Category: "News of China"

Shanghai hosts one-third of AI talent pool nationwide

April 3rd, 2018Shanghai is home to one-third of the artificial intelligence professionals nationwide, drawing firms and organizations to the city to tap the talent pool and potential AI development, a top city government official said today.

Besides the talent pool, Shanghai has an advanced capital market and a huge volume of tradable data, which account for half of the national level, Wu Qing, the city's vice mayor, said during a meeting with visitors from Massachusetts Institute of Technology and SenseTime, one of the leading AI firms in China.

Wu, however, didn't mention the detailed figures of AI professionals the city hosts.

But China suffers from an AI talent shortfall of 5 million professionals which include 500,000 core engineers who master programming and related technologies, dajie.com, an online recruitment firm, has said previously.

SenseTime, which plans to invest 6 billion yuan (U.S.$938 million) in Shanghai, signed cooperation agreements with state-owned giants Shanghai Lingang Group and Shanghai Inesa to develop AI. SenseTime will set up a headquarters for global research, intelligent car, smart chip and smart education in Shanghai, said Tang Xiao'ou, founder of SenseTime, who is also a professor at the Chinese University of Hong Kong.

Airline giants post strong annual profits

March 30th, 2018Carriers face competition from booming railway industry, fuel costs

China's major airlines recently released their annual profits for 2017, with all reporting a jump in profit due to soaring travel demand.

Air China said on Tuesday that its net profit in 2017 rose 6.3 percent to 7.24 billion yuan ($1.15 billion), its strongest profit increase since 2011. Meanwhile, China Southern Airlines Co posted a 17 percent jump in profit and Hainan Airlines reported a net profit of 3.3 billion yuan, up 6 percent compared to its net income of 3.1 billion yuan in 2016.

China Eastern Airlines had not released its financial report as of press time.

Those numbers mean that the three airline giants contributed substantially to the overall robust growth of the domestic aviation market witnessed in 2017.

Air China said that the level of outbound travel in the industry is continuously increasing, causing the demand for international flights to soar. At the same time, its cargo sector has witnessed a recovery due to an increase in global demand, with the airline noting that its cargo revenue jumped 23.5 percent in 2017 alone.

China Southern, which is based in Guangzhou, South China's Guangdong Province, said that the number of transfer passengers traveling through its main hub at Guangzhou Baiyun International Airport grew by 24.2 percent year-on-year while its transfer revenue grew 22.6 percent year-on-year.

According to the Civil Aviation Administration of China (CAAC), in 2017, China remained the world's second-largest aviation market, with a total annual freight transport turnover of 108.31 billion ton-kilometers, representing a year-on-year growth rate of 12.5 percent.

In detail, the number of domestic and regional passengers reached 500 million, representing a year-on-year growth rate of 13.7 percent. The number of international passengers reached 55.442 million, representing a year-on-year growth rate of 7.4 percent. Meanwhile, the total domestic aviation freight volume reached 7.058 million tons, representing a year-on-year growth rate of 5.7 percent.

CAAC has predicted that 2018 could see the high demand trend continue, forecasting a passenger growth rate of more than 10 percent for the year.

Looming challenges

However, despite the strong forecasts and 2017's climb in growth, numerous factors, including a pickup in fuel prices, a boom in high-speed rail travel, the prospect of interest rate hikes and fluctuations in exchange rates, are posing challenges and bringing uncertainties to the industry.

The three airlines said that each of their fuel costs are now at more than 28 percent, with Air China in particular noting that its fuel costs now stand at 29.2 percent, or 6.42 billion yuan, the highest fuel cost rate among the three giants.

Air China also said that currency fluctuations remain a risk as a 1 percent change in the yuan against the dollar could lead to a 279 million yuan shift in net profit.

All three companies have pointed out that the rapid development of China's high-speed railway system could pose a big threat to their performances in the future, as the train network has almost completed the construction of four horizontal and four vertical transportation arteries spanning the entire country.

The National Development and Reform Commission said earlier that the country's entire railway system could extend by as much as 150,000 kilometers by 2020, with that number including a 30,000 kilometer high-speed railway line increase. However, since Air China does not operate as many domestic short- and medium-haul routes as its peers, which are challenged by train journeys of a similar length, the impact of railway expansion on the airline's overall performance will be limited.

Future strategy

As for future development, competition over slots at major domestic airports is becoming increasingly tense and it is getting ever more difficult for carriers to tap airports in first- and second-tier cities.

Because more carriers have been placing an increasing number of planes at domestic airports, competition has even been spreading as far as third- and fourth-tier cities.

Air China noted that since domestic airlines operating with wide-body aircraft are actively involved in the development of remote, second-tier markets, it has brought about a kind of diversion effect from its hub operations in first-tier cities.

In 2009, there were only three second-tier airports operating long-haul international routes longer than 5,000 kilometers. By December 2017, however, such flights were being operated in 21 second-tier airports across the nation, Air China said, adding that those airports have developed so much in recent years that they now have destinations across Europe, the Americas, Australia and Africa. This demonstrates the recent exponential growth of second-tier markets.

Despite the fierce competition, the three airline giants are nevertheless still holding on to the strategy of accelerating intercontinental routes as their main form of expansion.

Hainan Airlines, for example, said it will amplify its intercontinental route network in second-tier cities while China Southern said it is expecting a more prominent position in its Guangzhou hub, attempting to expand in Beijing and establishing more routes connecting China with overseas destinations. face competition from booming railway industry, fuel costs

International investors setting their eyes on China's future global cities

March 29th, 2018China's top tier cities may elevate themselves from regional centers to future global metropolises, with advantages in sectors such as smart cities and artificial intelligence.

International investors from global giants like Boeing, Merck and Siemens shared this view at the Annual Investment Conference in south China's Guangzhou on Wednesday.

The conference is a major event aimed at promoting the city to potential investors and listening to their comments on its business environment. Over 1,800 enterprises from around the world attended the conference.

Many investors stated that China is now more than just a large market for them.

This year China is celebrating the 40th anniversary of its reform and opening-up.

Merck, a world leading company in health care, life science and performance materials, has been operating in China for over 80 years. As well as its existing research and development centers and labs in Beijing and Shanghai, the company established a new China Innovation Center in Shanghai in February.

"The opening-up of China has made a great difference to our business and it allowed us to advance business sectors liquid crystal and pigments," said Allan Gabor, managing director of Merck China.

"When Merck looks at China, we see China as much more than a large business market, we see it actually as an enabler of our global strategy," Gabor added.

Similarly, John Bruns, vice president of Boeing International, said China is now "a source of innovation" from the company's perspective.

The American aviation giant will soon open its first finishing and delivering center for 737 planes outside the United States in east China near Shanghai, and recently signed an agreement with China Southern Airlines to initiate a 737 converted freight project in Guangzhou, and to include a local maintenance company in its 787 global care program.

Cities like Beijing, Shanghai, Guangzhou and Shenzhen, and the Greater Bay Area of Guangdong, Hong Kong and Macao, are becoming the key players in investors' global strategies.

These cities have mature urban infrastructure, advanced industries and are renewing their focus on development to be in line with the information revolution and an international lifestyle.

Guangzhou, for example, is focusing on the new generation of information technology, artificial intelligence, bio-pharmaceuticals, as well as new energy and new materials.

The output of its new generation internet technology and panel display industries have both exceeded 100 billion yuan. It is also ambitious in becoming a smart city, by teaming up with global giants like Cisco and Siemens.

New York and London are indisputably global cities now, but what will global cities of the future look like?

"A future global city should be leading in smart mobility and smart energy distribution and future technology like A.I. I think Guangzhou is on a very good way to that," said Jens Hildebrandt, chief representative of Delegation of German Industry and Commerce Guangzhou.

