Category: "Investing in China"

International investors setting their eyes on China's future global cities

March 29th, 2018China's top tier cities may elevate themselves from regional centers to future global metropolises, with advantages in sectors such as smart cities and artificial intelligence.

International investors from global giants like Boeing, Merck and Siemens shared this view at the Annual Investment Conference in south China's Guangzhou on Wednesday.

The conference is a major event aimed at promoting the city to potential investors and listening to their comments on its business environment. Over 1,800 enterprises from around the world attended the conference.

Many investors stated that China is now more than just a large market for them.

This year China is celebrating the 40th anniversary of its reform and opening-up.

Merck, a world leading company in health care, life science and performance materials, has been operating in China for over 80 years. As well as its existing research and development centers and labs in Beijing and Shanghai, the company established a new China Innovation Center in Shanghai in February.

"The opening-up of China has made a great difference to our business and it allowed us to advance business sectors liquid crystal and pigments," said Allan Gabor, managing director of Merck China.

"When Merck looks at China, we see China as much more than a large business market, we see it actually as an enabler of our global strategy," Gabor added.

Similarly, John Bruns, vice president of Boeing International, said China is now "a source of innovation" from the company's perspective.

The American aviation giant will soon open its first finishing and delivering center for 737 planes outside the United States in east China near Shanghai, and recently signed an agreement with China Southern Airlines to initiate a 737 converted freight project in Guangzhou, and to include a local maintenance company in its 787 global care program.

Cities like Beijing, Shanghai, Guangzhou and Shenzhen, and the Greater Bay Area of Guangdong, Hong Kong and Macao, are becoming the key players in investors' global strategies.

These cities have mature urban infrastructure, advanced industries and are renewing their focus on development to be in line with the information revolution and an international lifestyle.

Guangzhou, for example, is focusing on the new generation of information technology, artificial intelligence, bio-pharmaceuticals, as well as new energy and new materials.

The output of its new generation internet technology and panel display industries have both exceeded 100 billion yuan. It is also ambitious in becoming a smart city, by teaming up with global giants like Cisco and Siemens.

New York and London are indisputably global cities now, but what will global cities of the future look like?

"A future global city should be leading in smart mobility and smart energy distribution and future technology like A.I. I think Guangzhou is on a very good way to that," said Jens Hildebrandt, chief representative of Delegation of German Industry and Commerce Guangzhou.

But investors also pointed out that Chinese cities still need to tackle a series of challenges before they become global cities, including IPR protection, environmental protection, further opening-up and continuous innovation, as well as self promotion.

These are also the areas where huge opportunities lie.

Three months ago, SHV Energy, the world's largest distributor of LPG energy solutions, signed an memorandum of understanding with Guangdong Province, to build a LPG terminal in the city's Nansha District.

"With the strong focus of the Chinese government to improve air quality and reduce emissions, you see a higher need for clean energy solutions." said Maarten Bijl, global vice president of the company.

He added that SHV is also innovating its business model and looking for cleaner energy solutions in which it can cooperate with the Chinese cities. "We're in discussion to see how we can work with the city of Guangzhou, and we can get hydrogen mobility solutions here, which is the next step."

Aside from the top tier cities, China as a whole is putting every effort to further open up. Earlier this month, the government pledged to continue to streamline administration and delegate power to improve the business environment and further stimulate market vitality.

Low private investment, high debt weigh down growth

August 1st, 2016Beginning with the second quarter of the year, China will be in the do-or-die battle of its economic transition, according to Hong Kong-based researchers.

The country's transition will undergo its most difficult stage, although it will probably maintain around 6 percent growth in GDP in the second half of the year, according to economists and financial analysts recently surveyed by China Daily.

According to the National Bureau of Statistics, the economy saw year-on-year growth of 6.7 percent in the second quarter, slightly above market expectations. The second quarter's growth rate was the same as in the previous quarter.

The growth was powered by retail sales, industrial output and new loans directed to fixed-asset investment.

But several things are at the center of concern, said Sun Mingchun, senior partner and chief economist of China Broad Capital Co Ltd, including an excess of industrial capacity, a large total social financing and a high leverage ratio, meaning a high level of debt.

Private investment was 15.9 trillion yuan ($2.39 trillion) in the first half of 2016. Its annualized growth rate fell from 3.9 percent in the first five months to 2.8 percent in the first half of the year, which means there was quite a dip in June alone.

Private companies are not seeing encouraging returns from their investments in most industries. And they probably still will not see a good profit in the next two to three years, Sun said.

By contrast, the State sector investment rose an impressive 23.5 percent in the first half of the year, concentrating mostly on infrastructure development in the less-developed areas.

But so much investment is still not as powerful a driver of growth as consumer spending, especially that on services, said Fielding Chen, Asia economist for Bloomberg Intelligence. If investment sees a further decline in the second half of the year, which he expects, the economy's growth engine will remain weak.

According to Cui Li, managing director and director of macroeconomic research at CCB International, the economy will be in its difficult period because it is facing an "unprecedented balancing risk", including "weaker-than-ever global demand, need for a sharper-than-expected capacity cut for the industry, and a round of bond defaults that weigh on investor sentiment."

Ding Shuang, head of China research at Standard Chartered Plc, said that although the hard landing scenario is less likely to happen, the mainland economic situation will remain complex, with questions about how to deal with its mounting debt and avoid the threat of capital outflow.

Ding expects that in the coming months of the year, China's fiscal policy will keep expanding while its monetary policy will be neutral. Cutting the reserve requirement ratio for banks may be the best way to enlarge the credit supply. But before the RRR is cut, the government may use reverse repos and lower interest rates on the medium-term lending facility.

Debt is a particularly ugly spot, the researchers said. As measured by Fitch Ratings Inc's Adjusted Measure of Total Social Financing, credit to companies, local governments and households rose as much as 15 percent in 2015 in the Chinese mainland, more than double its GDP growth.

Chinese office buildings draw international investors

July 8th, 2016International investors have a growing appetite for office buildings in China's key cities like Beijing and Shanghai due to bullish demand, a survey from international real estate service provider CBRE showed on Thursday.

About 35 percent of investors surveyed showed their interest in office buildings in the country's first tier cities this year, compared with 20 percent in 2015. A total of 25 percent showed their interest in the residential sector, 25 percent in the logistics sector and 12 percent in the retail sector.

"Though international investors have more competition from domestic ones, China remains one of the most popular investment destinations in the Asia-Pacific region, following Australia and Japan," said Gran Ji, executive director of capital markets for northern China at CBRE Group,

Meanwhile, with public awareness of environmental protection increasing and green building initiatives on a clear government agenda, the green building concept is increasingly gaining the spotlight in China's commercial building market.

In the 10 select cities CBRE observed, rental premiums of LEED-certified Grade A office space in most cities is in the range of 10-30 percent, compared to non LEED-certified samples. LEED-certified office projects enjoyed higher average rental performance and were in a better position in a weak downward market.

Large shareholders selling spree spooks retail investors

June 20th, 2016A number of companies listed in Shanghai and Shenzhen have been reducing their holdings since the beginning of May, according to disclosures to the bourses concerned.

Market observers said this paring of holdings may dent small investors' confidence and hurt prices of the stocks concerned.

In the first seven trading days this month, large shareholders sold 543 million shares worth 14.02 billion yuan ($2.13 billion) in various companies, according to the China Securities Journal.

This almost matched similar selling through all of May, which saw big shareholders' sales of 435 million shares worth 14.43 billion yuan.

Each large shareholder holds more than five percent in a company's stock.

According to the Journal, 45 companies, through 52 filings, disclosed large shareholders' plans to sell 1.216 billion shares worth 29.14 billion yuan or $4.43 billion.

They will sell these shares gradually in three months to a year as per regulations. A big shareholder is required to disclose any substantial paring of its holding and complete such sales within a given timeframe.

