Alibaba growth slowest in three years; revenue falls short of analysts' estimates

August 13th, 2015Alibaba Group Holding's revenue for the three months ended June rose 28 percent, missing analysts' estimates, with growth slowing to its lowest rate in more than three years.

China's biggest e-commerce company posted quarterly revenues of $3.27 billion on Wednesday, below an expected $3.39 billion, according to a Thomson Reuters poll of 28 analysts.

The drop in revenue growth came as gross merchandise volume - the total value of goods transacted across Alibaba's platforms - rose 34 percent to 673 billion yuan ($105 billion), also rising at its slowest pace in more than three years.

Alibaba, which has a market value of $194 billion, is branching out from its core online-only shopping platforms in a bid to stem a slowdown in revenue growth and the total value of goods transacted over its websites.

"[We] made significant progress monetizing our mobile traffic, with our mobile revenue exceeding 50 percent of our total China commerce retail revenue for the first time," said Maggie Wu Wei, Alibaba's CFO, in a press release on Wednesday.

On Monday, Alibaba said it would invest $4.6 billion in brick-and-mortar retailer Suning Commerce Group Co Ltd.

The deal could give Alibaba more traction in logistics and electronics, areas in which smaller but growing rival JD.com Inc specializes.

Alibaba's strategic priorities are internationalization, beating out competition in mobile, expanding into rural China and investing in cloud computing, Chief Executive Zhang Yong said in Wednesday's release.

The company also announced a $4 billion, two-year share repurchase program.

Tsinghua arm readies to take on Qualcomm

August 12th, 2015Tsinghua Holdings Co Ltd, a technology conglomerate backed by Tsinghua University, plans to invest at least 30 billion yuan ($4.76 billion) in developing mobile chip technology, highlighting the company's ambition to challenge Qualcomm Inc's dominance in the country's chip market.

"To catch up with Qualcomm as soon as possible, we will pour 30 billion yuan, and probably even more, into the research and development of mobile chips in the next few years," Xu Jinghong, chairman of Tsinghua Holdings, told China Daily in an interview on Tuesday.

Tsinghua Holding said a certain proportion of the money will come from government funding and its partners. In February, its unit Tsinghua Unigroup Ltd said it has received 10 billion yuan from governments to invest in chip companies.

"Frankly, compared with global competitors, we are still three-to-five years behind in technology, especially in cutting-edge 4G and 5G products," Xu said, "but if we don't close the technological gap, we will never win."

The comment came after Tsinghua Unigroup Ltd filed a plan to buy US chipmaker Micron Technology Inc for $23 billion. Xu said earlier it was still in discussions for a potential deal.

"We will continue to expand our presence in the integrated circuit industry through both acquisition and self-research," he said, adding chips will be one of the focuses of the Beijing-based company.

Roger Sheng, senior analyst at research firm Gartner Inc, said the government's emphasis on the semiconductor sector is the biggest advantage for Tsinghua Unigroup.

"Few tech companies in China have such a large amount of capital at their disposal as Tsinghua Holdings does," Sheng, said adding "despite its current technological weakness, it has ambitions and is acting very quickly".

"Qualcomm's pioneering efforts in the sector also established a successful business patten which Tsinghua can follow," Sheng said.

Tsinghua Holdings' intensified efforts to boost its chip-related resources come as the Chinese government seeks to reduce the country's reliance on foreign technology, on worries that it may hurt national security.

The company evolved into the largest chip firm in China after it acquired Spreadtrum Communications Inc, the world's third-largest mobile phone chip maker, and RDA Microelectronics Inc, the fourth-largest, in 2013.

"If we can manage to catch up with Qualcomm technologically, our innovation capability, the huge smartphone market in China as well as the labor cost, which starts rising but is still lower than that of the US, can offer us considerable commercial opportunities," Xu said.

Earlier this month, Tsinghua Holdings announced it has made a breakthrough in chemical mechanical polishing, an important process in manufacturing chips. One of its unit successfully developed the first 12-inch polishing machine in China which could planarize semiconductor wafers to an extent that every square of a nanometer (billionths of a meter) is flat.

"The machine shows that we are the first Chinese company to have mastered the technology, and enables us to produce extremely tiny chips for smart wearable gadgets," said Li Zhongxiang, vice-president of Tsinghua Holdings.

Alibaba, Suning enter into 'marriage'

August 11th, 2015Alibaba, China's largest e-commerce company, and Chinese home appliance retailer Suning have inked a multi-billion dollar collaboration deal for online and high-street sales.

Alibaba will invest about 28.3 billion yuan (4.63 billion U.S. dollars) in Suning to become its second-largest shareholder, while Suning will buy no less than 27.8 million new shares in Alibaba for 14 billion yuan, Alibaba said on microblogging service weibo.com on Monday.

Making the investment through its subsidiary Taobao (China) Software Co. Ltd., Alibaba will hold 19.99 percent of Suning after the non-public offering, slightly less than the more than 20 percent held by Suning chairman Zhang Jindong, according to a statement issued by Suning filed to the Shenzhen Stock Exchange.

