Largest coal firm in NE China struggles to cut losses

April 22nd, 2015The largest coal mining group in northeast China is struggling to reduce its losses and pay thousands of its employees.

Heilongjiang Longmay Mining Holding Group Co. Ltd., suffered around 5 billion yuan (815 million U.S. dollars) in losses last year due to the drop in coal prices, the exhaustion of mines and high production costs.

With 240,000 employees, the state-owned firm has subsidiaries in Jixi, Hegang, Shuangyashan and Qitaihe in Heilongjiang Province. The group started management restructuring last year in an attempt to give its subsidiaries more power to become self-operating market entities.

However, some managers have not been paid since last September, a senior executive of subsidiary Shuangyashan Mining Co. said on Tuesday.

Structural streamlining should be finished by August, which will reduce the number of administrative employees from 36,000 to 20,000.

The company will also expedite development of its coal-related chemical industries.

Longmay's difficulties reflect the wider economic slowdown in Heilongjiang, which only grew by 5.6 percent last year, much lower than the national rate of 7.4 percent.

Economic growth in Jilin and Liaoning province was also weaker than the national average.

Earlier this month, Premier Li Keqiang urged northeastern regions to offer preferential policies to encourage innovation and entrepreneurship; to promote systemic reform in major state-owned enterprises; and support the growth of micro, small and medium-sized firms, including private enterprises.

"Due to shrinking coal demand and the company's accumulated problems, Longmay faces losses and strained cash flow. However, it is thinking about ways to guarantee employees are paid," an executive of the group told Xinhua.

Song Yufei, acting chief accountant of Longmay Mining, said the group would reduce costs and losses by improving management and follow up outstanding payments totalling 4.8 billion yuan.

In April, the provincial government loaned 500 million yuan to Longmay Mining and earmarked a special unemployment insurance fund of 500 million yuan and another 100 million yuan for those laid-off to find new jobs.

Foreign seed producers to be saddled with tough regulations in China

April 21st, 2015Chinese lawmakers are looking at limiting foreign access to the country's seed production industry.

The Standing Committee of the National People's Congress is now considering an amendment to make seed production part of the national security lexicon.

If passed, this would require seed producers or research firms with any foreign investment undergo new security assessments.

Foreign investment, mergers or technological cooperation by foreign companies with Chinese seed producers will also be strictly scrutinized.

The proposed changes come amid concerns in China about the production of genetically-modified foods.

Automotive industry's profits take a tumble

April 20th, 2015China's auto industry's profits have been on a downward trend this year, plagued by a slowing market and plunging car prices.

The sector's profits dropped by 5.4 percent in the first quarter from a year earlier, according to data from the National Bureau of Statistics.

This is the first quarterly profit decrease in three years, said Chen Xi, a senior analyst from the bureau's China Economic Monitoring and Analysis Center.

The industry's sales profit ratio slumped 0.6 percentage points to 7.9 percent in the first quarter of this year, from the last quarter of 2014.

Almost one-fifth of the automakers and spare parts producers in China were in the red, a 7 percentage point increase, according to the data.

"The hardship could be attributed largely to the market deceleration, car price cuts and growing marketing costs," Chen said.

Total vehicle sales in China climbed by 3.9 percent to 6.15 million units in the first quarter, according to the China Association of Automobile Manufacturers.

Sales of passenger cars decreased by 0.36 percent to 3.10 million units and micro bus sales plunged by 17.84 percent to 32.64 million units.

A slew of carmakers cut prices this year in an attempt to boost sales amid the slowing market.

China's top automotive group SAIC Motor slashed prices of its MG and Roewe models by 10,000 yuan ($1,600) to 20,000 yuan last week.

Shanghai Volkswagen?SAIC's joint venture with Volkswagen?cut the prices of its Touran, Polo, Tiguan, Passat and Lamando models by as much as 10,000 yuan on April 5. The Lamando compact sedan hit the market just three months ago.

On April 11, Sino-US joint venture Chang'an Ford offered price concessions of 7,000 to 11,000 yuan by paying car purchase tax for buyers.

Hyundai Motor's joint venture with Beijing Motor also started providing customers interest-free loans for two to three years earlier this month.

Analysts predict more carmakers will have to join the price war to boost sales later this year to survive.