Since the beginning of May, big shareholders in nine companies listed in Shanghai and Shenzhen disclosed that they are going to sell all their holdings. Among them, three firms will see big shareholders selling shares worth more than 1 billion yuan within 12 months.

Many of the companies that are seeing selling by large shareholders are small- to medium-cap enterprises in emerging sectors such as biochemicals and high-tech.

For instance, Shanghai Hile Bio-Pharmaceutical Co Ltd, a drugmaker, has seen heavy selling in their counters.

On May 3, the first trading day of the month, shares in Hile Bio-Pharma closed at 42.97 yuan in Shanghai. But by June 1, they fell to 16.37 yuan. They closed at 15.22 yuan on Friday, marking a 65 percent decline since May 3.

Although the meltdown is attributable to the automatic price shrinkage due to the company's 13-for-10 stock split on May 4, the large shareholders' selling is also believed to be a major factor.

A research note from Ping An Securities said quite a number of companies in emerging sectors listed recently, suggesting that large shareholders may be exiting to secure their gains.

Citing filings, analysts attributed the selloff to big shareholders' desire to stay liquid.

A research note from Chang Xin Asset Management said recent paring of holdings had a limited impact on the A-share market so far, given the small size of sales relative to the whole market. But small investors holding shares in these stocks may feel the pinch due to falls in prices.

Zhang Shaofen, 56, a Shanghai-based small investor, said it is understandable if big shareholders like institutional investors reduce their holdings to boost their liquidity. But, if individuals such as company founders or senior executives, or their family members, are behind such sales, it could mean they are cashing out or eager to get rid of the company's shares for some reason.

"Usually, individual large shareholders have close knowledge of a company's profitability, operations and financial situation. If such individuals sell shares in bulk deals, small investors may interpret the move as a sign of erosion of confidence in the company's future."

But brokerages said block deals do not necessarily mean big shareholders are giving up on the company or that they are cashing out or exiting for good.

A research note from Guangfa Securities said some block deals could well be in anticipation of possible mergers and acquisitions. M&A activity usually stands a better chance of success when the equity structure is clear and simple.

Ping An profit up 38% on life insurance, investment returns

March 17th, 2016Ping An Insurance Group yesterday reported a nearly 40 percent jump in net profit last year on stellar life insurance sales and investment returns.

Ping An, Asia's second-largest insurance company by market value, said its net profit rose 38 percent to 54.2 billion yuan ($8.3 billion) in 2015, the highest since 2003.

Strong life insurance sales and a surge of investment returns partly from the bullish Chinese stock market in the first half of last year helped drive up the profits.

The company reported that premiums for life insurance rose 20 percent to 299.8 billion yuan, and the gross investment returns jumped 80.1 percent to 114.75 billion yuan last year.

Timothy Chan, the group's chief investment officer, told reporters yesterday that he expected more uncertainties this year and would seek more investment opportunities in blue-chip stocks, preferred stocks and fixed assets, especially logistic infrastructure in first and second-tier cities.

Guotai Junan Securities said in a note that Ping An's investment returns this year is likely to fall but its core insurance business remains in good shape.

The life insurance sector has benefited from greater focus on offering protection type of policies than capital-consuming investment-related ones.

The property and casualty sector has also outperformed industrial average in managing costs, the note said.

Analysts also said the group's more than 10 Internet financing branches spanning wealth management, e-commerce, health care consulting, and home sales will bring more revenue as well as clients.

Reform opens up more sectors to foreign investment

September 17th, 2015China vows to further open up domestic markets to foreign investors with fewer restrictions as the country's economic reform goes deeper.

"We have largely slashed restrictions to market access to the Chinese market to further lure foreign investment," said Lian Weiliang, deputy head of the National Development and Reform Commission, at a news briefing on Wednesday.

He added that restrictions over the proportion of foreign equity have also been further eased in the foreign-invested projects, especially in the service and manufacturing sectors.

"It's very important to set up a new system for an open economy and create a business environment that is more legalized and more international", he said. "And the country's efforts have paid off."

China's foreign investment has bucked the trend of the cooling global economy to increase 9.2 percent during January-August, among which investment in the service sector surged 20.1 percent from a year earlier.

In March, the country halved the number of industries that used to be off-limits to foreign investors, another big step toward a more favorable business environment amid reforms.

Lian said the country has been gradually shifting to the "negative list" approach to better regulate market access and encourage foreign investment.

The negative list, which identifies sectors and businesses that are off-limits for investment and allows investment in all other sectors, was first announced in September 2013 in the Shanghai Free Trade Zone and then extended to the other three FTZs in Guangdong, Tianjin and Fujian a year later.

Equities slump on economic concerns

August 19th, 2015

Retail investors check share prices at a brokerage in Qingdao, Shandong province, on Aug 18. The benchmark Shanghai Composite Index plunged by 6.15 percent to close at 3,748.16 points.

Share prices plunged on Tuesday as jittery investors resorted to huge sell-offs on concerns that the government has halted its plan to buy equities to stabilize the market.

The benchmark Shanghai Composite Index sank by 6.15 percent, or 245.5 points, to close at 3,748.16. It was the biggest loss in three weeks since an 8.5 percent dip on July 27.

State-owned enterprises, which are expected to undergo major ownership reforms, led the decline with more than 1,600 stocks on both the Shanghai and Shenzhen bourses tumbling by the 10 percent daily limit.

The market slump came after the country's securities regulator said on Friday that the State-owned margin lender China Securities Finance Corp will not step into the market unless there are abnormal market fluctuations.

The regulator's announcement has been widely interpreted as a signal that the government is ending its direct intervention and letting the market mechanism play a bigger role after the benchmark rebounded by about 15 percent from a bottom on July 8.

But Tuesday's decline underscored that investors' sentiment remained fragile as a slowing economy and the depreciation of the yuan continued to weigh on the market.

Jiang Chao, an analyst with Haitong Securities Co, said that the monetary authorities appear to be in a dilemma over the easing policies and the monetary uncertainty may continue to destabilize the market.

"There is need to inject more liquidity as the depreciation of the yuan is likely to trigger capital outflows. But the market rescue efforts have led to a surge in the broad monetary supply which created a policy dilemma," he said in a research note.

The recovery of the country's home prices has also dimmed investors' expectation for further monetary easing, some analysts said.

Li Daxiao, chief economist at Yingda Securities Co, urged investors not to overreact to Tuesday's decline, but warned about the risk of excess valuations of companies in the military industry.

Share prices of listed military-related companies have ballooned substantially ahead of the country's military parade commemorating the end of World War II and on expectations of major reforms.

The average valuation of the industry has been ranked the top among all industries with the price-to-earnings ratio of most companies exceeding 100 times, according to estimates.

"There is a big risk of the bubble bursting in military-related stocks, which is even worse than the startup board," Li said.

Stock markets show signs of recovery

July 1st, 2015

Chinese shares bounced back from early morning losses and closed sharply higher on Tuesday following a nightmarish two weeks.

After a two-week tumble, China stocks surged on Tuesday as a series of government measures bolstered investor confidence.

The CSI 300 Index, which monitors share prices of the largest companies listed in Shanghai and Shenzhen, jumped by 6.7 percent to 4,473.00 points, while the Shanghai Composite Index gained 5.6 percent to 4,277.22 points, the highest daily gain since 2009. The Chinese A-share market has fallen by about 20 percent from its peak in mid-June.

A series of measures to maintain market confidence have been introduced since Friday, including draft rules to allow pension funds to buy stocks, funds and equity-backed pension products.

That could channel more than 1.5 trillion yuan ($242 billion) into equity-backed investments, including about 15 billion yuan directly into the A-share market, Shanghai Securities News reported.

