| « Robot sales shift to higher gear as labor force wanes | 'Made-in-China' shines at World Cup » |

China surpasses US as world's top corporate borrower

Sluggish capital market limits funding: expert

The Chinese mainland has surpassed the US as the world's top corporate borrower, and higher debt risk in the world's second-largest economy may mean greater risk for the world, a report said on Monday.

However, Chinese economists noted that the debt risk in China's corporate sector is still well under control.

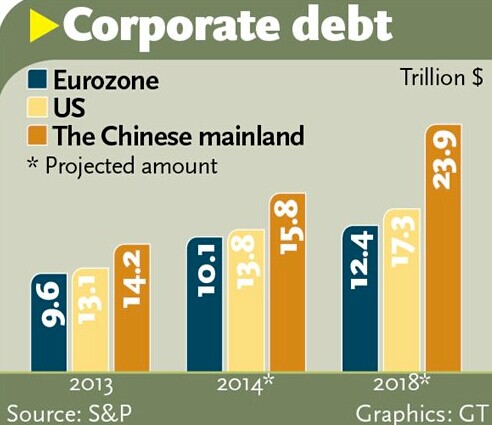

Nonfinancial corporate debt in the Chinese market was estimated at around $14.2 trillion by the end of 2013, overtaking the $13.1 trillion debt owed by the US corporations, a progress happening sooner than expected, said a report from the Standard & Poor's Ratings Services on Monday.

The report expects that by the end of 2018 debt needs of mainland companies will reach $23.9 trillion - around one-third of the almost $60 trillion of global refinancing and new debt needs.

"It [the mainland surpassing the US as the largest corporate borrower] is not surprising at all, as the [size of] mainland non-service sector has already surpassed that of the US," Tian Yun, an economist with the China Society of Macroeconomics under the National Development and Reform Commission, told the Global Times on Monday.

Cash flow and leverage at mainland corporations has worsened after 2009, and debt risks in the property and steel sectors remain a particular concern, the report said.

Private companies are facing more challenging financing conditions - highlighted by China's first corporate bond default case of Shanghai Chaori Solar Energy Science and Technology Co in March and another case of default of leading private steel maker Shanxi Haixin Iron and Steel Group.

"The capital market has been sluggish during the past few years, leading to the fast growth in corporate debts," Xu Hongcai, director of the Department of Information under the China Center for International Economic Exchanges, told the Global Times Monday.

Experts noted that the rapid growth in debt reflected some problems of the Chinese economy, but the size of the debt is still in a safe range and will not cause major risks as the economy remains stable.

"The problems of the Chinese economy are institutional and structural," Tian said, "By addressing these issues, debt risks can be managed."

Tian further noted that most corporate debts in China are internal debts, thus debt problems in the country will have limited impact on the rest of the world.

The report also said a possible contraction in "shadowing banking" will be detrimental to businesses as general.

But Xu noted that China's tighter supervision of the "shadow banking" sector will make it more transparent and better-regulated, which will reduce the potential risks in the sector.