But investors also pointed out that Chinese cities still need to tackle a series of challenges before they become global cities, including IPR protection, environmental protection, further opening-up and continuous innovation, as well as self promotion.

These are also the areas where huge opportunities lie.

Three months ago, SHV Energy, the world's largest distributor of LPG energy solutions, signed an memorandum of understanding with Guangdong Province, to build a LPG terminal in the city's Nansha District.

"With the strong focus of the Chinese government to improve air quality and reduce emissions, you see a higher need for clean energy solutions." said Maarten Bijl, global vice president of the company.

He added that SHV is also innovating its business model and looking for cleaner energy solutions in which it can cooperate with the Chinese cities. "We're in discussion to see how we can work with the city of Guangzhou, and we can get hydrogen mobility solutions here, which is the next step."

Aside from the top tier cities, China as a whole is putting every effort to further open up. Earlier this month, the government pledged to continue to streamline administration and delegate power to improve the business environment and further stimulate market vitality.

Industrial profits rise 16.1% in first 2 months

March 28th, 2018Policy support to reduce costs, higher sales help boost growth

The nation's industrial profits grew significantly in the first two months of the year, thanks to policy support to lower costs and higher sales offsetting weaker price rises.

Industrial profits increased by 16.1 percent to 968.9 billion yuan ($154.6 billion) in the January-February period compared to the same period last year, up from the 10.8 percent growth in December, data from the National Bureau of Statistics showed on Tuesday.

Profit growth in sectors such as oil and natural gas extraction and pharmaceutical manufacturing helped drive up the overall profit growth, according to the NBS.

Better than expected demand in the first two months led to stronger growth of industrial product sales, which helped offset the downward pressure from slower price rises, according to Liang Jing, an analyst with the research institute of Bank of China.

In the first two months, the industrial added value increased by 7.2 percent year-on-year, up 1 percentage point compared to December.

Revenue from companies' major businesses increased by 10 percent year-on-year in the first two months, which is 1.2 percentage points higher than that in December.

Looking ahead, analysts expect slower profit growth in the near future due to the high base effect in the past several months, but they expect relative strong growth in the medium-to-long run as the growth momentum persists.

Gao Ming, an analyst with China Merchants Securities, said government support implemented since last year, such as efforts to lower production costs and tax cuts, will continue to help increase the efficiency of industrial production.

He expected industrial profit growth will increase by around 13.2 percent in 2018.

While many manufacturing sectors failed to see major improvement in profit growth in the first two months due to cyclical factors, government support to lower enterprises' debt levels will encourage enterprises to restructure to achieve more sustainable profit growth in the long run, according to Gao.

The overall debt level of State-owned enterprises has been declining steadily as the government implements measures to help enterprises to improve asset quality.

Some promising signs can be found in enterprises' financial performance, reflected by improved cash flows, higher investment returns and improved performances of inventories, according to a research note by China International Capital Corporation.

The profitability of consumer-related manufacturing enterprises is expected to see continued improvement, including food and consumption upgrade related industries, according to CICC.

Tencent listed as China's most valuable brand

March 27th, 2018New analysis from market observation firms Kantar Millward Brown and Wire & Plastic Products Group now lists Tencent as China's most valuable brand.

The analysis is part of the group's "2018 BrandZ Top 100 Most Valuable Chinese Brands" ranking and report.

The report says the total value of the Top 100 Chinese brands has come in at $683.9 billion to start this year. This would represent 23% growth compared with the start of last year.

With a brand value of $132.2 billion, Tencent tops the list for the 4th year in a row.

E-commerce giant Alibaba now has an estimated brand value of $88.6 billion, a 53% year-on-year rise.

Other noteworthy sectors performing well are education, logistics and technology.

"Chinese customers pay increasing attention to brands, and top brands affect purchasing to a great extent," said Wang Xing with Kantar Millward Brown.

The 2018 BrandZ China Top 100 is based on interviews with over 400,000 Chinese customers, as well as analysis of financial data, market evaluation and risk prediction.

Pony Ma: Tencent mulling A-share listing

March 26th, 2018Pony Ma Huateng, chairman and CEO of Chinese internet giant Tencent, indicated his support for the company's listing both in Hong Kong and the Chinese mainland, and said he has discussed Tencent's A-share flotation during the two sessions, which concluded last week.

Ma made the remarks at the China (Shenzhen) IT Summit on Sunday, according to a transcript from financial news outlet wallstreetcn, which broke the Hong Kong-listed company's silence on returning to the mainland stock market.

Chinese business magazine Caixin earlier reported Tencent has been singled out as one of eight companies in the first batch to issue Chinese Depository Receipts — similar instruments to American depositary receipts, which are certificates that allow investors to hold shares listed across borders.

The other seven are Baidu, Alibaba, JD, Ctrip, Weibo, NetEase and Sunny Optical, which will go back to the A-share market via the CDR.

In Tencent's 2017 Fourth Quarter and Annual Results announcement Wednesday, Ma also said the company will consider issuing CDRs if conditions permit, the Paper reported.

To woo tech giants home, China's regulators have been working hard. Yan Qingmin, the deputy head of the China Securities Regulatory Commission confirmed to Securities Times on the sidelines of the two sessions that CDRs will be released very soon, and the instrument is an effective measure for enabling Chinese enterprises listed elsewhere to return to the mainland's A-share market.

China's investment bank China International Capital Corporation Limited predicted China will release a draft on CDR rules after the two sessions.

For years, China's capital market was dominated by traditional industries such as property development, finance and industrial materials.

Innovative firms, tech startups in particular, face legal and technical barriers to list on the A-share market, including restrictions on weighted voting rights, or dual-class shares, and mandatory requirements on IPO applicants' profitability.

Tech firms have declared support for the China-based listings. China's search engine giant Baidu Inc, Chinese game developer NetEase Inc, Chinese search engine Sogou Inc and major online marketplace operator 58.com are among a host of firms interested in a secondary listing at home.

If CDR rules are released soon, China's high-tech titans Alibaba and JD will probably issue CDRs in June, Caixin reported, citing a person familiar with the matter.

Report: Top Chinese real estate companies hold half of market in 2017

March 23rd, 2018Market share of the Chinese top 100 real estate companies reached about 50 percent in 2017, up 7.9 percentage points year-on-year, suggesting a trend for concentration in the domestic property industry, report said.

Total sales of those companies grew 32.8 percent to surpass 6.37 trillion yuan ($1 trillion) last year, with a 23.7 percent increase in sales area, showing an overall positive performance, according to a report released Thursday by the China Index Academy, the Development Research Center of the State Council and Tsinghua University.

"Since 2003, the Chinese property industry has undergone a 15-year golden era as one of the pillar industries in the Chinese economy and an engine of urbanization," the report said.

Gross assets and sales of the top 100 real estate operators have seen fiftyfold growth amid the period, showing a steady and quick development, the report showed.

In 2017, those companies strengthened cost controls to improve the quality of operations, whose average revenue and net profit increased 28.5 percent and 30 percent respectively, it said.

They also helped to provide houses for low-income families and construct eco-friendly and energy-saving buildings, as part of the effort to realize corporate social responsibility, according to the report.

However, the average asset-liability ratio of the top 100 property developers reached 78.9 percent, up 2.2 percentage points over 2016, suggesting greater pressure from debt.

In the future, the report suggested those companies should not buy too many parcels of expensive land in hot cities to prevent the risk of overstock.

Besides, they need to attach more importance to the safety of cash flow to avoid capital risk, it said.

Minimum salaries on the rise in China

March 22nd, 2018China's Ministry of Human Resources and Social Security announced the country's 2017 monthly minimum salary standard and hourly minimum salary standard among 32 provinces and cities.

