proposed growth of M2 is lower than that of last year, indicating that the monetary policy will stay prudent and neutral, and meanwhile, the government will put more emphasis on keeping consumer prices stable.

Q: Will China’s M2 growth present an inflation risk?

A: Countries with high savings rates and a heavy reliance on indirect financing usually have high M2 growth, which is the case with China. However, the high M2 to GDP ratio will not necessarily create an inflation threat. Japan, for instance, has an even higher ratio than China, yet still suffers from deflation rather than inflation.

For the central bank, stabilizing consumer prices is its first priority, the M2 figures will not necessarily put consumer price stability in jeopardy. If the growth of M2 can be controlled at a reasonable level, it won’t lead to sudden price hikes.

Q: Will the central bank support Taiwan to become an offshore RMB market?

A: The People’s Bank of China and the currency administration institution of Taiwan signed the Cross-Straits Cooperation Memorandum in Currency Settlement on August 31 last year. According to the Memorandum, financial institutions on both sides could undertake currency settlement through a correspondent bank or a clearing bank. The two sides may also discuss a currency swap agreement if cross-Strait trade demands a higher level of financial cooperation.

However, whether Taiwan will become an offshore RMB center needs to be decided by the market. Some important financial centers might become offshore RMB trading markets in the future as a result of market demands and competition.

Q: Will the central government provide a better environment for the opening of capital accounts? Are there going to be any adjustments on the opening schedule?

A: The Global Financial Crisis has created a special opportunity for the rapid growth of the cross-border usage of RMB in trade and investment, which is mainly due to a confidence crisis with the world’s major currencies, and closer regional cooperation between China and other economic entities.

With the development of cross-border usage of RMB, there will be greater demand for the exchangeability of RMB under capital accounts. However, making the RMB convertible under capital accounts is quite complicated. China has been pursuing the free exchange of RMB since 1993. Currently, the RMB has become convertible under current accounts, and its convertibility under capital accounts will be promoted step by step.

It is also important to notice that the convertibility of RMB under capital accounts will not only help promote RMB internationalization, but will also boost the development of an open-market economy in the country and strengthen confidence of domestic and foreign investors in the Chinese currency.

Morgan Stanley to cut jobs, may signal more pain ahead

January 11th, 2013Morgan Stanley plans to slash 1,600 jobs in what may be just the beginning of a new round of layoffs at large investment banks, this time driven by a deeper reassessment of Wall Street businesses in the face of new regulations and capital standards.

Morgan Stanley, the sixth-largest US bank by assets, plans to begin letting go of the employees, many of whom work in its securities unit, starting this week, two people familiar with the matter said.

A third person who has been involved with plans to cut staff at Morgan Stanley and other large banks said that Morgan Stanley’s cuts had been in the works for months, and that more are expected in the future.

Large global investment banks have been cutting staff for the better part of five years, when the financial crisis pegged to the US housing market began to seize up markets.

Firms previously focused their job cuts on areas where activity had screeched to a halt, such as securitization of mortgages, or that were explicitly banned by new regulations, such as proprietary trading.

But banks are now making strategic decisions about businesses in grey areas where management teams do not see major profit potential, or realize that their individual banks are not competitive, the third source said.

“It’s hard to look at yourself in the mirror, and say: ’I’m not good at this,’” said the source. But now that management teams are coming to those realizations, he said, they are beginning to make strategic decisions to exit businesses and cut more staff.

So far, the most prominent example of a bank making that kind of a tough decision is Swiss bank UBS, which said in October that it would exit bond trading altogether and eliminate 10,000 jobs.

Morgan Stanley has said it will not give up on the fixed income, currency and commodities trading business, known as ”FICC” in Wall Street circles. The firm has said it wants to boost market share in FICC by two percentage points.

But Morgan Stanley is aiming to exit more complex realms of bond trading that require more capital under new regulations.

The latest staff reductions will affect 6 percent of the institutional securities unit’s workforce, which includes the bank’s FICC business. The cuts will target salespeople, traders and investment bankers, the sources said. Support staff who work in areas such as technology will also be affected, the sources said.

Although all staff levels will be affected, the likely targets will be more senior employees who take in the biggest paychecks, and about half of the cuts will come from the United States, one of the sources said.

The cuts are also notable because, unlike its chief rival Goldman Sachs, which culls the bottom 5 per cent of its workforce each year to improve performance, Morgan Stanley does not have such a staff reduction program.

Some analysts have questioned Morgan Stanley’s plans to gain market share in the bond trading business.

JPMorgan analyst Kian Abouhossein - who earlier said that Morgan Stanley should give up that goal - expects Wall Street banks to report a 10 per cent decline in revenue for the fourth quarter, compared with the previous period.