Roche's office in Hangzhou 'sealed off'

May 22nd, 2014Swiss pharmaceutical company Roche AG China's Hangzhou office is said to have been sealed off by the local administration, according to news portal Netease.com.

Meanwhile, the company's Beijing office is reportedly under investigation, according to the Chinese website.

"More than 20 officials rushed into the Hangzhou office, shut down the door, and asked employees not to leave," the news portal quoted a Sina Weibo user on Wednesday.

China Daily tried to contact one staff member at the company, but he refused to answer the phone.

The reported sealing off of Roche's office comes after an executive with British drug maker GlaxoSmithKline was charged last week for allegedly bribing doctors and hospitals to use the company's drugs.

Roche, the world's largest manufacturer of cancer drugs, has said it has seen continued strong growth in China in recent years.

Preliminary manufacturing PMI beats expectations

May 22nd, 2014

Workers assemble molybdenum refining equipment at a Citic Heavy Industries Co Ltd plant in Luoyang, Henan province.

A preliminary Purchasing Managers Index for China's manufacturing sector in May has beaten expectations, suggesting that the economy is stabilizing.

The PMI, released by HSBC Holdings Plc and Markit Economics, was at 49.7, exceeding the 48.3 median estimated by analysts. It was also a big rise from a final reading of 48.1 in April.

At the same time, the number remained below the expansion-contraction mark of 50. The final reading will be released June 3.

China, Russia pledge stronger cooperation in trade, energy

May 21st, 2014

Chinese President Xi Jinping (R) and Russian President Vladimir Putin sign a joint statement aimed at expanding cooperation in all fields and coordinating diplomatic efforts to cement the China-Russia all-round strategic partnership of cooperation after their talks in Shanghai, east China, May 20, 2014.

China and Russia on Tuesday vowed to beef up cooperation in a wide range of fields, including finance, trade, energy and transportation infrastructure.

The pledge came in a joint statement during a visit by Russian President Vladimir Putin. Putin is in China for the 4th summit of the Conference on Interaction and Confidence Building Measures in Asia (CICA) in Shanghai and a state visit at the invitation of President Xi Jinping. Xi held talks with Putin in Shanghai on Tuesday.

According to the joint statement, the two countries will expand local currency settlement for bilateral trade, cross-border investment and financing and will strengthen exchanges for the formulation of macro-economic policies.

The two pledged to increase bilateral trade to 100 billion U.S. dollars by 2015 and 200 billion U.S. dollars by 2020 from nearly 90 billion U.S. dollars last year.

The two will work to ensure balanced trade, optimize trade structure and expand mutual investment in fields like transportation infrastructure, mining development, and housing projects in Russia, said the statement.

The two sides vowed to deepen cooperation in the petroleum industry, kick-start Russia's supply of natural gas to China as soon as possible and jointly develop coal mines in Russia. The two also will consider jointly building power plants in Russia to increase power supply to China.

The two countries will strengthen cooperation in major projects in the peaceful use of nuclear energy, civil aviation, research on basic aerospace technologies, satellite navigation and manned space flight, said the statement.

The two will speed up the construction of cross-border transportation infrastructure, including bridges on cross-border rivers, and Russia will facilitate China's goods shipment using its railway networks, ports and through the Northern Sea route, said the statement.

The countries also pledged constructive cooperation in the use and protection of water resources in cross-border rivers as well as in the establishment of cross-border nature reserves to protect biodiversity.

Spirit of success moves nation's entrepreneurs

May 20th, 2014

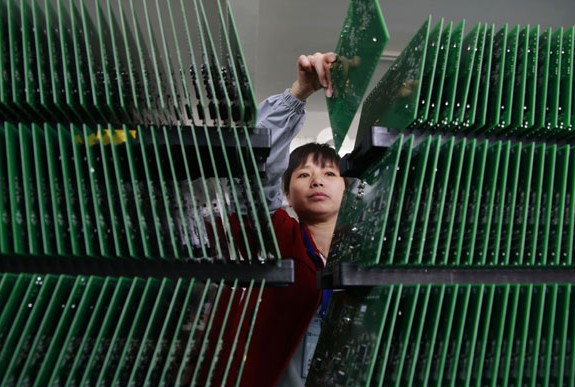

A worker with the Jiangxi-based high-tech company Shanshui Electronics Co Ltd sorts circuit boards. Tens of thousands of private equity and venture capital firms are believed to be behind China's vibrant technology, media and telecommunication sector.