According to the data, Shanghai's monthly minimum salary was top in the country last year, with its full-time workers at least earning 2,300 yuan ($364), and Beijing's part-time workers earned the highest hourly minimum salary at 22 yuan.

Monthly minimum salaries in Shanghai, Shenzhen, Zhejiang, Tianjin and Beijing have broken 2,000 yuan, and Beijing, Tianjin and Shanghai's hourly minimum salary has also reached more than 20 yuan.

Last year, 20 provinces and cities increased minimum salary standards, with an average increase of 11 percent from 2016.

This year, many other regions in China, including Jiangxi, Liaoning, Tibet and Guangxi, have all enhanced their minimum salary. Guangxi increased its minimum by 20 percent.

Shanghai announced it will increase its monthly minimum salary standard by 5 percent to 2,420 yuan per month starting April 1.

China's R&D spending up 11.6 pct in 2017

February 13th, 2018China's spending on research and development (R&D) grew faster in 2017 as the country continued to push for innovation-driven development.

Preliminary calculations showed that R&D spending rose 11.6 percent year-on-year to 1.75 trillion yuan (about 280 billion U.S. dollars) in 2017, 1 percentage point higher than in 2016, the National Bureau of Statistics (NBS) said Tuesday.

The spending accounted for 2.12 percent of China's gross domestic product, 0.01 percentage points higher than the previous year.

Chinese enterprises spent more than 1.37 trillion yuan on R&D last year, up 13.1 percent from 2016, while R&D spending at government institutions and colleges increased 7 percent and 5.2 percent, respectively.

Some 92 billion yuan, or 5.3 percent of the total spending, was put into fundamental research in 2017, up 11.8 percent from a year earlier, the NBS said.

According to the 13th five-year plan for national science and technology talent development (2016-2020), China will increase its annual per capita spending on R&D to 500,000 yuan by 2020, up from 370,000 yuan in 2014.

China had 5.35 million people working in R&D at the end of 2015, the world's largest pool of R&D personnel.

Sales of FMCG surge 4.3%

February 7th, 2018China's sales of fast moving consumer goods, such as packaged food, beverage and cosmetics, recorded the highest annual growth in three years in 2017 at 4.3 percent, with online sales volume rising 29 percent, according to Kantar Worldpanel.

Retailers are adopting new methods to catch up with the digital transformation, with the combined sales volume of hypermarket, supermarket and convenience stores rising 2.6 percent, from 1.6 percent growth a year ago.

Most multinational and local retailers have strengthened their foothold with new store openings or business formats through tie-ins with Internet companies.

Sun Art Retail Group, which runs Auchan and RT Mart malls, remains the biggest player by sales, lifting its market share to 8.4 percent from 8.1 percent a year ago.

Yonghui recorded the fastest growth with new formats such as Super Species and community stores. It overtook Carrefour as the fourth largest retailer, with a market share of 3.3 percent.

About 60 percent of Chinese families have purchased fast moving consumer goods online, and in Beijing, Shanghai, Guangzhou and Chengdu, that figure is nearly 70 percent.

China embraces new opportunities in offline retail despite e-commerce development

January 29th, 2018

China's offline retail is embracing new opportunities as e-commerce is presenting innovative consumption experiences for the country, said People's Daily in a Monday report.

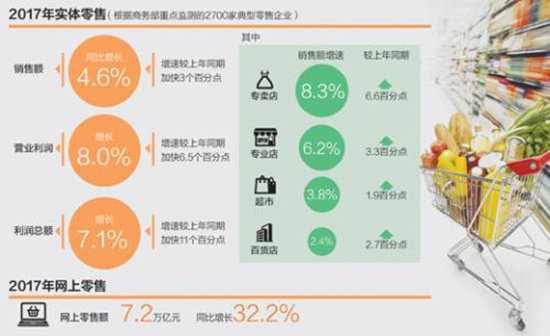

According to recent statistics released by China's Ministry of Commerce (MOFCOM), the sales of 2,700 key typical retail enterprises rose by 4.6% year on year in 2017, 3 percentage points higher than that of last year over the same period.

Convenience stores are a miniature that shows signs of the recovery of the retail industry. The overall business index of China's convenience stores was 71.28 in the fourth quarter of 2017, 2.03 higher than that in the third quarter, said a report issued by the MOFCOM.

The statistics of different businesses of typical retail enterprises showed that in 2017, the sales of specialty stores, pro-stores, supermarkets, and department stores increased by 8.3%, 6.2%, 3.8%, and 2.4%, respectively, 6.6, 3.3, 1.9, and 2.7 percentage points higher respectively than those of the first half of this year over the same period of time.

Online and offline retail have always been considered rivals to each other. Some people even attributed the previous fall of market share of the real economy to the diversion of e-commerce.

"Online and offline competition is not a 'win and die' situation, and 'survival of the fittest' is the only market law," said Li Keaobo, Executive Secretary General of Center for China in the World Economy under Tsinghua University.

After timely adjustment, offline retail still has the opportunity to win the market share because of its unique advantages in meeting consumers' demand.

The narrowing gap between online and offline prices is the primary reason for the recovery of offline business. "Now the prices offered at online platforms and department stores are almost the same," said a consumer named Cai Wei, adding that he prefers the latter since it features more credibility.

"China's online and offline retail are experiencing integration and common development," noted Ren Guoqiang, senior partner of the global strategy consulting firm Roland Berger. More Chinese retail enterprises have realized that innovation, enhanced operating capability, and the upgrading of consumer experiences are the only way of development, he said.

"But we still have to further improve the business environment for retail industry," said Li. According to him, the online-offline integration calls for a fair and orderly competition environment.

Currently, online retail sales account for 15% of the total retail revenue in China, and a well-built monitoring system would better guide the direction for its future development.

China's Hainan cuts red tape to attract foreign investment

January 25th, 2018Denis Koreshkov waited only one night before getting his business license in south China's Hainan Province.

The 34-year-old Russian engineer and his business partners were amazed at the administrative efficiency. The office of his company in Hainan Software Park in Chengmai County, which is undergoing fitment and equipment installation, will be put into use after Spring Festival, which falls on Feb. 16.

Koreshkov and his partners moved their computer technology company from Russia to Hainan last year and established the Hainan firm with a registered investment of 10 million U.S. dollars.

"China is a rising power in the IT industry and has a huge potential market," he said. His company has signed three cooperation projects in Hainan.

The Russian entrepreneur is among foreign investors benefiting from the favorable business environment in China.

The country has been making efforts to remove barriers to market access and requires local governments to create healthy business environment for fair competition.

To attract foreign investors, since October last year the approval of foreign enterprises in Hainan has only taken three days, compared with 18 days previously.

Hainan took the lead on online administrative approval in July 2017, enabling applicants to submit administrative approval affairs at home with a computer.

"A highly efficient government will cut the institutional and time costs for companies' development," said Wang Jing, head of the Hainan provincial government affairs service center.

"Streamlining administrative approval procedures will push the transformation of government functions and create a favorable soft environment for economic development," she said.

Wu Yusheng, founder of Tetranov International, a U.S. pharmaceutical company, also feels the benefits of such policies.

The registration and construction of his health product plant in Haikou, the provincial capital, only took five months.

"We have lots of investment projects around the world. The Hainan project is the fastest," Wu said.

To attract foreign capital, Hainan also identified 12 key industries, including tourism, Internet, medical treatment and bio-pharmaceuticals, and introduced preferential policies.

Due to the policies, the island province has become a hot spot for foreign investment.

In the past five years, 360 foreign-funded enterprises have been set up in the province, with contracted foreign capital reaching 25.4 billion U.S. dollars. In 2017, the island signed almost 40 foreign investment projects.

