| « Brand challenge of smart and wearable bands | Property developers slash home prices » |

Sina Weibo mulls IPO: report

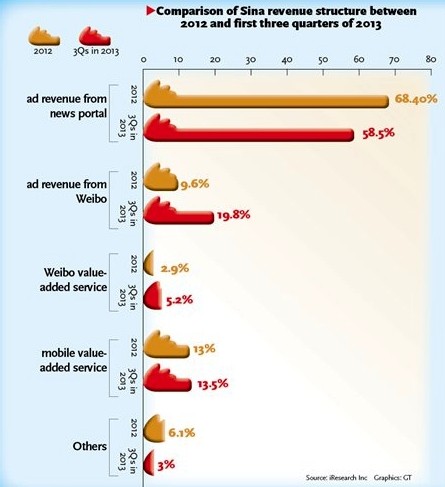

Comparison of Sina revenue structure between 2012 and first three quarters of 2013 Source: iResearch Inc, Graphics: GT

China's Twitter-like microblogging service provider Sina Weibo is mulling raising a $500 million share issue in the US for the second quarter of 2014, a media report said Monday.

The company has hired Goldman Sachs and Credit Suisse to manage the New York listing, the Financial Times reported Monday, citing two people familiar with the matter.

Sina Weibo's public relations office was unavailable for comment when contacted by the Global Times as of press time.

Alibaba Group, China's leading e-commerce platform, paid $586 million for an 18 percent stake in Weibo in April last year, valuing the microblogging business at $3.3 billion.

Alibaba's public relations department also declined to comment on the issue Monday when contacted by the Global Times.

Normally Internet companies offer 10-15 percent of their stake for IPO, meaning Sina Weibo could be now worth about $4-5 billion, Wang Guanxiong, a Beijing-based expert on IPOs, told the Global Times Monday.

Sina is due to report its fourth-quarter earnings after the close of trading on Monday in New York.

Some analysts expect its Weibo platform to reach breakeven in the fourth quarter of 2013.

"Turning profitable will be the basis for Weibo's IPO," Lin Juan, analyst at research firm Wedge Partners, said in a research note released earlier this month.

"We think Weibo is ready for IPO since management restructuring has finalized, as well as the platform turning profitable," Lin noted.

In the previous quarter that ended September 30, 2013, advertising revenues generated by Sina Weibo posted a 125 percent year-on-year surge to $43.7 million, while non-advertising revenues from Weibo's value-added services, such as Weibo membership fees and games, also roared by 121 percent year-on-year to $9.7 million.

"Alibaba's joining in has speeded up the microblogging platform's commercialization process," Ding Daoshi, deputy managing editor of IT website sootoo.com, told the Global Times on Monday.

Sina Weibo's listing comes at a time when microblogging services in China are losing appeal due to strengthened government regulation and fast emergence of other social networking services, analysts said.

The number of Chinese microblogging users dropped 9 percent year-on-year to 280.8 million by the end of December 2013, China Internet Network Information Center said in a report published on January 16.

The report sent Sina's share price tumbling 7 percent on the same day.

Weibo is facing increasing competition with Tencent Corp's mobile messaging app WeChat, which is more private than Weibo, Ding said.

Sina Weibo's daily active users amounted to 60.2 million by the end of September 2013, while WeChat boasted 272 million monthly active users, data from the two companies showed.

Sina Weibo's offering also follows a number of Chinese companies which have been flocking to the US stock markets in their biggest numbers since 2010.

"The current market environment is favorable to China-based Internet companies, as US investors have gradually regained their appetite for Chinese stocks based on better performance of some newly listed Chinese firms since the second half of 2013," Li Ling, an analyst at ChinaVenture Investment Consulting, told the Global Times on Monday.

Jd.com, a major online platform in China, announced in January a plan to raise $1.5 billion in a US IPO that would be the largest by a Chinese Internet company.