Shi Jianhua, deputy secretary-general of the auto association, said the overall market downturn would push the auto industry to further polarize.

"Carmakers which have competitive products will continue to have decent profits, but those without competitive products will have meager profits and even losses," Shi said.

According to the statistics bureau, fixed-asset investment in the auto industry has also slowed due to the market downturn.

Fixed-asset investment in the first quarter grew by 5.1 percent year-on-year. The pace is down 18.2 percentage points from a year ago.

Growth of employment in the auto industry also slowed to 3.9 percent in the same time period.

Chinese SMEs confidently join global competition

April 17th, 2015With increasing manufacturing capability and desires to expand their business, more and more Chinese manufacturing companies, especially small and medium-sized enterprises (SMEs), are looking beyond Chinese boundary to join global competition confidently.

At the ongoing Hanover Fair, the world's biggest industrial trade show, nearly one sixth of the exhibitors, came from China.

"With years of investment in technology innovation and improvement in product quality, we feel that we have gained enough strength to compete with foreign companies. So we decided to get out and broaden market overseas," said Li Wenguang, sales chief of a 400-employee manufacturer of reduction drives in China's central Hubei province.

According to Li, the company, Hubei Planetary Gear Boxes, was founded in 2004 and had earned a strong market position in China. But it was not satisfied with the status quo and wished to gain more business.

It was the first time that his company attended a foreign trade fair.

Compared to Li's company, Anyhertz Drive from Shenzhen, which started exporting five years ago, was more experienced in foreign business, as a quarter of the variable-frequency drive manufacturer's total sales come from overseas.

"Our main foreign markets were in Southeast Asia and the Middle East. In Hanover, we wish to get more resources and expand our markets," the company's foreign business chief Ocean Wang said.

For some Chinese SMEs, the purpose of expanding foreign business is not just making money.

"We also wish to help promote our national brand and improve the reputation of 'Made in China'," said Yanbeen Deng, vice president of Sure Instrument from Tianjin.

" 'Made in China' does not mean low price and low quality," Deng said, adding that the competitiveness of Chinese products increased tremendously in recent years thanks to Chinese manufacturers' flexibility in providing services and increasing investment in research and development.

"We see more opportunities as our nation is more and more open to the outside world, and we are confident to join global competition and to win in foreign markets," he said.

At the Hanover Fair, Chinese exhibitors could be seen in almost every exhibition hall.

"I feel that it is a very good strategy of Chinese companies to be here year by year continuously on the trade show," said Jochen Koeckler, a member of the Managing Board of Deutsche Messe responsible for the fair.

"That is a strong signal that China is really willing to be more open, and is willing to be one of the industrial nations of the world."

Realty growth sinks to single-digit level

April 16th, 2015

A man inspects a property model display on June 14, 2014 in Rizhao, Shandong province.

Housing sales remain soft despite several policy easing measures announced by government

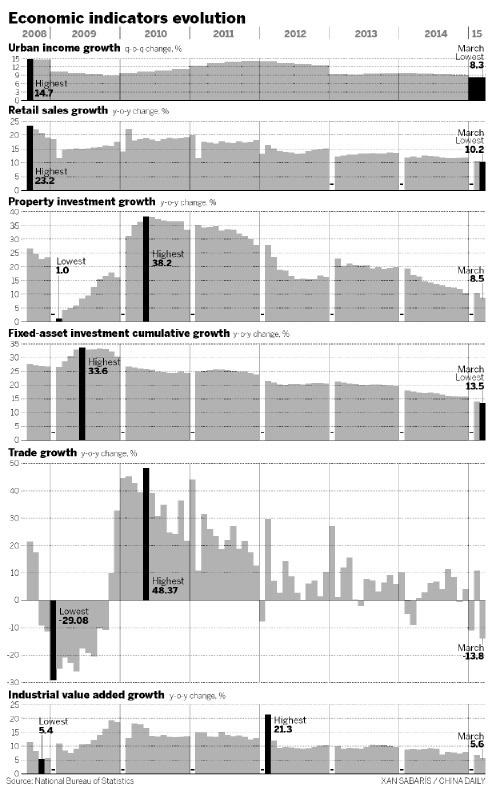

First-quarter investment in the real estate industry plunged to the lowest point in nearly six years, according to data released by the National Bureau of Statistics on Wednesday.