Pension funds may not be allowed to buy stocks before the end of this year, according to the draft rules, but investor confidence has been bolstered by the news, pushing up sentiments in the A-share market, researchers said.

"Although the pension funds may not help the A-share market in the short term, the draft measure, along with the recent cuts in the reserve requirement ratio and interest rates, show intentions to stabilize market incentives," a research report by Haitong Securities said.

The country's fund association said the falling prices presented valuable buying opportunities and it urged hedge fund managers to make rational investment decisions.

"Confidence is more important than gold," the Asset Management Association of China said on Tuesday. "Sunshine always follows rainy days," it added.

Brokerage firm Guotai Junan Securities said it would lower margin requirements for certain blue chips to lever-age investment values.

Leading asset managers echoed the sentiments to convince investors that the bull market was not yet over.

Managers of private equity funds also stated that they believe the market will continue to be bullish.

"From a mid-to long-term perspective, the foundations of the bull market have not been shaken. Instead, they have been consolidated amid corrections, and the market will be bullish in a more stable and lasting manner. We believe it is a rational decision and good timing for value investing," said Wang Yawei, president of Shenzhen Qianhe Capital Management.

Technology companies and brokerage stocks rallied on Tuesday, with an average rise of the sectors reaching about 8 percent.

Market gives back morning gains as cautious investors take profits

June 26th, 2015Mainland stock markets tumbled in late afternoon trading Thursday as investors cashed in on gains from earlier in the day.

The Shanghai Composite Index fell 3.46 percent or 162.37 points to 4,527.78 points Thursday. The Shenzhen Component Index lost 3.80 percent or 619.87 points to close at 15,692.44 points.

The CSI 300 Index of the biggest companies traded in Shanghai and Shenzhen fell 3.56 percent or 173.61 points to 4,706.52 points.

A total of 1.55 trillion yuan ($249.71 billion) changed hands on the two bourses, up from the previous trading day's 1.49 trillion yuan.

News about the central government's decision to scrap the debt-to-loan ratio for banks sent heavily weighted financial stocks soaring during morning trading, pushing the Shanghai benchmark above the 4,700 point mark by midday.

However, in the afternoon session, banking heavyweights took a hit as cautious investors decided to take some profit, dragging down the Shanghai index.

Despite the good news about the debt-to-loan ratio, the banking sector still suffered losses, indicating weak investor sentiment, New Times Securities said in a note Thursday.

The regulatory approval of a new batch of IPOs may have also contributed to the fragile sentiment.

The China Securities Regulatory Commission said late Wednesday that it has approved 28 new IPOs, which media reports said would freeze more than 1.4 trillion yuan.

The coal and nonferrous metal sectors were among the worst performers Thursday. Gansu Jingyuan Coal Industry and Electricity Power Co, Shaanxi Coal Industry Co, Anhui Jingcheng Copper Share Co and Shenghe Resources Holding Co fell 9.46 percent, 9.04 percent, 9.45 percent and 9.20 percent, respectively.

ChiNext, the country's NASDAQ-style board for high-tech and emerging start-ups, slumped 5.23 percent or 177.02 points to close at 3,206.38 points.

China's campaign to simplify administration encourages foreign investors

May 27th, 2015Japanese fashion manufacturer and retailer UNIQLO opened its first store in Ma'anshan City in east China's Anhui Province earlier this year, thanks in part to China's campaign to streamline administration.

With the help of a local subdistrict office, Fast Retailing (China) Trading Co., Ltd. managed to obtain a business license, despite lacking an important document.

"We needed the department store's certificate of title for our business license before making orders and employing people. However, the construction work was not done yet and we didn't have much time to wait," said Qiang Lili, a manager with the company.

The company went to the city's government affairs service center for help and learned that Ma'anshan had just launched a new regulation simplifying business location registration.

According to the new rule, which went into effect on December 31, 2014, those who temporarily lack the certificate of title for business license applications can submit proof of location from the local subdistrict office instead.

"We know the streamlining campaign is going on and we experienced the convenience this time. It's encouraging," said Qiang.

In addition to making business registration easier, Ma'anshan has also shortened the vetting period for investment projects. For example, the approval time for industrial projects was slashed from more than 30 to just 17 days.

"Foreign investors came for business opportunities, but the better government affairs services gave us more confidence," Qiang said.

In the first quarter of this year, Ma'anshan City's utilization of foreign direct investment reached 347 million U.S. dollars, up 12.8 percent year on year.

Similarly, foreign direct investment in other provinces also achieved steady growth in the first quarter of this year.

In Hubei, utilization of foreign investment hit 2.24 billion U.S.dollars, up 10.1 percent year on year. In Jiangxi, utilization of foreign investment reached 2.21 billion U.S. dollars, up 10.3 percent, and in Tianjin, it hit 6.37 billion U.S. dollars, up 10.5 percent.

Since 2013, China's State Council has been streamlining government administration to reduce government control and unleash market vitality.

In two years, more than 700 approval items controlled by central government departments have been canceled or delegated to lower agencies, more than a third of all approval items handled by the State Council prior to streamlining.

Following the steps of the central government, local administrations also explored ways to simplify the approval process and lower the threshold for investment.

On May 12, Chinese Premier Li Keqiang again called for more efforts to streamline administration procedures at a national teleconference attended by senior and mid-level officials.

Li said the government will cancel more approval items, make business registration easier and waive administrative charges it deems unreasonable this year.

"It is a positive trend," said Wang Yukai, a professor from the Chinese Academy of Governance. "But to create a better foreign investment environment in the long run, the government management system should also be improved."

Finance companies launch new funding program for female entrepreneurs

February 5th, 2015China's first funding program aimed at providing finance exclusively to female entrepreneurs has been launched by a group of heavyweight finance organizations.

International Finance Corporation, Ant Financial Services Group, a subsidiary of Alibaba Group Holding Ltd, and Goldman Sachs Foundation will jointly run the program.

The funds to be offered - through loans from Ant Financial Services' microcredit arm Ant Credit, with the backing of IFC and Goldman Sachs - are expected to benefit around 46,000 female entrepreneurs. The program has 500 million yuan ($80.13 million) available to it.

"The market opportunity for financial products designed specifically for female entrepreneurs is huge", said Ji Min, deputy director of finance research institute of the People's Bank of China, with few, if any, currently on the market.

Karin Finkelston, IFC's vice-president for Asia Pacific, said women starting out tend to invest their business knowhow in different directions from their male counterparts, for instance into family-oriented fields, including children's education and family healthcare, which often represent appealing prospects for financial companies.

On the flipside, however, research shows that women entrepreneurs have traditionally found it hard to get financed, and if they do, the amounts approved can be tiny, even as little as 10 percent of what they are seeking, said Finkelston.

She claims her own organization, however, is female-friendly when it comes to financial support, a philosophy shared with its partner in the new fund, Ant Financial Services, which already has a strong client base of female-led startups, many of which run their businesses on Alibaba's online market platform.

Yu Shengfa, Ant Financial's vice-president, said that just over half of the business owners using Alibaba's online market platforms are female.

IFC provided 1 billion yuan in senior loan funding to Ant Credit in 2014 which it loaned, in turn, to 62,000 micro-, small and medium-sized enterprises across China.

Online-based Ant Credit's role is to evaluate potential borrowers' creditworthiness based on their transactional and behavioral data, without the need for deposits, it says, or using any assets as guarantees.

By the end of March 2014, Ant Credit had loaned 190 billion yuan for more than 700,000 small and micro-business.

Ding Qinyan, 26, an Ant Credit customer, started her online apparel store on taobao.com when she was still in college.

Her first online business loan was granted in 2013, for the deposit needed to join an online sales campaign.

Based on Ding's sales records and credit history, the application was approved within a minute at an interest rate of 0.0005 percent per day.