Game developers, designers among highest paying jobs: report

January 24th, 2018

Game developers at Perfect World, a Beijing-based game company

Consider playing video games is simply a waste of time and money? You may need to think again.

Those thousands of hours spent playing video games, especially if supplemented with a degree in game development and design, can now lead to a career in the video game industry with a very competitive salary.

Game developers and designers are earning the highest salary among almost all professionals in the cultural and creative industry, with a median salary of over 10,000 yuan (U.S.$1562.5) a month in China, according to a report released by the Beijing-based market consultancy CNG.

Its chief analyst Wang Xu explained this could be attributed partly to rapid industry development and to the high demand for talents.

China's game market has become the world's largest, with sales revenue rising from some 10 billion yuan in 2007 to 203.6 billion yuan in 2017, a nearly 20-fold jump in a decade, according to China Gaming Report.

Despite the rapid development, the country still faces a lack of skilled professionals in the industry. Survey analysis shows the gaming market still need over a million game designers to match its rapid development.

Although a high diploma is not a must in the career, big game companies still prefer college graduates with hands-on experience and vocational skills in game development and designing, CNG reported.

Due to course design and lack of interaction with the industry, however, universities usually are not producing the kind of graduates suited to industry demand, said Guo Lei, executive dean of the Pixseed Digital Art Education Base, a talent incubator focusing on digital art fields such as games, comics and animation.

"We want to work with top universities at home and abroad as well as leading companies in course designing and work orientation, so as to cultivate more talents fitting the industrial demand," she added.

Traditional retailers fight to maintain market share

January 23rd, 2018

People select food products imported from Britain at an Ito Yokado department store in Beijing.

In their competition with online giants, which have recently expanded to offering fresh food in physical stores, traditional brick-and-mortar retailers are gearing up to secure their market shares in this sector.

Sam's Club, the membership store and high-end format of one of the world's largest retailers by revenue Wal-Mart Stores Inc, has decided to set up "club depots", or storehouses, with Dada-JD Daojia, a food-delivery unit of the country's second largest e-commerce platform JD, at places where their physical stores have not yet reached.

The system will be built together by Sam's Club and Dada, including selecting locations for the storehouses, managing the inventory and deliveries.

Each storehouse will cover about 1,000 merchandise items, mostly high-frequency fresh groceries. That category currently takes up 20 percent of the Sam's Club stores' revenue. Every storehouse will cover a neighborhood market of three to five kilo-meters, offering delivery within one hour.

Chen Zhiyu, Walmart China vice-president, said since the testing of two club depots in Shenzhen, the delivery time has been shortened to 40 minutes on average, with orders quickly raised to 200 a day and repeating orders to 30 percent.

"We've often heard that despite consumer's preference in products at Sam's Club, they are often restrained by the long distance to the store or large packages of each item," said Chen, who is also in charge of Sam's Club's e-commerce and marketing and membership.

"The new storehouse will increase customer's shopping frequency and loyalty by satisfying their needs for convenience, especially for fresh goods," he said.

Chen, who held several positions at Alibaba Group Holding Ltd prior to his current role, said Sam's Club expects to increase its online sales to as much as the level of its physical stores within three years.

Sam's Club's digital services have seen three-digit annual growth in recent years.

French leading retailer Carrefour SA is also planning to expand its digital and online reach to 18 cities in China from the current 12. The six new cities include Guangzhou, Dongguan, Haikou, Changsha, Hefei and Dalian.

Carrefour has built its own shopping application and its stores have worked with online-to-offline delivery platforms including Metian, Ele.com and Baidu Waimai. Meanwhile, in Beijing and Shanghai, Carrefour has started to sell fresh goods directly from overseas, with a special focus on lobsters and oysters.

Meanwhile, traditional department store Ito Yokado has initiated upgrades on its remaining Yayuncun store after closing its seven other stores in Beijing.

The revamping efforts include expanding its food supermarkets, introducing catering, entertainment and education businesses and gyms, which cover nearly half of the total area, while the general merchandise area will be downsized.

Founded in 2002, the Yanyuncun store of Ito Yokado has an operating area of 21,200 square meters. The new store will set up a central kitchen to offer processed foods and half-processed food for consumers.

Fresh merchandise has also been upgraded to meet the demands for high-end products. Imported beef from Australia, food from Japan and packaged processed food for neighboring working families are now also available.

China's economy accelerates for 1st time in 7 years

January 19th, 2018China's economy expanded 6.9 percent in 2017, picking up pace for the first time in seven years.

GDP totaled 82.7 trillion yuan (about 13 trillion U.S. dollars) in 2017, up from around 41.3 trillion yuan in 2010, when China first overtook Japan.

But it's not only the speed or quantity of growth that may make China a sustained engine for global economic growth. With policymakers reiterating the importance of "high quality growth," China's economy is entering a new era.

BEATING FORECAST

"Major macroeconomic indicators all beat market expectations, pointing to economic stabilization," said Ning Jizhe, head of the National Bureau of Statistics (NBS).

While exceeding market consensus of around 6.8 percent, the 6.9-percent growth rate in 2017 was also well above the official target of around 6.5 percent, and 6.7 percent in 2016.

Wang Hanfeng, an analyst with China International Capital Corporation, said that the pick-up signaled that China's economy has entered a new phase of development.

"The acceleration added to evidence that the economy passed a turning point in 2016 and continued upward on the back of industrial and consumption upgrades," Wang said.

Growth in the fourth quarter came in at 6.8 percent, unchanged from the rate seen in the third quarter, NBS data showed.

The Q4 data was driven by a robust expansion of the service sector, as it continued to benefit from China's economic rebalancing, Nomura said in a research note.

"Given these stronger-than-expected Q4 GDP data, we have decided to raise our 2018 growth forecast by 0.1 percentage point to 6.5 percent," it said.

BETTER STRUCTURE

The new era's basic feature is a shift from high-speed growth to high-quality development, according to a statement issued after the Central Economic Work Conference in December.

A breakdown of economic data Thursday showed a better economic structure, with new growth drivers emerging and outdated capacity fading.

New-energy vehicles, industrial robots, solar power and integrated circuit outshone most other industries in terms of output, growing 51.1 percent, 68.1 percent, 38 percent and 18.2 percent, respectively, year on year, contributing to a pick-up in industrial output growth in 2017.

On the other hand, mining and cement sectors saw their output decline 1.5 percent and 0.2 percent, while the textile and coal industries only grew 4 percent and 3.2 percent.

"New growth drivers are increasingly important for the economy, contributing more than 30 percent of growth and 70 percent of new jobs," said Tang Jianwei, an analyst with the Bank of Communications.

Bright spots such as retail sales in rural areas create future growth potential, analysts said.

The private sector is also showing vitality as the government pushes market reforms and improves business environment.

Private investment reached 38.15 trillion yuan, up 6 percent year on year, 2.8 percentage points faster than the previous year, accounting for 60.4 percent of the total investment.

HARD-WON RESULT

The growth came despite government measures to contain risk, which should have dampened growth.

Data Thursday showed a delicate balance between defusing risks and maintaining growth.

In 2017, stricter rules were adopted to curb pollution, local government debt, housing speculation and financial irregularities. All these "reductions" add up to a more sustainable growth model.

"The fact that the economy rebounded despite pollution controls and deleveraging showed that the real economy is improving, leaving room for risk control in 2018," said Liu Dongliang, an analyst with China Merchants Bank.

Chinese authorities said the country would continue to seek solid progress in preventing major risks, targeted poverty alleviation and pollution control in 2018, or the so-called "three tough battles."

When asked if such battles would weigh on growth in 2018, Ning hinted that he would not worry too much.

