Chinese yuan-linked financial products rise in S Korea

November 20th, 2014The Chinese yuan-linked financial products rose in South Korea ahead of the launch of a market where currencies of the two countries would be traded directly and the implementation of a bilateral free trade agreement (FTA).

Shinhan Bank, one of South Korea's four leading banks, said Thursday that it rolled out the yuan deposit product, named China Plus Time Deposit. It has five maturities, including one month and a year, and the deposit rate was set at 3.15 percent.

Hana Bank and Korea Exchange Bank launched a joint yuan deposit product with a maturity of six months and a year earlier this month. The deposit rate was more than 3 percent.

The yuan deposit rate almost doubled the rate of the South Korean won-denominated deposits offered by local banks. The won deposit rate stays at a mid- to upper-bound of 1 percent.

The rise in yuan-related financial products came as the two countries are expected to implement the bilateral FTA next year. South Korea plans to launch the direct trading market between the yuan and the won within this year.

A South Korean news media reported that the financial regulator plans to increase the portion of yuan settlement in trade with China to 20 percent in the long term.

In 2013, South Korea and China traded 228.8 billion U.S. dollars of goods and services, among which 1.2 percent was settled with the Chinese yuan.

Wuzhen to host World Internet Conference

November 18th, 2014The World Internet Conference, which will take place in Wuzhen, a town in East China's Zhejiang province, on Wednesday, has attracted more than 1,000 participants from across the world.

The conference, held from Wednesday to Friday, will focus on several hot issues in the cyberspace, including cyber security, online anti-terrorism crackdown, mobile network and cross-border e-commerce.

It is the first time that China is holding such a top-level conference related to Internet. Guests include government officials from various countries, cyberspace specialists and technology enterprises tycoons, such as Zhou Hongyi, head of Qihoo 360, Chinese largest security software manufacturer, and Jack Ma, the founder and board chairman of Alibaba, China's largest e-commerce business.

According to the organizer, the Cyberspace Administration of China, the country's top Internet watchdog, the meeting has also attracted almost 700 journalists from the world and 500 volunteers have been deputed to serve the guests.

In addition, participants can enjoy fast-speed free Wi-Fi in Wuzhen, and the town will become the permanent place to hold the conference in future.

Major private steel company files for bankruptcy protection

November 17th, 2014Haixin Iron and Steel Group, the largest private iron and steel enterprise in Shanxi Province, has started bankruptcy reorganization procedures, according to a local court on Monday.

The company, located in Wenxi county, had an annual steel output of five million tonnes and was ranked second only to Shougang Changzhi Iron and Steel Company, another state-owned enterprise, within the province. It is also the largest privately-owned company in Shanxi.

According to public data, the company recorded 10.46 billion yuan (1.71 billion U.S. dollars) in debt compared with 10.07 billion yuan in its account.

Production was suspended on March 18, due to industry overcapacity, a stagnant market, tightened credit and management issues.

In August, four lenders to Haixin filed bankruptcy plans to the Yuncheng Intermediate People's Court, aiming to reorganizing five companies within the group.

New copyright trading base set up in FTZ

November 14th, 2014Move aims to boost cross-border transactions

A national copyright trading base was launched in the China (Shanghai) Pilot Free Trade Zone (FTZ) Thursday, with the aim of using the advantages of the FTZ to promote the copyright industry, Chinese financial news portal yicai.com reported Thursday.

The national-level copyright trading base, which is the first of its kind in the Yangtze River Delta region, was approved by the National Copyright Administration on September 28, the report said.

Xu Jiong, director of the Shanghai Copyright Administration, said that the new base will protect copyright and encourage cross-border transactions for cultural products, according to the report.

Beneficial trade policies for the FTZ and the financial reforms that have been conducted there have already been positive for copyright trade growth, it noted.

The national base can be a helpful platform for individuals to sell the copyrights for their works, Wang Qian, a professor with the School of Intellectual Property at the East China University of Political Science and Law in Shanghai, told the Global Times Thursday.

However, it may not be that effective in terms of large-scale copyright transactions, such as for foreign movies, TV dramas or literature works that the Chinese market usually buys, he noted.

The copyrights for these cultural products are mainly held by large companies. For instance, the copyrights for animated films are dominated by two US-based firms - Walt Disney Company and Pixar Animation Studios - Wang noted.