Foreign banks optimistic about future performance in China: report

January 14th, 2015Foreign banks in the Chinese mainland continue to be optimistic about their future performance going forward, according to a report released by Ernst & Young Greater China here on Tuesday.

"The regulatory landscape continues to challenge foreign players, while alongside are also the opportunities generated from the evolving RMB internationalization and interest rate liberalization," Managing Partner of Financial Services at Ernst & Young Greater China Jack Chan said.

In terms of total assets, based on the China Banking Regulatory Commission's 2013 annual report, foreign banks' market share in China was just 1.73 percent as of Dec. 31, 2013, below the market share of 1.84 percent back as of Dec. 31, 2004.

According to the report, foreign banks in China expect a modest improvement in performance over the next three years. Half of the participants predict a slight improvement, while 45 percent of them hope to see a significant improvement.

Despite the optimism, the report said many of the CEOs that they have surveyed find the market challenging and complicated by issues surrounding financial reform and economic uncertainty.

The most difficult regulatory challenge in 2014 was access to the bond market, followed by the myriad of rules and regulations and capital and liquidity constraints, Chan said.

As China's economy evolves, the foreign banks believe it is critical that the capital markets open up and the foreign banks participate more fully in the bond market, he said.

The report is based on interviews with 41 foreign bank CEOs and senior bank executives based in Shanghai, Beijing and Hong Kong and conducted during August and September 2014.

It examines the challenges facing players as they push to improve their footprint in China. It also looks at the trends and regulatory reform that is shaping the market and offer insights into ways of driving growth now and in the future.

Beijing targets high-end industry investors

December 11th, 2014This year's "Invest in Beijing" Fair, which aimed at attracting more investment to the city's high-end industries, opened in Beijing on Dec 9.

As an annual investment promotion event taking place in the city since 2009, this year's Invest in Beijing attached more emphasis on social and private capital's involvement in its cutting-edge sectors, such as the new generation of information technology, biological medicines, as well as energy conservation, and environmental protection.

The organizing committee also set up a service station to offer face-to-face counseling for potential investors and companies in various fields, such as laws and regulations, investment environment and planning of industries.

Representatives from the city's governmental departments, including the commission of science and technology, commission of education and commission of development and reform, came to explain the investment policies at the station, as did the investment promotion organizations from all the districts and counties of Beijing, as well as the city's major industrial clusters —Zhongguancun Science Park, Beijing Economic-Technological Development Area and Beijing Tianzhu Free Trade Zone.

At the Fair, the Beijing Municipal Commission of Development and Reform released a batch of pilot projects which call for social investment in public services and utilities, and the new list of industries that are prohibited or limited by the municipal government.

The China National Gold Group Corporation, the country's biggest gold producer, Nanshan Group, a chemical firm based in east China's Shandong province, and China Energy Conservation and Environmental Protection Group signed contracts worth 31.1 billion yuan ($5 billion), higher than the 27.9 billion yuan at the contract signing ceremony during last year's "Invest in Beijing" Fair.

This year's Fair highlighted the promotion of projects in high-end sectors and strategic emerging industries to help advance the city's economic restructuring and strengthen its role as the country's center of politics, culture, global exchanges and scientific and technological innovation.

More than 500 representatives from state-owned enterprises, large private companies, multinational corporations, leading players from different industries, as well as chambers of commerce from China and abroad attended the fair.

Ma Peihua, vice-chairman of the Central Committee of the China National Democratic Construction Association, Niu Youcheng, a member of the Beijing Municipal Party Committee and the city's vice mayor Cheng Hong were present at the Fair.

Chinese stock benchmark index regains 3,000-point mark

December 8th, 2014Chinese shares continued rising on Monday, with the benchmark Shanghai index jumping over 2 percent to regain the 3,000-point psychological mark, the first time since April 25, 2011.

China renews innovation drive

December 4th, 2014China's State Council, the Cabinet, has unveiled a series of measures to promote independent innovation and encourage entrepreneurship.

According to a statement released Wednesday after a State Council executive meeting presided over by Premier Li Keqiang, the country must expand pilot programs for independent innovation and seek "multiplication" in social enthusiasm for innovation and entrepreneurship with the "subtraction" of government grip.

Since 2010, China has experimented with policies promoting scientific and technological innovation in the Zhongguancun National Innovation Demonstration Zone in Beijing.

The government will roll out six Zhongguancun policies to the rest of country, including new rules on research funds and equity financing for small enterprises.

There will also be some tax preferences for innovation demonstration zones. For instance, the income tax for equity incentives given to technical and managerial employees can be paid by installment within five years, according to the statement.

The statement added that China will do research in Zhongguancun concerning overseas talent, diversify corporate financing channels and support the construction of bonded warehouses.

China has six national innovation demonstration zones and plans for more.

70% rise in angel investments in China

December 4th, 2014A total of 547 angel investment deals have been signed in the first 11 months in China totaling $341.4 million, a 69.6 percent increase compared with the whole last year, according to a report of Zero2IPO Group on Wednesday.

Ni Zhengdong, chairman of Zero2IPO Group, said that lots of angel investment institutions and funds were set up in 2014, stimulated by the rising number of start-up deals.

Ni said 55 new angel investment funds have been set up this year and their scale has reached $700 million.

Venture capital companies also have focused on deals at early development stage and about 60 percent of their funds are invested in these deals, said the report.

Relaxing restrictions on foreign investments

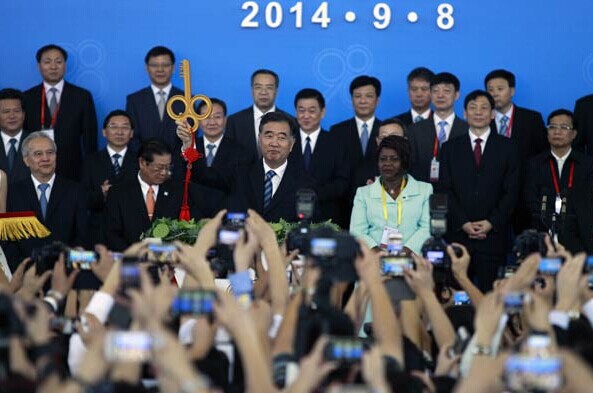

September 9th, 2014

Vice-Premier Wang Yang (center) holds a golden key to signal the opening of the 18th China International Fair for Investment and Trade on Monday.

Service sector will be steadily opened-up

China will further open its investment and cooperation system and optimize the environment for foreign investment, Vice-Premier Wang Yang said on Monday.

"China's policy of investment and cooperation will be kept in the long run, although the inbound and outbound investment situation is witnessing big changes," said Wang.

Wang made the remarks at an international investment forum during the 18th China International Fair for Investment and Trade, which opened on Monday in Xiamen, Fujian province.

The annual international investment event provided more than 30,000 potential investment projects and attracted companies and government organizations from 54 countries and regions, according to the organizers.

The competitiveness of the domestic companies in the world's second-largest economy has grown remarkably and there are fundamental changes that foreign investment will have to adapt to, said Wang.

Traditional manufacturing businesses are returning to developed countries and developing economies are boosting efforts to introduce foreign investment, which has affected the international capital flows, he explained.

But he said, "We will not ignore the role that foreign investment plays in the Chinese economy and will not reject foreign-invested companies."

However, according to Wang, China will not simply introduce foreign capital in the future, instead it will look to introduce advanced technology, managerial experience and intelligence resources and build various market-oriented systems in accordance with international practices.

"We will relax the restrictions on foreign investments, and steadily open-up the finance, education, culture and healthcare markets," Wang said.

According to Wang, the Chinese government will strengthen efforts to protect foreign investors' interests by tackling the problems of monopolies, commercial bribery and copyright infringements to improve the domestic investment environment.

This year marks the 30th anniversary of China's first group of national-level economic and technology development zones, and Wang said such zones need to be further transformed and upgraded.