"When we talk about keeping the economy running within a proper range, we should not only look at the growth pace but also employment, income growth and improvement in the environment. After all, that's what economic development really means," Ning said.

China's catering industry revenue to reach nearly 4 trillion RMB in 2017

January 15th, 2018Revenue of China's catering industry in 2017 is expected to reach 3.9 trillion RMB ($607 billion), according to a report by China's Cuisine Association (CCA) on the country's food consumption.

The revenue stood at 3.23 and 3.58 trillion RMB in 2015 and 2016, respectively. The continuous rise of the figure indicates the industry's growing impact on the general consumption market.

CCA President Jiang Junxian noted that the growth of China's catering industry has been maintained within a reasonable range, predicting revenue of over 5 trillion RMB in 2020.

According to the report, dining environment was selected by 19.2% of the consumers as the most important factor that influenced their choices of restaurants. A total of 17.8% of them considered taste as the most important.

Chinese cuisines took 57% of the catering market, possessing a dominant position. The figure was 55% in mega cities and 63% in small- and medium-sized ones.

A total of 92% of the people born between 1970 and 1979 marked Chinese food as their priority, while the proportion was only 19% among those born in the 1990s.

Hotpot was the most favored food of Chinese consumers in 2017, for which food safety, price, and environment were all criteria for their choices, especially those born between 1980 and 1989.

In addition to the dominant Chinese cuisines, snacks were another major contributor to catering industry growth in 2017, accounting for 16% of the sector. The proportion was even 18% in major cities.

CCA statistics indicate that salty taste was the most popular among Chinese consumers in 2017, favored by 23.3% of them. Spicy food ranked second, with a percentage of 17.2%.

China's mobile games market posts $15b revenue in 2017

January 12th, 2018Mobile games revenue in the Chinese market in 2017 reached $14.6 billion, beating the United States market, which recorded $7.7 billion revenue, CBN Daily reported Friday, citing a whitepaper released on the China Digital Entertainment Industry Annual Summit.

China's gaming industry leader Tencent saw its online games revenue in the third quarter of 2017 grow by 48 percent to 26.8 billion yuan ($4.14 billion), which reflected contributions from smartphone games, including existing titles such as Honour of Kings, and new titles such as the China version of Contra Return and Legacy TLBB Mobile, according to the tech giant's website.

Another major play NetEase reported a net revenue of 8.11 billion yuan in the third quarter, up by 23.5 percent year-on-year, according to tech.163.com, NetEase's online news portal.

Japan and South Korea followed with a revenue of $6.51 billion and $2.07 billion respectively, according to the whitepaper.

Mobile games revenue reached $46.1 billion worldwide, up by 12.5 percent year-on-year. The North American region saw a revenue of $82.6 billion year-on-year, up by 5 percent, while the Asia-Pacific recorded a revenue of $27.54 billion year-on-year, up by 13 percent.

The fastest growing region was the Middle East and African market, which saw $2.32 billion yuan in revenue, up by 46 percent. The second-fastest growing market was the Latin American, which saw a revenue of $1.71 billion, up by 24 percent.

China's producer prices dip in December

January 10th, 2018China's producer price inflation eased in December on government restrictions for polluting industries, official data showed Wednesday.

The producer price index (PPI), which measures costs for goods at the factory gate, rose 4.9 percent year on year in December, said the National Bureau of Statistics (NBS).

It was down from growth of 5.8 percent recorded in November, according to the bureau. On a monthly basis, it was up 0.8 percent.

For the whole year of 2017, PPI climbed 6.3 percent from one year earlier, compared with a 1.4-percent drop in 2016, ending the declining trend for the past five years.

As northern China enters its winter heating season, the government has increased efforts to tackle smog, asking steel mills and smelters to halt production to curb pollution. Those measures cooled demand for industrial raw materials.

Compared with a month ago, factory-gate prices increased at a slower pace in oil and natural gas developers, while ferrous metal producers and the coal mining industry saw prices drop. Costs increased in gas production and supply industries, NBS senior statistician Sheng Guoqing noted.

Compared with a year ago, prices in oil and natural gas extraction increased by 20.1 percent, followed by 18.5 percent for ferrous metal smelting and 12.3 percent for oil processing.

The PPI figures came alongside the release of the consumer price index, which rose 1.8 percent year on year in December, up from November's 1.7 percent.

China's passenger vehicle sales up slightly in 2017

January 9th, 2018China's passenger vehicle sales edged up slightly in 2017 and are expected to grow faster this year, according to an industrial association Tuesday.

About 24.2 million passenger vehicles were sold last year, up 1.5 percent year on year, according to the China Passenger Car Association (CPCA).

In December, about 2.8 million passenger cars were sold, up 0.6 percent year on year, while over 100,000 new energy vehicles were sold, marking a month-on-month increase for 11 months, CPCA data showed.

The association expected sales of passenger vehicles to pick up in 2018 to reach about 4 percent year-on-year growth.

China is the world's largest auto market and also the fastest-growing market for new energy vehicles, thanks to the government's preferential policies to boost clean energy use to curb pollution.

China’s services activity rises fastest in 4 years

January 5th, 2018New businesses gave a boost to China's services activity which expanded in December by the quickest momentum in four years, a private report showed yesterday.

The Caixin China General Service PMI rose to 53.9 at the end of the year from 51.9 in November, according to the survey conducted by financial information service provider Markit and sponsored by Caixin Media.

It said the growth in services activity was due to a greater volume of new business.

The PMI showed services companies posted the strongest upturn in new orders since May 2015 as around 14 percent of monitored companies noted an increase.

Services companies continued to increase their payroll numbers at the end of the year amid reports of rising business requirements.

Released on Wednesday, the Caixin manufacturing PMI rose to a four-month high of 51.5 for December from November's 50.8 to confirm steady economic growth in 2017.

"The December readings of the Caixin PMI surveys point to improving economic sentiment," said Zhong Zhengsheng, director of macroeconomic analysis at CEBM Group. "Expansion in total new orders and new export business revealed that manufacturers and service providers are optimistic over the business outlook for 2018."

Meanwhile, the official non-manufacturing PMI released last week edged up to 55 for December from 54.8 in November.

The official non-manufacturing PMI survey covers 4,000 large and small companies, while the Caixin service PMI measures over 400.

The services sector contributed to more than half of China's gross domestic product in recent years as the country is in the midst of transforming its economy from investment-driven to consumption-driven.

The Bank of Communications wrote in a report yesterday that China's GDP may have grown 6.8 percent in 2017, above the government target of 6.5 percent.

The bank's economists expect GDP this year to dip to 6.7 percent, with growth of tertiary industries continuing to outpace the industrial sector.

China speeds up introduction of property tax

January 4th, 2018

As part of the plan to contain housing price, China vows to step up housing system reform and create a long-term market mechanism.

When and how a property tax will be levied has long been a public concern.

China's finance minister Xiao Jie has published his policy statement on People's Daily, the Communist Party of China (CPC)'s flagship newspaper.

What have been specified?

Xiao outlined that property tax will be levied on industrial and commercial properties, as well as personal residential houses, based on their "appraised value". He also suggested the legislation work would be completed by 2019, which would lay the foundation for its enforcement in as early as 2020.

Experts believe it has sent out signals for the speeding up of China's introduction of property tax.

"The article shows that the authorities now have clearer thinking on the levy of property tax, as substantial questions have been specified, especially how the taxes will be collected," said Yan Yuejin, senior researcher of the Shanghai-based E-house China R&D Institute.

Yan noted that "appraised value" means a comprehensive assessment of the original and current value of the property, while also taking into account affecting factors such as the real estate market situations and the price of similar property in surrounding areas. "It's a rather fair and reasonable way to do it," Yan added.