For larger transactions such as this, sellers and buyers can easily reach each other without needing any special platforms, according to Wang.

Zhao Zhanling, a Beijing-based intellectual property lawyer, agreed with Wang and said that small copyright transactions may benefit from the new base in Shanghai.

Usually, copyright transactions for more popular products such as TV shows are dominated by a small number of companies, he told the Global Times Thursday.

For example, the fierce competition among China's online video websites for copyrights for popular US TV dramas in previous years has forced up the prices, even if the battle for copyright has been less intense since two major video websites - youku.com and tudou.com - merged in August.

The new base in Shanghai might function as more than just a platform, according to financial news portal cs.com.cn, which reported Thursday that the base will seek policy breakthroughs in fields such as tax, financing and registration for copyright trade.

The FTZ facilitates overseas art works' entry into the domestic market with fast customs clearance, and tariff and value-added tax (VAT) payments can be delayed until after sales rather than before, Li Wei, an employee at a cultural communications firm in Shanghai, was quoted as saying in the yicai.com report. Overseas buyers do not pay the 8 percent tariff and 17 percent VAT if cultural products are purchased through the FTZ, Li said.

China's copyright trade is still at an early stage, cs.com.cn reported Thursday.

Cross-border copyright trade revenue is decided by a country's soft power, Wang said, noting that China does not currently export as many cultural products as it imports.

Xiaomi, Youku Tudou agree video content cooperation

November 13th, 2014

TV, smartphone hardware maker might also invest $300m in iQiyi video provider

Chinese smartphone maker Xiaomi Technology Co reached an agreement with US-listed Chinese video streaming firm Youku Tudou Inc Wednesday to invest in the distribution and production of online video content, a move analysts said will be a win-win solution for the two companies.

The two companies will cooperate in online video content and technologies, according to a press release that Xiaomi e-mailed to the Global Times Wednesday. It didn't specify how much the smartphone maker would invest in the video streaming firm.

Xiaomi announced on November 4 that it would inject $1 billion to develop its Internet TV content.

"The first batch of money (of the $1 billion) has been invested in Youku Tudou… Xiaomi will join in content distribution and production with Youku Tudou to provide favorable content to Xiaomi fans... The two companies will dedicate themselves to pushing forward the online video industry in China," Xiaomi founder and CEO Lei Jun said on his personal Sina Weibo account Wednesday.

To expand its TV content business, Xiaomi hired Chen Tong, a former executive at Chinese Internet firm Sina Corp, to manage its TV business.

Chinese media also reported Tuesday that Xiaomi will invest $300 million in online video provider iQiyi, which China's biggest search engine Baidu Inc owns a 96 percent stake of.

Calls to iQiyi went unanswered by press time Wednesday while Xiaomi refused to comment on this event.

Xiaomi's moves in video content come a year after it unveiled its first 47-inch smart TV in September 2013, which has since gradually gained popularity among users.

The burgeoning TV hardware business of Xiaomi, including its TV sets and set-top boxes, "has already developed well," and further "expansion in TV content will increase its profit space further," Luo Lan, an analyst at Analysys International, a Beijing-based Internet consultancy, told the Global Times Wednesday.

Luo suggested Xiaomi and Youku Tudou focus on improving the quality of their TV content in the face of intense competition in the sector.

In addition to Xiaomi, other Internet companies also launched smart TVs to capitalize on the burgeoning market.

In September 2013, China's biggest search engine Baidu's online video provider iQiyi launched a 48-inch smart TV called "TV+" in partnership with domestic TV maker TCL Corp. In the same month, domestic e-commerce giant Alibaba launched three smart TV models in partnership with Shenzhen-based appliance firm Skyworth.

Luo noted that the cooperation between Xiaomi and Youku Tudou was "a win-win solution," as Xiaomi will enable Yuku Tudou to get more access to the huge amount of Internet and mobile users that Xiaomi has accumulated since it was set up in 2010.

Youku Tudou's expertise in the production of original content will also be helpful for improving the user experience for Xiaomi TV and smartphones, said Luo.

The total sales value of Xiaomi smartphones, TV, as well as its set-top box on Tmall, a leading Chinese e-commerce website operated by Alibaba group, hit 1.56 billion yuan ($254.28 million) on November 11, which is dubbed "Singles' Day" in China, Lei Jun disclosed on his Weibo.