Gong Yan, assistant professor of entrepreneurship at the China Europe International Business School, shows passion when he talks about Tesla Motors Inc.

For him, the California-based company represents a "disruptive innovation" that few Chinese companies have achieved.

Tesla, he says, is to the vehicle industry what Apple Inc has been for the mobile phone industry. It's tossed out what people think of as being a car.

Its "disruptive innovation" is reflected mainly in its product and business model. Tesla produces battery-powered electric cars. It provides car owners with a free battery-charging service through a nationwide network of solar-powered charging stations.

Unlike buyers of conventional cars that rely on massive dealer networks, Tesla consumers can go to its direct sales stores for test drives, place orders online and enjoy cloud-based after-sale service.

Chinese electric car companies don't lag too far behind Tesla in terms of technology, Gong said. On the contrary, a few companies such as Shenzhen-based BYD Auto Co Ltd have developed an edge in some electric car-related technologies. What they lack, according to Gong, is a "revolutionary" aspect to their products and the will to pursue an "extreme" consumer experience.

Companies do not necessarily have to be "revolutionary" to be successful. Most companies succeed as they follow well-established paths and improve their products incrementally. In this regard, Gong said it's "not fair" to compare BYD and Tesla because they are totally different companies.

"It is difficult to compare Tesla with any other company because it is really disruptive, in its business model and product," he said.

That doesn't mean Chinese companies haven't got a chance. Chinese enterprises are rapidly catching up with their Western competitors in many fields. Contrary to popular perception, there is little difference in the mobile Internet field, said Gong, who completed a doctoral degree in the United States and taught at the University of California, Irvine before joining CEIBS.

"The mobile Internet industry in China is so developed that I believe it could soon export some innovation to the rest of the world," Gong said. "So far, Chinese entrepreneurs have excelled at application-oriented fields, such as the mobile Internet and electric cars. But if you look at fields that are more closely related to basic science, such as medicine, there is a huge gap with the US."

Behind China's vibrant technology, media and telecommunication sector, Gong said, are tens of thousands of private equity and venture capital firms, as well as millions of entrepreneurs who aspire to be tomorrow's Elon Musk (chief executive officer of Tesla).

China's VC model is copied from Silicon Valley, so both extensively focus on the TMT sector. That focus has offered a good financing environment for entrepreneurs in that particular sector, but it's a much less friendly environment for other industries, according to Gong.

"In China's TMT sector, the problem is not lack of money but a lack of creative ideas. China's social enterprises face a much tougher environment," he said. "In Silicon Valley, nearly a quarter of the venture capital funds have gone into social enterprises, but here the share is minor.

"If you also consider charitable foundations and crowdfunding in the US, which support social enterprises, the gap is huge."

Another potential risk of VCs' focus on TMT in China is that too many entrepreneurs might be tempted to join this field despite lacking the passion and resources, Gong said.

"So for entrepreneurs, it is important to care about what VCs care about, but not to follow them blindly. You can't dance to the VC firms' beat," he added.

But Gong is no pessimist when it comes to China's entrepreneurship. He said his interaction with domestic entrepreneurs convinced him that the nation's entrepreneurial spirit is high.

Cultural factors are also on China's side, he said, because "no fear of making mistakes", a vital trait for entrepreneurs, is much more prevalent here than in other East Asian nations.

"You look at any entrepreneurship index, and you find China is among the highest in the world. This is a country full of passion for entrepreneurship. I see no sign that the fever is waning. Quite the opposite," he said.

The only factor that may hinder this innovative impulse, according to Gong, is government regulation in many industries. China's most dynamic sectors are also those least regulated, and there's a good reason for that.