It would require the establishment of an appraising system by each city, according to Zhang Dawei, chief analyst of Beijing-based Centaline Property, a leading property agent company. In Xiao's article, he also confirmed that local governments would obtain enough authorization in the process.

"That means local governments are allowed to run pilot policies based on their specific circumstances, so as to map out practical schemes that suit local development," said Jiang Zhen, research fellow with Chinese Academy of Social Science, "and their experiences drawn from the pilot programs will become important reference for property tax legislation, which will be pressed ahead steadily."

Why is property tax put on China's legislation agenda?

"Housing is for people to live in, not for speculation," this has been the tone-setting slogan for China's real estate market since it was first brought up by Chinese president Xi Jinping on the Central Economic Work Conference in December 2016. The long-awaited property tax is a key measure to reduce the appeal of houses as speculative investment, and bring the development of China's housing market to the right direction.

China's property price has been rocketing for over a decade, partly due to Chinese investors' preference for houses as investment and the resulting speculations. Bloomberg estimated that 25 percent of China's housing demand is out of speculations.

At present, taxes are only levied when houses are bought or sold, which leaves multi home owners with no extra financial burdens. The planned introduction of property tax may not only deter future speculators, but also drive existing multi home owners to sell extra ones before the enforcement of the new tax, thus increasing housing supply in the market.

But it's all up to the release of further details on how the property tax will be rolled out step by step.

China to optimize business environment

January 3rd, 2018The State Council made arrangements to optimize the business environment to stimulate market vitality and social creativity, at an executive meeting Wednesday.

Premier Li Keqiang, who chaired the meeting, called for universal use of a negative list of sectors and businesses off limits to foreign investment to control market entry.

Optimizing business environment would help productivity and competitiveness, he said.

The business environment is the foundation for developing a modern economy and ensuring high-quality development, the premier said.

Greater efforts should be made in streamlining administration, compliance oversight and offering better services. An internationally competitive business environment would have equal treatment for domestic and foreign enterprises and stimulate market entities and social creativity," he said.

China was ranked the 78th in ease of doing business, according to a 2017 report by the World Bank, up from the 96th place in 2013.

The government will cut red tapes, reduce taxes and slash fees for enterprises.

It was decided at the meeting that more efforts will be made to slash or cancel fees paid by enterprises, including operational and service fees and fees charged by sectoral associations and chambers of commerce. Costs for customs clearance will be lowered.

The government will further simply the procedures of administrative review and speed up approval procedures for business start-up, tax payments, application for construction permit and water, electricity and gas services, and real estate registration. The slashing of electricity price will also be a priority.

A new oversight mechanism characterized by integrity and information disclosure will be established at a faster pace. A unified punishment mechanism for breaches will be improved. An evaluation mechanism for business environment will be established, and rolled out nationwide over time. Special sectoral measures will be unveiled to facilitate the application for construction permits and cross-border trade.

"There is still much more that we can do to streamline administration, enhance compliance oversight and improve services. We should foster a more enabling business environment to incentivize a visible improvement in the ease of doing business for entrepreneurs, market entities and the general public," Li said.

A series of measures have been taken by the current government to cut red tape, reduce corporate burdens and improve the business environment. It has canceled or delegated administrative approval by the State Council bodies on 697 items, which account for 45 percent of the total.

The government also shortened the list of intermediary services for administrative approval by 323 items, or 74 percent of the total, and canceled professional qualification and certification requirements for 434 items, more than 70 percent of the total.

'Corporate service labs' to support startups in first three months

December 22nd, 2017Shanghai's first "corporate service lab" has opened in a number of downtown districts to offer legal, financial and other support to local startup companies.

The service project, named "wehome LINK", was initially established in two major Dobe innovative parks in Changning and Jing'an districts as the first batch of "service labs" to serve hundreds of locally based startup firms in a trial operation.

Under the scheme, service providers such as law firms, human resource management companies, insurance providers and incubators will offer services to the small and medium-size enterprises for three months. The parks' operator will evaluate their performances and decide whether to retain or substitute them with better service providers.

This scheme will support a large swathe of startup companies under the government's mass entrepreneurship campaign, especially during the bottleneck period that most local innovative firms are undergoing.

"We found many young entrepreneurs, though they do have achievements in their fields, can hardly figure out many problems during the management and operation of their startup companies, such as share allocation, legal disputes and financial issues," said Jia Bo, chairman of Dobe Group, a major developer of local innovative parks.

"Some small and medium size companies don't even know how to apply for government subsidies that they are entitled to, and lost the opportunity to further develop," Jia said.

The first batch of seven service providers has entered the two innovative parks and begun serving startups on these issues. They include the Watson & Band law firm, online insurance company Qibao 360 and other service suppliers in print, office decoration, air purification and housekeeping.

Currently, most of the startup companies receive basic administrative services from incubators who merely help the entrepreneurs register their companies, pay taxes and apply for patents.

Most of the incubators neglected other more essential demands from startup companies, which hampered their development, according to mobile-Internet consultancy iiMedia Research.

Shanghai aims to be global cultural, creative center by 2035

December 15th, 2017Shanghai municipal government said Thursday it will develop the city into a cultural and creative center with international influence by 2035.

According to a newly-issued document, which introduced 50 promotional measures, the added value of the cultural and creative industry will account for about 15 percent of the city's GDP in the next five years, and about 18 percent in 2030.

Shanghai Mayor Ying Yong said the cultural and creative industry is a pillar industry for Shanghai, and plays an important role in the city's development and the people's livelihood.

The document said Shanghai will become a global film and television production center, a performance capital in Asia, a global animation and game production base, a leader in domestic Internet culture and publication, an international creative design highland, and an international art trading center.

Google to open China AI center

December 14th, 2017

Customers try the Google Daydream VR at a Google pop-up shop in the SoHo neighborhood in New York City. The shop lets people try out new Google products such as the Pixel phone, Google Home, and Daydream VR

Amid the enthusiasm shown by the government and domestic technology companies for research and development of artificial intelligence, global technology giant Google announced on Tuesday the opening of its AI center in China.

Li Feifei, chief scientist of AI and machine learning at Google Cloud, announced the launch of the AI center during the Google Developer Day in Shanghai. Based in Beijing, the center will host a group of researchers supported by hundreds of engineers in the country.

The China AI center is the first of its kind in Asia. It will join similar overseas centers operating in New York, Toronto, London and Zurich.

Li will lead the center, which will focus on basic AI research. She said this is one of the first steps for Google to conduct long-term research in China.

"There are a large number of scenarios where AI technology can be applied in China. The talents here are also top-class if put in an international context," said Li.

Scott Beaumont, president of Google in China, expressed his confidence about the AI center, since he has witnessed the vibrancy of local developers and Chinese people's willingness to embrace new technologies, which is hardly found elsewhere in the world.

According to global market consultancy Roland Berger, China now ranks second globally in the quantity of AI enterprises, patent applications, and the scale of financing across the world, only next to the United States. It is expected that AI technology will create 10 trillion yuan ($1.5 trillion) in profits for related industries by the end of 2030.

Finance, automotive, medical and retail will be the four industries in China seeing the most benefits by adopting AI technology, according to Roland Berger.

Leading Chinese technology companies such as Baidu Inc, Alibaba Group Holding Ltd and Tencent Holdings Ltd are making inroads into AI development in the form of self-driving cars, energy-efficient automobiles and educational equipment.

Simon Lance, managing director of global human resources company Hays in China, said that the AI sector faces a great shortage of candidates in China at the moment, since the country is "moving away from manufacturing and toward AI and robotics".

It is calculated by domestic online recruitment platform Zhaopin.com that the demand for AI talents in China has doubled so far this year, with the biggest demand for algorithmic engineers.