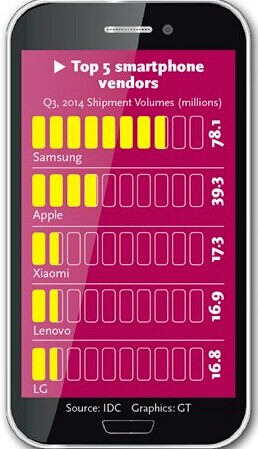

Xiaomi ranked third in the global top smartphone manufacturers list due to its focus on China and adjacent markets, according to the latest report by the International Data Corporation (IDC), a global market research company.

According to IDC, the global market share of Xiaomi stood at 5.3 percent, following Samsung with 23.8 percent and Apple's 12 percent in the third quarter.

Weaving a high road to growth

November 12th, 2014

Workers at the Beijing Institute of Fashion Technology prepare traditional Chinese-style outfits for participants in the 22nd Asia-Pacific Economic Cooperation Economic Leaders' Meeting held on Monday and Tuesday in Beijing.

Chinese silk company uses APEC platform to highlight global plans

Riding on the back of endorsements from global leaders during the Asia-Pacific Economic Cooperation leaders' meeting in Beijing, Chinese silk major High Fashion Silk (Zhejiang) Co Ltd is looking to spread its reach beyond the nation and enhance its standing as an icon of Chinese culture, a company official said on Tuesday.

High Fashion Silk, a leading woven silk and knitting fabric producer from Xinchang in Zhejiang province, rocketed to instant fame after top global leaders wore the company's glitzy New Chinese Suits during the APEC welcome ceremony in Beijing on Monday night.

"We are honored to be the sole fabric provider for the APEC meeting," said Lin Ping, chairman and chief executive officer of High Fashion Silk. "China is the cradle of cultivated silk and we hope the endorsement from global leaders and their spouses will lead to more taking to Chinese-style fashion."

Lin said the company had offered four lots of fabric totaling 6,000 meters for the APEC meeting. Two sets were made from the top mulberry silk, while the other two were a blend of top mulberry silk and wool.

"Our focus is to transform and become a cultural and creative company, based on supportive policies and our own advantages," said Lin.

According to Lin, the entire fabric-making process for the APEC took over a month to complete. "We traveled on the ancient Silk Road to draw inspiration for colors and designs. The finished product was achieved after 60 processes spread over one month.

"The New Chinese Suit stands for peace, happiness and beauty," Lin said.

The fabric designs for the APEC meeting represent China's commitment and vision to be a global leader in quality, he said. The same vision has now been translated into the commercial parlance of haute couture, which refers to the creation of exclusive custom-fitted clothing.

"We are planning to open several stores in Beijing soon," said Lin, adding that in Shanghai, the company has inked cooperation agreements with Donghua University (formerly China Textile University).

High Fashion Silk posted flat revenue growth of 1 billion yuan ($164 million) last year and a net profit of 30 million yuan during the same period. During the past three years, its total output in terms of value exceeded 2 billion yuan, with $80 million in exports.

The company has an annual production capacity of 10 million meters of woven silk, 1,000 metric tons of silk knitting fabrics, 3 million pieces of home textiles and 3 million silk neckties.

The company is also looking to improve its technology and innovative skills by using its 38 patents and advanced equipment from Italy, Germany, France, Switzerland and Japan.

The main brands, designers and retailers it cooperates with are the Guangzhou-based Exception de Mixmind, Uniqlo Co Ltd from Japan, and Calvin Klein Inc, Diane von Furstenberg and Macy's Inc from the United States.

Besides High Fashion Group, the parent company of High Fashion Silk, other leading silk companies in China include Wujiang Dingsheng Silk Co Ltd in Jiangsu province, Hangzhou-based Wensli Group, Zhejiang Jiaxin Silk Co Ltd and Jiangsu Xinmin Textile Science and Technology Co Ltd.

China's exports of genuine silk products in 2013 totaled $3.5 billion, up 3 percent, while imports rose 3.5 percent to $260 million, according to data from the General Administration of Customs.

Shanghai-based CharColn Consulting said the value of Chinese silk products accounts for less than 0.5 percent of the nation's entire textile industry, but these are high-value products with a strong cultural aspects.