More Chinese companies choose US as destination to go public

May 20th, 2014A senior vice president with NYSE Euronex says that more and more Chinese enterprises are attracted to do initial public offering (IPO) in the United States and predicts that around 15 to 20 of them could go public in the States this year.

"What I've seen is a nice building process from two years ago when we only had two IPOs. One of them VIP (Vipshop Holdings Limited) was listed here and did extremely well," said David A. Ethridge, senior vice president and head of the Capital Markets Group at NYSE Euronext, in a recent interview with Xinhua.

Shares of Vipshop, an online discount retailer, were traded at around 165 U.S. dollars per share Monday, compared to 6.50 dollars per share since it announced its IPO in March 2012. China's social gaming portal YY Inc., which was listed on Nasdaq in November 2012, also saw its shares surge to around 56 dollars per share from its IPO price of 10.50 dollars apiece.

Two things happened to increase the likelihood of companies coming from China, Ethridge said.

"One was the public capital markets in the U.S. were very strong," he said. The major U.S. stock indices traded up 25 percent or more during 2013, which is very helpful to all IPOs and certainly helpful to the technology sector with most of the companies coming from China in the technology arena, he explained.

"The second thing that happened was the Chinese companies that were already public were trading up," which helped investors feeling positive about these IPOs coming from China, he said.

Ethridge said he doesn't believe accounting concerns should be an issue today with Chinese companies. "They've got first-class, world-class advisors around them."

"As we came into 2014, you saw a lot more people thinking positively about the IPO market in the United States, and likewise, you saw the same thing in China," Ethridge said. "I think it will obviously depend on whether the IPO windows are there and if you are confident about launching (IPOs)."

So far, there have been seven Chinese companies having listed their shares in the U.S. stock market.

China's e-commerce giant Alibaba Group Holding Ltd. filed its IPO in the United States on May 6. It is expected to be one of the largest stock listings in history.

"So I feel good about the way the market looks right now," Ethridge said.

Ethridge believes that the technology sector is expected to see the most Chinese companies' IPOs this year.

"If we are going to use the past as a harbinger of what we'll see in the future, then you have to say will be technology companies. Most of the companies we've seen from China have been technology-oriented, many of them internet-oriented. And so I would expect the same," he said.

Ethridge said one piece of advice he would give to Chinese companies planning to list stocks in the U.S. market is that "they need to be able to project their result and tell others how they will do in terms of their revenue profitability, and do it with confidence, and then actually beat those numbers."

Ethridge said that U.S. investors welcome Chinese companies " very much" judging from the growing number of China-based companies that went public in the U.S., their valuation and extraordinary performance after their IPOs.

"For the public investor, to see a country the size of China and that kind of growth rate on top of it is astounding, and I think that is always in the back of their mind," he said. "The question is will the company execute and how do they take advantage of that growth rate."

China's changes continue to dazzle Western world

May 19th, 2014

Humphrey Hawksley says over the years China has achieved tremendous economic growth.

Country is achieving growth in its own way, says BBC correspondent

People in the West still have not "got their heads around" the astonishing changes in China over the past 20 years, a leading BBC foreign correspondent says.

"The difference between China (then and now), in my view, is quite confusing to the West," says Humphrey Hawksley, who set up the BBC's bureau in Beijing in 1994.

Nevertheless, the "image of China in the Western eye has shifted in recent years from a mysterious developing country to an economic power closely intertwined with the global economy", he says.

Hawksley recalls his early days of reporting in China when it was difficult to get editors interested in stories that were not linked to the West's criticism of the country's lack of Western-style democracy.

But over the years China has achieved tremendous economic growth, brought a large proportion of its population out of poverty and shown the world that those things can be achieved without Western-style democracy. China is "winning the game", he says.

By that he means that for other emerging economies China has presented an alternative model of achieving economic growth, which is often the thing they are looking for.

"In my travels around the world, in the poorest parts of Africa or Latin America, people want their children to be safe, they want a clinic to be nearby, they want a road. They don't want 'isms', which are all mechanisms to deliver those things."