Regarding the rise and prospects of the AI industry in the country, the central government released the first number of national-level open innovation platforms for AI in November. AI technology has been used at Customs and procuratorates to seek innovation in different scenarios. Such adoption at the government administration level will be extended in 2018.

Google to open AI center in Beijing

December 13th, 2017Global technology giant Google announced on Wednesday the opening of its artificial intelligence (AI) center in China during its second developers conference in Shanghai.

The new AI center will be based in Beijing. A small group of researchers supported by hundreds of Chinese engineers will be working there. Basic AI research will be the main area that the center will be focusing on.

Li Feifei, chief scientist of AI and machine learning at Google Cloud, will lead the research group of this new center. The center will seek cooperation with the local academia and other possible partners since China is one of the world leaders in AI technology development with ample supply of top talents in this area, she said.

"The center is a corporate-level effort. It is one of the first steps for Google to carry out long-term research in the Chinese market," she said.

The preparation for this center started in January. A number of Google's teams, such as the one for Tensor Flow - computation using data flow graphs for scalable machine learning, have taken part in the establishment of this center.

Water diversion project drives environmental improvements and provides new jobs for locals

December 12th, 2017

Residents stroll through the streets of Ankang city, Shaanxi province.

Tuesday marks the third anniversary of the start of operations of the central route of the South-to-North Water Diversion Project, a massive infrastructure program designed to transport water from the south of the country to the arid northern regions via three separate channels.

So far, more than 10 billion cubic meters of water have been carried to North China via the central route, benefiting more than 53 million people.

The environmental improvements that have resulted from protection efforts in the regions that supply the water?the provinces of Henan, Hubei and Shaanxi?have attracted investment and brought new job opportunities in green industries, including tourism and ecological agriculture, benefiting people in the areas that supply the water.

Xia Qinghua is one of them. The 43-year-old was employed in a small toy factory in Shenzhen, Guangdong province, for 12 years before he returned to his home, Chenjiawan, a village in Hubei's Shiyan city, in June.

He had long wanted to return, but was prevented by a shortage of jobs. However, the situation changed after Hubei Beidouxing Eco-agriculture and Forestry Co began investing in the area in 2014, lured by the cleaner environment.

"Great improvements have happened to the environment in my hometown. When I left at age 17, I had never seen an egret. Now, there are birds everywhere. They are beautiful," he said.

Though he earned more than 5,000 yuan ($756) a month in Shenzhen, Xia often had to work until 11 pm.

"The salary was good, but I felt lonely and helpless because I had no family around me," he said.

In 2011, he attempted to return to Chenjiawan, but the move wasn't successful. "There weren't many business opportunities in the poverty-stricken area at the time," he said. Xia had spent 50,000 yuan on a small truck and started a transportation business, but he lost his investment and was 20,000 yuan in debt after a year, so he was forced to return to Shenzhen.

After that, he only returned home once a year, for the Spring Festival holiday, and leaving his family was always a tearful affair.

"I remember very clearly leaving home on the evening of the fifth day of the Lunar New Year in 2013. My wife, my daughter and I cried in each other's arms. They all didn't want me to go," he recalled, tears glinting in his eyes.

Now, he works in the warehouse at a farm operated by Hubei Beidouxing, making about 2,000 yuan a month. Even though he earns less than he did in Shenzhen, Xia is much happier because he is close to his family and can care for his 70-year-old father, who is unwell. He supplements his income by leasing 0.5 hectares of farmland to Hubei Beidouxing, which brings in an extra 4,000 yuan a year.

The Danjiangkou Reservoir in Shiyan, Hubei province, is a source area for the South-to-North Water Diversion Project.

Li Wei, head of the farm, said the company rents 200 hectares of land from residents of three nearby villages, which have a combined population of about 5,000. While 500 villagers work on the farm full time, a further 2,000 are employed seasonally every year.

So far, the company has invested 280 million yuan in the farm, which has been in operation since 2014. However, the enterprise only became profitable this year; Hubei Beidouxing made more than 2 million yuan from the sale of fruits and flowers, and the farm attracts a steady flow of visitors who come to view the blossoms on the trees and pick fruit, he said.

The company has bought a number of vehicles to provide free transportation for sightseers. "The purpose of offering these services is not to make money. Instead, we hope to attract tourists and create business opportunities for people in local villages," Li added.

Some local residents have also started providing services in their homes, such as restaurants and guest rooms. In response to the rise in the number of visitors, Xia plans to provide tourist services too.

The most recent data is not yet available, but the Office of the South-to-North Water Diversion Project said that between 2011 and 2015 the central government invested more than 17 billion yuan in environmental protection measures in the area that supplies the central route.

Beijing and Tianjin, two of the prime beneficiaries of the project, have also invested a combined 2.3 billion yuan in 650 projects, including a number designed to protect the environment and develop ecological industries, such as eco-agriculture and tourism. The municipalities have also mobilized local businesses to invest 88 billion yuan in 118 projects.

People stroll on a walking path near an embankment of Hanjiang River in Ankang, Shaanxi province.

Marketing opportunities

Last year, Chen Guosheng returned to his hometown of Shiquan county in Ankang city, Shaanxi, which is also located in the source area for the water diversion project.

The entrepreneur was prompted to return by the rise in the number of business opportunities resulting from the improvement to the local environment.

"The improvements have resulted in a lot of high-quality farm produce, but the local farmers don't know how to market or sell the goods," he said.

In response, Chen's company, Shaanxi Baren Tourism and Culture Co, is building marketing channels, and has invested 20 million yuan to transform Zhongba, a small village, into a business hub.

His plan is that tourists will be able to visit for sightseeing and also learn how to make local delicacies, including tofu and cooking oil, using local farm produce and traditional facilities and methods. A trial has been in operation since Oct 1, while the village is being redeveloped.

Chen also rents 67 hectares of land, which he has turned into a tea plantation. The leaves grown on the plantation are highly rated by a tea merchant in Guangdong province, who has ordered a continuous supply.

Business opportunities are also being nurtured in Madeng township, Nanyang city, Henan, via a 1,667-hectare forestry project intended to restore desertified land in a mountainous area.

Two scenic spots are the township's main tourist attractions, generating annual revenue of 35 million yuan. Now, the local government is using the forestry project, which has attracted investment of 82 million yuan, to widen the area's appeal to visitors.

Cherry and Chinese cherry apple trees will be planted along roadsides to create attractive scenery, while pomegranates and walnuts will be cultivated to allow tourists to pick their own fruit, said Zhou Yushan, head of the Madeng government.

In 2009, the per capita income in the township was about 3,000 yuan, but this year the figure is double that thanks to the tourism boom. There are now more than 100 "farm resorts" in the township, according to Zhou.

"The environmental improvements are bringing more opportunities for the development of tourism. All nine registered impoverished villages in the township will be lifted out of poverty by the end of the year," he said.

China increasingly attractive to foreign professionals

December 11th, 2017It took Nikita Ermakov, a second-year Russian student at Peking University's Yenching Academy, four months of job hunting and many interviews before he finally got an offer from the HNA Group, a Chinese conglomerate on the Fortune 500 list. He is currently negotiating the offer with them, and hopefully, he will start the job after graduation.

Ermakov, 25, got his bachelor's degree at a university in South Korea and a master's in Russia before coming to China. He has three years of work experience from his time in South Korea and Russia and can speak four languages: English, Korean, Russian and Chinese.

"China has become the new U.S., a new land of opportunities," he said. "The U.S. is a country of immigrants, but it is already a developed country. With President Trump's new policies, the country has become stricter with visa and immigration regulations. China is still developing; it has a huge market."

Ermakov is just one of many foreign talents who choose to come to China for career development.