"China's economic and technology development zones should be driven by innovation and they should make better use of foreign investment for their future success," Wang said.

Such zones are also being encouraged to enhance communication with their foreign counterparts to promote new growth models, according to Wang, who pointed out that China's 215 national-level economic and technological development zones realized one-fifth of the country's foreign investment and one-eighth of its GDP in 2013.

Commerce Minister Gao Hucheng said the Chinese government will adhere to its policy of mutual benefits and strive to build an open economic system, actively working with international organizations and governments to promote a healthy recovery of the global economy.

"The annual international investment fair has proved to be an efficient platform to create investment and cooperation opportunities. I hope all participants will take full advantage of this event to boost investment and cooperation," Gao said.

Gao urged domestic economic and technological development zones to play an active role in boosting international investment.

"Such development zones have not only promoted the country's development they have also become an important platform for international investment," Gao said.

By attracting foreign direct investment, catalyzing the development of industrial clusters and adopting new technologies and management practices, the economic and technology development zones have played a key role in China's economic success, said Cai Jinyong, chief executive officer of the International Finance Corporation.

"Successful programs, which can contribute to the long-term future of the zones, are the ones that focus on market demand and are integrated into the domestic economy. The development of any zone should be based on an identified market opportunity," he said.

Alipay starts online financing for SMEs

August 26th, 2014

Zhaocai Bao was designed to connect the investment activities of 300 million individual investors in China with the financing needs of 1 million small and medium-sized enterprises. Its annual sales volume is expected to reach 1 trillion yuan in the next two to three years.

China's largest online payment provider Alipay announced the official launch on Monday of Zhaocai Bao, an Internet finance platform that aims to reshape financing for small businesses to the tune of 1 trillion yuan ($162 billion) within three years.

For investors, the Zhaocai Bao (Money-drawing Treasure) platform offers products with average annualized returns of between 5.4 percent and 6.9 percent. In comparison, the annualized return rate for Yu'ebao, China's largest money market fund, has fallen to about 4.1 percent since its launch in June 2013, while China's one-year fixed-term deposit rate is 3 percent.

Zhaocai Bao is different from Yu'ebao as its major product consists of loans to small businesses, while the latter is a money market fund managed by Tianhong Asset Management.

"We aim to connect the investment activities of 300 million individual investors in China with the financing needs of 1 million small and medium-sized enterprises," said Yuan Leiming, CEO of Zhaocai Bao.

In addition to the higher return rate, Zhaocai Bao has set the threshold for investors at a mere 100 yuan. And risk of bad loans is underwritten by insurance companies.

Although products on Zhaocai Bao are bound by a fixed maturity ranging from three months to three years, investors are allowed to "liquidate" the product before its due date by transferring it via the platform to other investors, after paying a 0.2 percent transaction fee, so they can still enjoy the original annualized return rate.

At the borrowers' end, Yuan said the financing cost for SMEs on Zhaocai Bao is about 7 percent, much lower than the average 18 percent financing cost for small and medium-sized companies, and the time it takes to borrow money can be as short as 10 seconds.

"The traditional approach for banks is to collect small pieces of capital, put them into a pool and then go search for borrowers, which pushes up the overall cost," Yuan said.

"Our capability of cloud computing and big data processing enables direct integration of every piece of capital with the borrowers, which significantly reduces the cost," he said, adding that the average Zhaocai Bao deal totals around 200,000 yuan and that Zhaocai Bao takes a 0.1 percent transaction fee on every deal.

Since a test run in April, Zhaocai Bao has already sold 11.4 billion yuan in financial products to a half-million customers, according to its official Web page, which is linked to Taobao.com. Forty financial institutions are currently working with the platform, while another 100 are waiting in the line.

By comparison, Yu'ebao currently has about 100 million users with transactions totaling 600 billion yuan.

"The aim for Zhaocai Bao is to reach 1 trillion yuan annual sales volume over the next two to three years," Yuan said.

According to independent statistics, China is home to 800 online lending websites, with close to 100 billion yuan worth of transactions in 2013.

Chen Jin, CEO of China's first online insurance vendor, Zhong'an Insurance - which is also one of Zhaocai Bao's partners - said the transition from Yu'ebao to Zhaocai Bao reminds him of Taobao.com and Tmall.com, and marks a strategic transformation for China's largest e-commerce conglomerate, Alibaba Group Holding Ltd.

Wu Zhigang, chief information officer for China National Investment and Guaranty Co, said that as most of China's individual investors are vulnerable to risks, a platform like Zhaocao Bao could effectively lower those by offering a high degree of information and comparisons.

"It's a good example of inclusive finance," he said.

Shanghai unveils measures to bolster VC

July 18th, 2014Shanghai announced new measures to encourage private investment in small and micro companies, the latest move to boost venture capital in the city.

The local government said in an online statement yesterday that it is striving to build Shanghai into an international venture capital center.

By 2017, the city is expected to accumulate an additional 100 billion yuan (US$16 billion) in capital for investing in innovative companies. The city also forecasts attracting an extra 1,000 venture capital professionals and 100 influential venture capital firms in a bid to help start-up companies receive the guidance they need.

The city's Venture Capital Investment Guidance Fund increased 1 billion yuan annually in the past three years. The fund invests in targeted sectors and also serves as a guide for privately owned funds. District and county-level governments are encouraged to establish similar funds.

Shanghai plans to simplify foreign investment procedures in domestic venture capital firms by piloting a foreign exchange settlement trial.

State-owned enterprises are also being encouraged to form VC firms.

The new measures are part of the government's efforts to support small and micro companies in Shanghai. Apart from direct financing solutions, Shanghai has also encouraged banks to lend money to cash-strapped small companies.

Executive Deputy Mayor Tu Guangshao's said earlier this week that Shanghai will improve fundraising services for small and micro companies.

There were about 370,000 small and micro enterprises in the city as of the end of 2013. They accounted for 97.1 percent of incorporated companies and provided 54 percent of the city's jobs.

Elsewhere, the People's Bank of China's Shanghai Headquarters agreed to loan 1 billion yuan (US$161.1 million) to Shanghai Rural Commercial Bank.

Guangdong outlines big FTZ plans

January 14th, 2014

A booth showcasing Guangdong-based businesses at an expo in Guangzhou, the province's capital. Guangdong is currently seeking central government approval of a Guangdong-Hong Kong-Macao free trade zone. Provided to China Daily

Southern province aims to capitalize on links with neighboring regions

The Guangdong provincial government has vowed to realize liberalization of trade in services in the South China province and its neighboring Hong Kong and Macao special administrative regions by this year through CEPA (the Closer Economic Partnership Arrangement).

"It is a task assigned to Guangdong by the State Council," Vice-Governor Xu Shaohua told a Monday news conference. "We are striving for the central government's approval of specific preferential projects and policies.

"At the same time, we will open up more fields for investors from Hong Kong and Macao, including those in the service sector, using a 'negative list'."

Xu also said Guangdong is currently seeking central government approval of a Guangdong-Hong Kong-Macao free trade zone.

"We are talking with ministries about the construction plan and preferential policies," Xu said.

At a joint meeting between Guangdong and Hong Kong in September, Guangdong Governor Zhu Xiaodan said that the new free trade zone will focus on liberalizing trade and building a platform for the cooperation in the high-end service industry, capitalizing on Hong Kong's reputation as a premier international finance center.

A focus on liberalizing trade in services will set this free trade zone apart from the China (Shanghai) Pilot Free Trade Zone, which focuses on financial openness, according to Lin Jiang, dean of the public finance and taxation department of Lingnan College at the Guangzhou-based Sun Yat-sen University.

"The volume of trade in services has surpassed that of trade in goods in international trade," said Lin, who also is vice-director of the university's research center of Pearl River Delta, Hong Kong and Macao.