Though China's economic success is amazing, he says, he is not entirely surprised, having got to know some of the country's political leaders in the 1990s.

One memorable figure for him is Zhu Rongji, who served as mayor of Shanghai between 1987 and 1991, during which time Hawksley interviewed him.

"In his office, he had a big map of Shanghai, which he put on the floor. We were all leaning on the floor, and he said, 'We're going to do this and that, and by 2020 we're going to have a better infrastructure like New York'."

Zhu's determination and attention to detail persuaded Hawksley that he was capable of transforming China's economy. Zhu later became the country's vice-premier and later premier, from 1998 to 2003.

Although Hawksley expected huge growth in Shanghai, he was astounded by the transformation when he saw it.

"I remember some years back flying into Pudong Airport, there is a six or eight lane highway, and all those very wacky buildings, and you think 'My God, this is going to be a fantastic city in 20 years, 50 years, or a hundred years.'"

For a country emerging from poverty, its infrastructure boom symbolizes hope for a better life, and a sense of purpose and future, he says.

"So if you're the poorest of the poor, and you wake up to see a skyscraper, and new airport, you can think you're a part of a system that will deliver it for you."

The turning point of the West's perception of China was the 2008 financial crisis, he says, when China fought against the crisis side by side with Western countries and won respect from them.

"During the 2008 financial crisis, it was Western institutions that were going down. China could have taken advantage of that and used it to weaken the West because it had the US treasury bonds, but it didn't do that. It could have gone the other way, but it didn't.

"It brought the realization to those in the West that China could be 'a very mature ally in times like this, and the deals could be done, and it was all pushing forward the Western world's economy'."

That realization has resulted in the West dealing with China as an important economic power, and it is increasingly acceptable for Western leaders to talk to Chinese leaders about trade and investment without having to always bring up the topic of "democracy", he says.

Having closely witnessed China's economic miracle, Hawksley says strong government intervention in infrastructure development and manufacturing is an important aspect of China's success.

Both aspects of the Chinese economy required significant government direction because a lot of China's infrastructure delivery is built in anticipation of future market demand, and China's manufacturing growth was facilitated by a favorable exchange rate to encourage exports. These could not be achieved by the private sector alone.

"Essentially China became the factory for the world. It created jobs for everybody, and there is a spread of wealth coupled with infrastructure growth. You wake up in the morning, and realize you can go on a better train, or get better seats, and that means a lot to many people."

This kind of attitude is especially inspiring for other emerging countries like those in Africa, where China has been welcomed as a partner in building infrastructure.

"What the Chinese say is that they will build a road, a stadium, and they don't tie it with anything else. The engineers go and do that, whereas Western aid is tied with 'human rights and democracy'."

From his experience in Africa, Hawksley has witnessed countries where global institutions such as the World Bank and the International Monetary Fund have helped for a long time, and yet there are still no roads between two big towns because large institutions are often inefficient in dealing with practical matters.

"All the people want is for the roads to be built, so that (their) children can go to the hospital, and the magistrate can go to court. If you don't build your road, everything breaks down."

Hawksley joined the BBC in 1981. Since the early 1990s he has traveled in China frequently on assignment. When he set up the BBC's Beijing bureau it consisted of just him and a cameraman, but together they reported many memorable stories.

China in those days was still mysterious to many people, partly a result, Hawksley believes, of the country having a long history and a rich culture, and partly a result of China experts in the West making out that the country is more mysterious than it really is to strengthen their credentials and worth.

"Western people who spend years studying Chinese want to keep the mystery up. You could draw mystery around everything you want, but essentially it is not there."

Hawksley says one example is guanxi, which means social connections and is a concept Westerners often talk about to explain why many things are done so differently in China. But essentially social connections help in getting things done in any country, he says.

In recent years the growth of Western media in China has also helped demystify China, giving Western audiences a more objective and multifaceted view of China, Hawksley says.

"China now has more foreign press going there, and it has its own press doing quite good investigations. (The media are) a lot freer than 20 years ago."