The share price was set at 15.23 yuan, 5.76 percent more than the average price in the previous 20 trading days.

Suning was established in eastern China's Jiangsu Province in 1990 and was listed in Shenzhen in 2004.

Trading of Suning's shares was suspended a week ago as it planned this round of non-public offering. Trading will resume on Tuesday, the company said.

Suning said the deal was still "uncertain," as it still needs the approvals by its stockholders' meeting and regulatory authorities, without specifying a time scale.

Suning will hold about 1.09 percent of Alibaba, which is traded in the Unites States, at a price of 81.51 U.S. dollars per share, according to another statement of Suning.

"Both sides will increase efficiency and provide better services to Chinese and overseas customers by linking online and offline businesses," Alibaba said.

More than 1,600 stores, 3,000 aftersales service centers and other offline service stations of Suning will be "seamlessly connected with Alibaba's strong online network," Alibaba said.

Suning will open a flagship shop on Alibaba's brand-focused online retail platform Tmall.com. The two sides will also cooperate on logistics, payment and aftersales services, as well as overseas business integration.

The cooperation will optimize consumer experience, and improve delivery services and aftersales, Alibaba said.

Alibaba chairman Ma Yun said at a press conference Monday that the deal reached after two months of negotiations was "like a wedding."

"If we do not integrate with offline, we will not have a future," Ma said.

Zhang Jindong said that combining online and offline businesses fulfilled not only the needs of the two companies, but also clients' demands.

"Customers do not care whether you are online or offline, they only care whether their needs are satisfied and whether it is convenient," according to Zhang.

If the cooperation model becomes a success in China, it can be rolled out to the global market and help promote the sales of Chinese products globally, Zhang said.

Suning has reaped great benefits from its transition from a traditional chain store to a more Internet-oriented entity.

In 2014, the company's profit jumped 555.28 percent year on year to 946 million yuan.

JD.com Inc narrows loss, stresses cooperation with Yonghui Superstores

August 10th, 2015

Deal part of e-commerce giant's strategy to create a new business model

JD.com Inc, China's second-largest e-commerce site by sales, has released its financial report for the second quarter of 2015 and announced investment into an off-line supermarket.

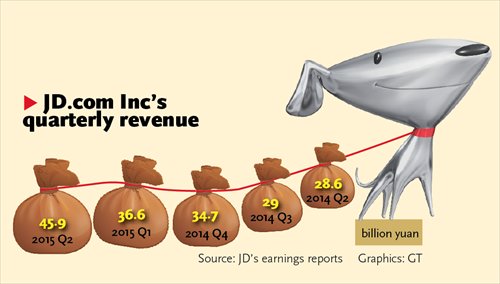

Over the weekend, JD reported a 61 percent year-on-year rise in quarterly revenue, topping expectations, powered by a jump in the number of shoppers and goods bought on its platform.

Second-quarter revenue of 45.9 billion yuan ($7.4 billion) exceeded an average estimate of 44.45 billion yuan from Reuters.

But the company's growth rate is expected to slow in the third quarter. JD said it sees third-quarter revenue of 43.2 billion to 44.7 billion yuan, which would be up 49 percent to 54 percent from the previous year.

JD, a distant rival to Alibaba Group Holding Ltd, is investing heavily in off-line operations to complement its Internet platform.

The company is taking activities such as warehousing and deliveries into its own hands.

This business model, similar in style to that of U.S.-based Amazon.com Inc, has taken a toll.

JD made a net loss of 510.4 million yuan, shrinking only slightly from the year-earlier 583 million yuan despite the leap in revenue.

The catalyst for that jump was the 118 million annual active customer accounts on JD in the 12 months ended June 30, up 72 percent from the same period a year earlier.

Those customers drove an 82 percent jump in the total value of products sold on the company's platforms in the quarter, to a total of 114.5 billion yuan.

JD also said it will buy 10 percent of Chinese supermarket operator Yonghui Superstores Co Ltd for 4.31 billion yuan, with the right to nominate two directors to the board.

Cooperating with Yonghui is part of JD's online-to-offline (O2O) plan, which is of key strategic significance compared with other O2O projects, JD's CFO Huang Xuande said on a post-earnings conference call, according to media reports.

Yonghui is one of China's top providers of fresh products but apparently its 350 stores cannot cover the national market, Huang said.

As a result, there is ample potential for the two sides' cooperation, Huang said, noting that Yonghui has suppliers and inventories while JD has a wide logistics network.

JD has sought to create a new business model by combining suppliers with online platforms to provide customers with a more convenient and timely service, Liu Xuwei, an industry analyst with market research firm Analysys International, told the Global Times on Sunday.

JD has hired thousands of part-time delivery staff to operate a wider delivery network, which will lower the logistics cost and make the delivery process more efficient, Liu said.

As of Friday, there were more than 50,000 part-time delivery staff registered on JD's logistics platform, with increasing orders, Liu Qiangdong, founder and CEO of JD, said on the conference call.