"The Guangdong-Hong Kong-Macao free trade zone is the pilot zone in China to make breakthroughs in fields such as offering tax refunds for service exports, which are intangible goods," Lin said.

"Liberalizing trade in services also answers the province's need for upgrading and transforming its processing trade. That's why the province doesn't stress liberalizing trade in goods," said Lin, who gave as examples of modern service industries high-end design and management consultancies.

Zhu also noted at the September meeting that the new free trade zone will help adapt the mainland's financial management mechanism to international practices in Hong Kong.

Lin said it will benefit the province to make business laws and regulations according to international practices in Hong Kong, since that will be one of the free trade zone's major incentives for international investors, compared with the Shanghai free trade zone.

Xu listed several items on the Guangdong government's action plan for liberalizing trade in services in the zone. They include: relaxing or canceling restrictions on Hong Kong and Macao investors' qualifications, shareholding ratios and/or scope of business; promoting mutual attestation of professional qualifications; and exploring possible business modes for individual professional services.

"The Hengqin New Area in Zhuhai, the Nansha New Area in Guangzhou and the Qianhai experimental zone in Shenzhen are the three areas opened up for Hong Kong service industry," Xu said. "In addition, Zhongshan, Foshan and Dongguan cities are proposing platforms to attract investors from Hong Kong and Macao."

The latest announced preliminary plan of the Guangdong-Hong Kong-Macao free trade zone includes the three new areas and experimental zones plus Guangzhou Baiyun International Airport, taking up an area of more than 1,300 square kilometers, which is 47 times of that of the Shanghai free trade zone.

Lin warned that it would be a challenge for the Guangdong government to figure out a way to coordinate so many areas.

Part of the reason for Monday's news conference was to interpret the provincial Party committee's suggestions for Guangdong's implementation of the central government's comprehensive reforms.

The suggestions were approved by the Third Plenum of the 11th General Assembly of the Guangdong Provincial Party Committee, held last weekend in Guangzhou.

"To further open up the province, Guangdong will also strengthen its cooperation with the US and European developed countries by establishing overseas offices of economic trade in these countries," Xu said, adding that an office in Germany already has been set up.

"This is to get in touch directly with big multinational corporations to attract investments and technologies that will assist in upgrading and transforming Guangdong's economy," he said.

Guangdong, the largest Chinese trader for ASEAN countries, also will further promote its foreign trade with these countries and spearhead the central government's strategy of building the Maritime Silk Road of the 21st century.

Alibaba's 'Leftover Treasure' hits 43 mln users

January 2nd, 2014Yu'ebao (Leftover Treasure). an Alibaba personal finance product, had 43.03 million users with aggregate deposits of 185.3 billion yuan (30.4 billion U.S. dollars) at the end of 2013.

Yu'ebao is an online fund established by Alipay, China's largest third-party payment platform and subsidiary of Alibaba, part of China's biggest online shopping mall, togetheer with the private Tianhong Fund.

"Investments" in the fund have brought 1.79 billion yuan in profits to users since its launch in June 13 this year, according Alipay on Wednesday.

Yu'erbao allows Alipay customers to invest any balance in thier accounts with the Tianhong Fund and has already become the largest fund of its kind in China.

Its users come from all over China: more than 2,000 counties and cities in 31 provincial-level administrative regions with an average deposit of 4,307 yuan per user.

Shanghai starts simulated trade in equity options

December 27th, 2013The Shanghai Stock Exchange has started simulated trading in equity options, part of a drive by regulators to expand investors' risk-hedging options.

Simulated trading began on Thursday morning, the SSE confirmed to China Daily, and more than 60 securities firms took part.

The shares of Ping An Insurance Group Co of China Ltd, SAIC Motor Corp Ltd, the China 50 ETF and the Shanghai SSE180 ETF were used in the exercise.

The exchange-traded funds track the top 50 and top 180 yuan-denominated stocks on the SSE.

In early December, SSE Chairman Gui Minjie told a forum that preparations "are almost complete" for launching options on individual stocks.

Single-stock options are essentially equity derivatives, giving buyers the right - but not the obligation - to buy or sell a stock at a fixed price within a certain period or on a set date, said Tony Sun, a strategist with Shanghai Tebon Fund.

The options "will allow investors to hedge their positions more effectively. We have limited financial instruments now, but as reform continues and China's financial markets become more global, innovation is a necessity," said Sun.

China introduced equity index futures in 2008, and those instruments remain the only equity derivatives in use. The regulators expanded a pilot program in August 2012 to boost margin trading.

In February, a new pilot was launched to enable securities lending and short-selling of blue chip stocks.

"Individual stock options can be seen as a form of insurance that reduces trading risks. However, options trading prices can be very volatile. Investors still have to be aware of the risks caused by leveraging and volatility," said Xiong Jinqiu, an independent financial commentator.

The China Securities Journal reported earlier this month that the SSE may officially introduce formal equity options trading in April. Some analysts believe the move is meant to stimulate investment in China's blue chips, which have been trading at depressed valuations.

The average price-earnings ratio for the SSE, where most of China's blue chip companies are listed, stands at only 11 times 2012 earnings. On the Shenzhen exchange, which is dominated by small-cap companies, the average ratio is 28.

Change for WMPs

Another development involving the liberalization of the financial markets took place on Wednesday, this one involving wealth management products.

WMPs will be allowed to invest directly in fixed-income products on domestic securities markets, the China Securities Depository and Clearing Corp announced.

The notice said that WMPs will be allowed to open accounts at the Shanghai or Shenzhen stock exchanges. Investment will be confined to fixed-income products, including exchange bonds, credit-backed securities and preferred shares. The latter are often classified as fixed-income products because of their fixed dividend.

Analysts said that the move on WMPs is intended to provide a bridge "linking" interbank market liquidity with the nation's stock exchanges, even though WMPs can't make direct stock investments at this stage.

The outstanding balance of WMPs stood at 9.92 trillion yuan ($1.63 trillion) as of Sept 30, the China Banking Association said earlier this month.

The figure has more than doubled since the end of 2011, and it's up from 7.1 trillion yuan at the end of 2012.

FTZ may get international board to lure yuan for gold

December 6th, 2013The Shanghai Gold Exchange plans to launch an international board in the pilot free trade zone to attract offshore yuan capital to invest in the Chinese mainland's gold market, a senior official said yesterday.

"We want to tap the opportunity from Shanghai's pilot free trade zone and launch an international board to attract offshore yuan to invest in the mainland," Xu Luode, chairman of the bourse, said at a precious metals forum in Shanghai yesterday.

The board will ensure that the onshore gold market correlates with the global market, said Xu, without disclosing a timetable for the launch.

Financial reforms in the free trade zone will allow free fund transfers between the zone and offshore markets for the first time, according to a directive issued by the People's Bank of China on Monday.

The Shanghai exchange will establish a system that publishes daily rates at which selected market participants are willing to lend gold in the mainland interbank market, which is similar to the Gold Forward Offered Rates by the London Bullion Market Association, according to Xu.

The world's biggest exchange for physical gold in Shanghai will also offer custody for the metal to retail investors.

Chinese mainland renews duties on Japanese, Taiwanese solvent

November 21st, 2013The Chinese mainland will continue to levy anti-dumping duties on methyl ethyl ketone (MEK), an industrial solvent, from Japan and Taiwan for another five years, the Ministry of Commerce (MOC) announced on Wednesday.

The decision was made after a one-year review and will come into effect on Thursday.

The Chinese mainland started to levy tariffs ranging from 9.6 percent to 66.4 percent on MEK from Japan, Taiwan and Singapore on Nov. 22, 2007.

When the five-year anti-dumping measures expired last year, Singapore was delisted, while the other two regions came under review.