According to the HSBC's 2017 Expat Explorer Global Report in October, a move to China offers expats numerous career and income advantages.

The report showed that China, as one of the world's economic powerhouses, now comes in second in HSBC's global rankings for career progression. A total of 70 percent of the 27,500 expats surveyed said the Chinese mainland offers strong job prospects compared with only 54 percent globally and 48 percent in Eastern Asia, a 16 percent increase over last year's figures.

Half of the surveyed expats on the Chinese mainland said they have more opportunities to acquire new skills here than at home, and they earn significantly more than the average expat - typically around $171,000 annually compared with $100,000 globally and $115,000 regionally, according to the report.

Wang Huiyao, founder and president of the Center for China and Globalization (CCG), said China is now involved in "global talent circulation."

"There is a new trend in which more foreign talents will go to China to develop their career in the next decade or two. China's international talent competitiveness is growing," he said.

Hot areas for foreign professionals

According to the HSBC report, the top three employment sectors are the education, service, and financial services sectors, which account for 31, 17 and 9 percent of the employment market respectively. The service industry includes hospitality, travel and leisure, tourism and customer service.

Ermakov thinks that foreigners, especially recent graduates and young specialists, face fierce competition from Chinese professionals. But as the HSBC report showed, the education, services and finance industries require the highest level of qualifications, so foreign talents can still compete with domestic specialists.

"In spite of the fact that foreigners have lower language skills, lack connections and have a limited knowledge of the market, they have comparative advantages: international networking experience, mobility, knowledge of specific business cultures, foreign languages or business English, special areas of expertise and so on," he said.

Eric Tarchoune, founder and managing director of the Dragonfly Group, an HR consulting firm in China, said foreigners who have competencies in big data, artificial intelligence, digital marketing, research and development, knowledge management, brand management, and smart data analysis are in greater demand. They have years of work experience and can bring innovative and different ways of working to their job in China, he explained.

Hays, a British recruitment company with offices in China, said the industries on the Chinese mainland that offer good job prospects for foreigners include science, technology, engineering and mathematics (STEM), the Internet, e-commerce and digital technology, and medical care in its December 5 release on the top 10 recruiting tendencies on the Chinese mainland in 2018.

"Candidates with well-developed soft skills and technical or product knowledge in their area of expertise are also in high demand for these roles and are well positioned to command the most attractive remuneration packages in the coming months," said Simon Lance, managing director of Hays China.

Attracting high-end talent

National initiatives such as the Belt and Road initiative and national technology projects are attracting more high-end foreign professionals.

Jurriaan Meyer, a 52-year-old man from the Netherlands, recently resigned from his post as Asia Pacific director at an international software company in Beijing to work as the general manager of Shandong SRCC Rail Transit Technology, a new Jinan-based company that does innovative propulsion systems for both the local and international markets. Meyer has been in China for over 15 years.

"This project is part of the Belt and Road initiative and is supported by the governments of Shandong and the Netherlands," said Meyer. "Jinan wants to build a local rail industry, and SRCC will be one of the first companies to contribute to this plan with local assembly facilities. If we succeed, this project could truly be the crown of my career in China."

A new work permit system was implemented across China on April 1. Under the new system, foreigners fall into the categories of A, B or C based on their educational background, qualifications and work experience. The policy, which was launched by the State Administration of Foreign Experts Affairs, shows that China wants more high- and mid-level foreign talents.

According to Shanghai-based newspaper Jiefang Daily, Ben Feringa, the winner of the 2016 Nobel Prize in chemistry and Kurt Wüthrich, winner of the 2002 Nobel Prize in chemistry, are expected to obtain a Chinese green card in December.

Meyer also applied for a Chinese permanent residence card last year, which is expected to be granted to him in 2018.

"I think China is right to attract foreign talent while focusing on high quality," said Meyer.

Meyer thinks that compared with big cities like Shanghai and Beijing, where the living costs are becoming excruciatingly expensive, second- and third-tier cities also offer a lot of opportunities these days.

"Facilities in China are very good these days. The transportation infrastructure is awesome, and the Chinese people and companies are usually very supportive and go to great lengths to accommodate foreign talent," he said.

A new generation of expats

Madeleine, a 21-year-old woman from Indonesia, works as an event manager for jingjobs.com, a Beijing-based startup recruitment company.

She came to Beijing in 2013 and studied marketing for four years at the University of International Business and Economics (UIBE). She also does public relations for Global Foundation of Young Entrepreneurs (GFYE) at UIBE.

"Startup environments attract me a lot, as they are very challenging and give me the opportunity to learn every single day," said Madeleine.

She started building her career here in 2016 by taking different internships and part-time jobs and has built her network from hundreds to thousands within a year.

Running events with NGOs and big job fairs, and meeting inspiring people are just some of her memorable experiences so far.

Madeleine thinks there is a bright future for bilingual professionals who speak Chinese and are passionate about China, its fast economic growth, growing advanced technology and diversity.

"Nowadays, employers and companies are hiring younger professionals because they're known to be very tech savvy, entrepreneurial, adventurous and very talented overall," she said.

Meyer agrees.

"I think a new generation of expats is coming who are younger and better prepared for China. Most speak Chinese, which is a great development," said Meyer, who passed HSK 5.

He explained that the new generation of candidates compromises millennials, those who are born after 1990, and Generation X or those who are born after 2000. They are coming to China to study and then work. They learn Chinese at an early age and mix with the younger generation in China, he said.

"They are very well integrated into the culture and business environment and are of great value to China and their home countries," he said.

"China is making a smart move by inviting many young people from abroad to study in China. This helps groom a pool of future 'ambassadors for China' who can help develop understanding and cooperation to the benefit of China and its counterparts abroad."

How to grasp the opportunities?

Meyer finds that after coming to China to work, he has learned much more and is earning more as well.

He said that while China is developing fast and Chinese graduates and professionals are catching up quickly, some high-level foreign workers are still sought after for their unique combination of academic, professional and soft skills and language abilities.

"Soft skills and foreign languages are a weak spot for some Chinese candidates, particularly those outside of the big cities, so there are opportunities for those who can help bridge the gap between China and the world," he said.

He thinks that to be successful in China, one needs many skills, such as in-depth experience in their related field of work.

He said recent graduates from abroad would have a hard time finding a job in China, as many graduates from China or Chinese returning from overseas are stiff competition.

Intercultural skills are also needed. Meyer said an excellent command of the Chinese language and an understanding of the business culture must be brought to the table. Flexibility and an innovative mind comprise the third and final essential factor.

"China will develop more and more, and the labor market will be even more competitive even for the most skilled talent from abroad. However, some very good ones will always be required and welcome if only to help China succeed on the world stage, away from the familiar home markets in China," he said.

Nicolas Fusier, operations director of Dragonfly Group, said more and more Chinese companies that are going global recruit foreigners to develop in the North American and European markets. He said for these specific jobs, it's definitely an advantage to be a foreigner because they know the culture and have their network.

However, Madeleine thinks that despite the good prospects, getting a work visa still poses a challenge.

"Be ready for the long process of applying for a work visa. It is sad because I have seen and met hundreds of young talent who did not get the work visa but are actually very enthusiastic and passionate," she said.

Fusier sees things differently.

"It takes time to get a visa, but I think the most important thing when it comes to attracting high-quality foreign talent is to offer them interesting and innovating challenges while working here in China," he said.

Graduates must adjust to new job market: expert

December 8th, 2017More than 8 million students will graduate from Chinese universities in 2018 and must adjust to lower-income opportunities amid intensifying competition, experts told the Global Times on Thursday.

The number of China's university and college graduates is estimated to reach 8.2 million in 2018, the People's Daily reported on Wednesday.