Investment in the property sector, a pillar of China's fixed-asset investment, expanded by 8.5 percent year-on-year, dipping from 10.4 percent in the first two months.

The pace of growth was the weakest since July 2009, which was the aftermath of the global financial crisis, and a far cry from the 30 percent-plus rates recorded just four years ago.

In the previous property downturn, which occurred in the second and third quarters of 2012, growth rates remained above 15 percent.

"China's property sector is still in a bad way. Prices continue to slide. Without a turnaround in loan growth, it's difficult to see a rebound in real estate," said Tom Orlik, chief Asia economist of Bloomberg.

Statistics suggest that investment growth in the sector is set for further slowdowns, which would drag down overall economic growth.

For example, funds raised by developers in the first quarter contracted 2.9 percent year-on-year, while new housing starts plunged 18.4 percent.

Yu Bin, a leading scholar with the Development Research Center of the State Council (cabinet), told a news conference earlier that real estate investment growth will decelerate further from 10.5 percent last year to about 7 percent this year. That would be about the same pace as the target for GDP growth.

In the longer term, property investment growth will stabilize in the 7 to 8 percent range, he said.

Investment is a lagging indicator that usually runs about three months behind changes in actual home sales, experts said. Given that relationship, last month's sales performance implies that investment will stabilize in the second half of this year.

First-quarter housing sales by area fell 9.8 percent, the NBS said. That was a big improvement from the whopping 17.8 percent contraction in the first two months.

Calculations by China Daily show that in March, home sales were just marginally below the year-earlier levels: 0.9 percent down by area and 0.2 percent lower in value.

The NBS does not provide single-month data.

However, policy loosening in late March failed to ignite sales, to the surprise of many observers. After a soft patch in the first week of April, sales in the second week continued to fall.

According to the China Index Academy, the research branch of SouFun Holdings Ltd, sales in the 38 cities it monitors fell 11.2 percent last week, compared with the previous week.

In late March, the central bank said that commercial banks could reduce their minimum down-payment requirements to 40 percent from 60 percent for buyers of second homes who have outstanding mortgages on their first homes.

Separately, tax authorities said that individuals selling an ordinary home would be exempt from the usual 5.5 percent tax if they had owned that unit for more than two years, down from five years previously.

The housing authorities also said that the government would curb land supplies in second-and third-tier cities in an effort to rein in oversupply there.

Ding Zuyu, president of China Real Estate Information Corp, said that several factors had undermined the effectiveness of the policy changes.

For one thing, the Qingming (tomb-sweeping) festival is considered an inauspicious time to buy a home. The holiday fell from April 4 to 6.

Another factor, according to Ding, is that the implementation of the support policies is taking time to trickle down to the local level. Further, supplies of new apartments dwindled during the festival.

As the policies take effect nationwide, their impact will be fully felt starting from the second half of April, he said.

Chinese household income continues to grow in Q1

April 15th, 2015The average per capita income of Chinese households continued to rise in the first quarter of the year, the National Bureau of Statistics (NBS) said Wednesday.

Average per capita household income rose 9.4 percent year on year to 6,087 yuan (992.30 U.S. dollars), recording 8.1 percent growth after inflation.

The household income growth rate for 2014 was 8 percent.

Per-capita disposable income for urban people hit 8,572 yuan, up 8.3 percent. The growth rate was 7 percent in real terms.

Disposable income for rural residents stood at 3,279 yuan, up 10 percent. In real terms, it climbed 8.9 percent.

The income gap narrowed with urban residents earning on average 2.61 times more than their rural counterparts, down from a calculation of 2.66 in the same period last year, according to the NBS spokesman Sheng Laiyun.

Income growth surpassed gross domestic product (GDP) growth in the first three months, which clocked in at 7 percent, down from the 7.3 percent registered in the fourth quarter of 2014.

This still meets the official annual growth target of around 7 percent for 2015.

China created 3.2 million new jobs in urban areas in the first quarter, said Sheng, adding an NBS survey showed that China's urban unemployment rate was "stable" at around 5.1 percent, unchanged from the rate in 2014.

The consumer price index, the main gauge of inflation, in the first quarter averaged 1.2 percent, the lowest since the fourth quarter of 2009 and lower than the government target of 3 percent, NBS announced Friday.