After the review, the MOC said domestic producers may again suffer losses to MEK from Japan and Taiwan if the anti-dumping duties were lifted.

MEK is a solvent widely used in making paints, dyes and lubricants.

Foreign Investment into China: Where's the Money Flowing?

November 20th, 2013Where’s the money going? The Ministry of Commerce gave a clearer picture with a press conference introducing foreign direct investment into China on Nov. 18.

First of all, China is on track for a big shift. Very soon, Chinese companies will be investing more money overseas than foreign companies bring to the mainland. In the first 10 months of the year, China nabbed $97 billion, up 5.8 percent. Meanwhile, outbound investment reached $69.5 billion, growing at a much more rapid 20 percent. “The trend for Chinese companies going abroad has just started,” said Zhang Yuliang, chairman of Greenland, a real estate developer, in a recent interview with Bloomberg News.

Who’s investing in China? The biggest surge is from the European Union, totaling $6.4 billion January through October, a 22.3 percent increase. U.S. companies, too, upped investment by 12.4 percent to reach $3 billion. And Japanese enterprises put in $6.5 billion, slightly more than the EU sum, a 6.3 percent rise. The largest amount came from Hong Kong due to its historical entrepot role; that totaled $63.5 billion, an increase of 10.5 percent.

STORY: China's Stock Boom Isn't Benefiting Foreign Investors

“We can see that foreign investment from Asian countries, the European Union, and the U.S. all kept relatively fast growth in the first 10 months,” Commerce Ministry spokesman Shen Danyang told reporters in a press briefing.

China’s service industries were the biggest draw for foreign investment, pulling in $50 billion, up about 14 percent in the first 10 months. That’s good news, with Beijing aiming to lift the proportion of its economy made up of the tertiary sector from today’s 45 percent to 47 percent by 2015.

Not surprising, given rapidly rising labor and other costs, investment in manufacturing fell by 5.2 percent, to $38 billion, making up just over two-fifths of the total. Investment in agriculture, animal husbandry, and fishery businesses dropped by 2.6 percent, to $1.4 billion.

STORY: The Trouble With China's Reform Plan

Eastern China continues to bring in the most investment, $81.4 billion in the first 10 months, up 6.0 percent, or about 84 percent of the total. That compares to $8.6 billion in the central part of the country, up 9.9 percent, making up 8.8 percent of total investment.

Meanwhile, western China, home to the restive Muslim region of Xinjiang, didn’t fare well—bad news for Chinese authorities who count on economic development to lessen ethnic tensions. Foreign investment of $7.1 billion was down 1.1 percent and amounted to only 7.3 percent of the total. Nine assailants and two auxiliary police officers were killed in an attack on a police station in Kashgar prefecture, Xinjiang, on Nov. 16, according to Xinhua News Agency.

Coca-Cola plans more than $4B investment in China

November 15th, 2013Coca-Cola says it plans to invest more than $4 billion in China over three years.

David Brooks, president of Coca-Cola’s Greater China and Korea business unit, told Bloomberg earlier this week that the company plans to invest the money between 2015 and 2017 to build factories and add new products to its portfolio. The company is also investing $4 billion in China between 2012 and 2014.

Coca-Cola has been expanding in emerging markets such as Russia and China. It aims to reach $200 billion in revenue by 2020, in part by catering to the rising middle class in emerging markets.

Shares fell a penny to $39.82 in midday trading. The stock has risen 10 percent since the beginning of the year.

Shanghai finance sector 'in shape'

October 29th, 2013Active, growing financial markets and innovations in the sector are making Shanghai more prosperous as a financial hub for the world's second-largest economy, a report released on Monday suggests.

The 2013 H1 Shanghai Financial Prosperity Index, released by Roland Berger Strategy Consultants and the Shanghai Financial Association, shows that the city's financial industry is in good shape to grow.

The analysis covers six dimensions of the industry: markets, institutions, internationalization, innovation, talent and environment.

"Financial markets in Shanghai maintained relatively fast development in the first half of 2013 with a booming fund market, gold market and insurance market.

"The financial innovation index also surged, with more financial products designed and the Free Trade Zone approved by the State Council," said Lian Ping, an executive member of the Experts Committee of the Shanghai Financial Association and chief economist of the Bank of Communications Ltd.

Shanghai's financial industry "has become more stable since 2010, and the growth rate of this sector slightly improved in the first half of 2013", the report said.

The report said that Shanghai achieved more progress than other financial centers, including Hong Kong, Singapore, Mumbai, New York, London and Seoul, in the past six years in terms of the "development index".

The index incorporates indicators of financial markets and the development of the financial environment.

"It is not a comparison of absolute value," said David Ye, partner and vice-president of Roland Berger, lead author of the report.

"It is meant to compare how the financial industry is evolving and progressing in these markets. Shanghai achieved more in the past six years, but Singapore, Hong Kong and Mumbai showed a stronger growth trend in the first half of 2013," he added.

The Shanghai Financial Association and Shanghai United Assets and Equity Exchange also released their Shanghai Merger and Acquisition Index report on Monday.

That report said that during the first half of 2013, there was marked growth of merger and acquisition transactions in primary industry.

Private companies were more active in this market than State-owned ones. Outbound M&A cases surged in May and June, and the quality of the deals improved.

Patrick Becker, chief executive officer of Bexuco Ltd, an M&A project consulting and service company based in Shanghai, said that although Chinese companies have become more willing to pursue outbound cases, they still lack the experience and management skills to handle and execute an overseas investment.

This can lead to strategic mistakes, inappropriate deal structures and overpaying for the target firm, he said.

"But I see a substantial improvement in the past 12 months. Chinese companies are more and more willing to engage foreign M&A advisers acting in their interest," he said.

What is this GEM manager's golden rule for investing in China?

August 30th, 2013Investing in Chinese equities is not easy - even the most experienced investors can get their fingers burnt trying to find the right stocks to back in an opaque and volatile market - but one manager has a tip for would-be investors.

Mirabaud Asset Management's Daniel Tubbs has one golden rule to invest successfully in the region - align yourself with whatever the government wants to do.

The group's head of GEM and manager of the $108m Mirabaud Equities Global Emerging Markets fund said he has been choosing his investments according to government policy, backing the property and infrastructure sectors recently after an uptick in state support.

Tubbs (pictured) said the government's spending on infrastructure such as railways is accelerating, while it is becoming more relaxed about the property market after three years spent trying to dampen the bubble.

"Average house prices have increased 6% year on year, in line with wage inflation," said Tubbs. "We bought Yuexiu Property Company in January. It has a business on the eastern seaboard where there is still pent-up demand.

"It is one of the few property companies which has an investment grade rating, leading to a cheaper cost of capital, which is a big advantage for a property company. It has a 5% yield, trades on six times earnings, and has rallied a lot in the last few weeks," he said.

One of the government's long-term aims is to rebalance the Chinese economy towards domestic consumption, and it will do this by boosting income levels, said Tubbs. He owns China State Construction in the fund's top ten holdings as a proxy to this theme.

The manager argued investors are too fixated on economic deceleration in the BRIC countries, especially China, and said a hard landing is not cause for concern as long as the corporate sector remains robust.

Low summer trading volumes have meant swings in sentiment are exaggerated, he added. This has combined with incremental positive data in the developed world to create a home bias, which is why emerging market equities have been at the sharp end of a sell-off in the last few months, said Tubbs.

He is overweight Russia, Turkey, and China because he is still able to find quality companies to own in those markets and, in China especially, he is seeing encouraging signs of stabilisation.

"It is wrong to be pessimistic on China - it was hard for it to continue to grow at 10% a year," he said.

"I am not worried about growth decelerating as long as companies are still doing well. The Chinese companies we hold reported average net profit growth of 38% year on year in Q2, which is not bad considering the consensus forecast for the whole of China was in the teens.