These part-time staff mainly carry orders for daily necessities from nearby stores to customers' doors, which is a cooperation project called "JD to your front door" between JD and off-line supermarkets.

Although fresh food usually cannot provide high profit margins, customers buy it with high frequency, Liu said, noting winning customers on fresh food purchases will lead a large amount of visits to JD's platform, which is crucial to e-commerce companies.

JD also attracted many visitors from social media platforms such as Tencent's WeChat and QQ.

More than 20 percent of JD's new customers gained in the second quarter came from the two platforms, Huang said.

Flat demand in U.S. starts to hit firms in China

August 7th, 2015Lei Shengzu, manager of China Textiles (Shenzhen) Co, does not mince his words about the future.

"The outlook for the United States textile and apparel market remains clouded by poor visibility," he said.

Lei visited shopping malls and retail stores when he was in New York recently for a three-day international textile and apparel sourcing show at the Jacob K. Javits Convention Center.

"There are few people buying clothes by piles, which, however, was common before the global financial crisis," he said. "Consumer habits have changed since the start of the crisis in 2007."

Last year, the US imported $467 billion worth of goods from China, compared with $440 billion in 2013, according to the US Census Bureau. But through May 2015, imports from China have averaged $37.1 billion a month, which would project to a yearly total of $445 billion.

Textile and apparel imports from China have remained flat after some sizable percentage gains from 2000 to 2009. According to the Office of Textiles and Apparel in the US Department of Commerce, total textile and apparel imports were $41.8 billion in 2014, compared with $41.7 billion in 2013, a rise of only 1.49 percent.

Tepid consumer spending is also echoed by the US GDP report for the first quarter of this year. It showed consumers ratcheted back spending, a key factor in slowing economic growth.

Personal consumption expenditures rose at a downwardly revised 1.8 percent rate from January through March. Spending on services climbed 2.5 percent, but purchases of goods rose 0.5 percent. By contrast, consumer spending was up 4.4 percent in the final quarter of last year.

US GDP contracted at a 0.7 percent seasonally adjusted annual rate in the first quarter, from an initial estimate of 0.2 percent, according to Commerce Department data released in May.

The US Federal Reserve is forecasting growth of 2.5 percent for the next two years, only marginally above the tepid rates from the start of the recovery.

The Financial Times reported after years of virtually no income growth, Main Street is unprepared for positive price fluctuations. Consumers have opted to pocket the recent gains from lower gasoline prices rather than spend them.

Lei said that as the economy becomes increasingly globalized, the ongoing recession in the eurozone is likely to put a dent in the US economic recovery. Lei said he believes the market needs at least two or three years to rebound. Industry insiders have realized that it is harder in the US to find buyers for high-priced, high-end fabrics and products.

"And US buyers tend to be more picky and sensitive in price," said Deng Zhijuan, an official from Shanghai-based High Fashion Textile and Manufacturing Co.

"Big deals are also hard to make. Many buyers are just (looking) for some small quantity shipments. They are either independent designers or online retailers."

Still, there are some bright spots. Zhu Jing, manager of Ningbo Aoqi Technological Knitting Co, said that although the bids are lower, there is still some profit margin.

"As the Chinese market has been open for decades, it has fostered a wealth of potential buyers and business partners who are willing to do businesses with China," he said.

Sinopec denies unit is reducing staff overseas

August 6th, 2015China Petrochemical Corp (Sinopec) said on Wednesday that one of its international units had withdrawn 263 Chinese employees from overseas markets since 2014 so that it could take full advantage of local labor resources.

Lü Dapeng, a spokesman for Sinopec, told the Global Times that the employees were recalled to China by Sinopec International Petroleum Exploration and Production Corp (SIPEPC), a wholly owned subsidiary of Sinopec that is responsible for overseas projects.

"The withdrawal is a normal staff rotation to optimize human resources," Lü said, adding that the move also allowed the company to improve its management capacity and operating efficiency.

Lü's comments amounted to a denial of reports about large-scale layoffs in overseas markets.

Media outlets have reported recently that Sinopec is restructuring its overseas assets and planning to recall 40 percent of its overseas staff in order to reduce costs.

At SIPEPC, "80 percent of the total employees are local people and about 700 employees are Chinese," said Lü, noting that Sinopec's overall overseas divisions have 51,000 employees from various countries and regions.

Analysts and media commentators have attributed the recalls to cost reductions that were made necessary by the slumping global oil and gas sectors.

Energy giants including Royal Dutch Shell Plc, BP Plc, Exxon Mobil Corp and Chevron Corp all recently lowered their revenue forecasts for this year and made large investment cutbacks.

There have been many problems surrounding SIPEPC's overseas acquisitions from 2001 to 2014, such as irregular acquisition procedures, procurement prices that far exceeded the actual values of the assets and irregular consulting fees, financial news website caixin.com reported on Wednesday, citing an internal report of SIPEPC.

Many of SIPEPC's projects in Australia, Syria and Brazil had performed below the expectations that prevailed at the time of purchase, the report said.

The report also said that Sinopec ordered SIPEPC to stop investing in worthless overseas assets and avoid more investment losses.