"People have not given the government enough credit that it can manage the recovery."

Over the year to 27 August the Mirabaud fund has lost 2.91% against an average 0.11% gain from the Equity - Emerging Markets sector, according to FE.

Shanghai’s free trade zone trial gets official go-ahead

August 23rd, 2013China has officially given the green light to setting up a pilot free trade zone in Shanghai, the Ministry of Commerce said yesterday, and an overall plan for the zone will be announced after legal procedures are completed.

“The State Council has proposed to adjust some laws in the free trade zone in an effort to accelerate transition of government functions, explore management of foreign investment through drafting a negative list for foreign investors, and seek innovation in the opening-up model,” according to a ministry statement.

The proposal is pending approval from the Standing Committee of the National People’s Congress, China’s top legislature.

“The free zone will benefit China with new advantages in international competition and provide a new platform for the country to cooperate with other countries and thus help it to explore economic potential and build an upgrading economy,” the statement said.

China plans to suspend some laws on foreign companies and joint ventures in free trade zones, including Shanghai, according to a statement released after a meeting presided over by Premier Li Keqiang on August 16.

The central government approved a draft plan in July, which involves further opening up the country’s service sector, speeding up transformation of trading methods, promoting openness and innovation in the financial sector and building a suitable regulatory system for the zone.

In a free trade zone, goods can be imported, manufactured and re-exported without the intervention of Customs authorities, thus improving convenience and efficiency and facilitating the free flow of commodities and capital.

Shanghai’s current bonded areas allow companies to import goods without paying tax unless they enter the Chinese mainland for sale in the domestic market.

The pilot free trade zone, the first of its kind on the Chinese mainland, will be in the Pudong New Area.

The 28.78 square kilometer area will cover Waigaoqiao Free Trade Zone, Waigaoqiao Bonded Logistic Zone, Yangshan Free Trade Port Area and Pudong Airport Comprehensive Free Trade Zone, where a series of preferential policies is already in place.

The Shanghai Financial Services Office said the trial will focus on facilitating trade and investment activities, promotion of cross-border yuan use, and decentralization and improvement of foreign exchange management.

The trial program and implementation will be designed with Shanghai’s own characteristics to pilot China’s new financial reform, opening up and innovation measures, the office said.

Some measures to be implemented in the trial are related to credit asset securitization and foreign direct investment by individuals.

Sun Lijian, head of the Finance Research Center at Fudan University, said: “The approval of the trial free trade zone in Shanghai indicates the government’s resolution to rebalance economic development from a government-led and policy-supported pattern to a deregulated and more market-oriented mode.”

Lu Zhengwei, chief economist with the Industrial Bank, said that building a free trade zone that follows international standards is expected to bring breakthroughs to China’s service industry, which is set to be a new engine for the Chinese economy over the next decade.

5 Eye-Popping Numbers Behind China's Rise

August 23rd, 2013China's a big place. The world's most populous country and second-largest economy has become a global star, ranking as the hottest emerging market and an investor target for growth, while previous top economies such as the U.S. and Europe have slowly staggered back from the recession. In China, the present is only part of the story: Growth investors have their eyes trained firmly on this nation's massive opportunity in the future.

But just how big is that opportunity? Let's look at five numbers that sum up China's present and future -- and just how this king of the emerging markets shapes up for investors everywhere.

1. 1.4 billion

China boasts around 1.35 billion people under its flag today, but Thomson Reuters estimates that the country's population will only increase to around 1.4 billion by 2050. This is a country looking at a low-growth environment over the next 35 years as it modernizes and urbanizes -- and it signals a major shift on how investors should look at this emerging market.

For decades, China has translated its massive population's burgeoning potential into double-digit annual economic growth. China's slowdown today is coming as the country faces a pair of demographic challenges that will probably prevent China from achieving its old, eye-popping annualized growth rates again. Indeed, many economists project that India will surpass China as the world's most populous country before then.

Beijing's one-child policy has gutted China's youth, leaving a swelling senior population too heavily reliant on a thin corps of young, productive workers. Thomson Reuters projects that more than 20% of China's population will be above age 65 by 2040, with that percentage growing even higher by 2050. Beijing will be forced to allot more attention and funds away from its current resource-oriented strategy -- one that has given rise to massive state-owned corporations, with many of the largest listed on American markets -- and toward services that can care for its elderly and increase the efficiency of its smaller working class.

Combined with a national birth trend that sees more than 120 boys born for every 100 girls -- one of the highest such ratios among top economies in the world -- China will be hard-pressed to bolster its youth population in the next few decades. But while that will hit the country's long-term growth rates, China does have other statistics firmly in its favor.

2. 651.3 million

China had an estimated rural population of 651.3 million people in 2012, according to figures from the World Bank. That's as many people as the populations of the United States, Russia, Japan, and France combined all living in China's rural fringes that, for the most part, haven't caught up with the country's advances in recent decades.

Urbanization has fueled China's growth, as some of the country's largest cities, from Shanghai to Wuhan, have grown into metropolises large and tall enough to rival America and Europe's biggest cities. As more and more Chinese citizens have flocked to the cities, companies both domestic and foreign have tapped into this source of new, cheap labor as a means to reduce manufacturing costs and boost their balance sheets.

But the face of China's urbanization is changing. The cheap "made-in-China" era is coming to an end as labor costs rise and companies look for cheaper means of production. Increasingly, China's leading companies of the future will need to tap into the nation's growing urban population not as a source of labor, but as a massive consumer market unrivaled on a global stage. This strategy's already paid off in a big way for international leaders in the auto industry that have tapped into China's burgeoning auto market as the revenue base of the future.

Yum! Brands (NYSE: YUM ) is one company that's already hitched its wagon to China's urban potential, for better or worse: Yum!'s KFC and Pizza Hut brands have thrived in China's market, but a 13% year-over-year same-store sales decline in July hammered the stock recently. Consumer stock investors should expect more hits and misses as companies look to cater to this lucrative market in the years to come.

3. 624 million

Not every industry is still emerging in China, however: The materials industry has come to be dominated by China lately, as exemplified by the 624 million tonnes of steel the nation used in 2011 alone. That was more than six times the amount of steel that the U.S., the second-place nation, used -- and China further beat a second-place America six times over in steel production for 2011.

It's a symbol of how China's investment in its growing nation has fueled its global ambitions -- and also a sign of how those ambitions can be a poison for investors. A caustic mix of oversupply and weak demand in the steel industry has taken down America and Europe's top steelmakers, which have ceded the lead in the industry to China's state-run behemoths, such as Wuhan Iron and Steel.

Wuhan's stock has suffered as a result, but the contagion has plagued former titans of the industry. China's quest to lead materials industries, combined with the general economic slowdown in the wake of the recession, has led to lean times in the materials sector. U.S. Steel (NYSE: X ) in particular has seen its stock fall more than 40% over the past two years, and the company's earnings have turned into the red for the past three fiscal years. Beijing has ramped down production across its state-run companies this year as a result of its slowdown, but China's materials giants are still dominating this hard-hit sector.

Aluminum and other industries have fared just as poorly, as oversupply has forced factory closures and worse. It's just one way that bigger isn't always better for investors in China.

4. 44%

Forty-four percent isn't even a majority, but it's a huge number when dealing with a population like China's. That's the percentage of Chinese citizens on the Internet as of the end of June, according to the Chinese Internet Network Information Center. It's an amount that adds up to 591 million people, more than the populations of the U.S. and Indonesia combined and a gain of 27 million Web-linked Chinese citizens since just the end of last year.

Out of all the industries standing to benefit from China's growth, Internet companies may top the list. China's increasing urbanization will only lead to more citizens on the Web, but Beijing's restrictive Internet regulation has prevented many U.S. or other international companies from establishing a strong base in the country.