Report: Top Chinese real estate companies hold half of market in 2017

March 23rd, 2018Market share of the Chinese top 100 real estate companies reached about 50 percent in 2017, up 7.9 percentage points year-on-year, suggesting a trend for concentration in the domestic property industry, report said.

Total sales of those companies grew 32.8 percent to surpass 6.37 trillion yuan ($1 trillion) last year, with a 23.7 percent increase in sales area, showing an overall positive performance, according to a report released Thursday by the China Index Academy, the Development Research Center of the State Council and Tsinghua University.

"Since 2003, the Chinese property industry has undergone a 15-year golden era as one of the pillar industries in the Chinese economy and an engine of urbanization," the report said.

Gross assets and sales of the top 100 real estate operators have seen fiftyfold growth amid the period, showing a steady and quick development, the report showed.

In 2017, those companies strengthened cost controls to improve the quality of operations, whose average revenue and net profit increased 28.5 percent and 30 percent respectively, it said.

They also helped to provide houses for low-income families and construct eco-friendly and energy-saving buildings, as part of the effort to realize corporate social responsibility, according to the report.

However, the average asset-liability ratio of the top 100 property developers reached 78.9 percent, up 2.2 percentage points over 2016, suggesting greater pressure from debt.

In the future, the report suggested those companies should not buy too many parcels of expensive land in hot cities to prevent the risk of overstock.

Besides, they need to attach more importance to the safety of cash flow to avoid capital risk, it said.

Minimum salaries on the rise in China

March 22nd, 2018China's Ministry of Human Resources and Social Security announced the country's 2017 monthly minimum salary standard and hourly minimum salary standard among 32 provinces and cities.

According to the data, Shanghai's monthly minimum salary was top in the country last year, with its full-time workers at least earning 2,300 yuan ($364), and Beijing's part-time workers earned the highest hourly minimum salary at 22 yuan.

Monthly minimum salaries in Shanghai, Shenzhen, Zhejiang, Tianjin and Beijing have broken 2,000 yuan, and Beijing, Tianjin and Shanghai's hourly minimum salary has also reached more than 20 yuan.

Last year, 20 provinces and cities increased minimum salary standards, with an average increase of 11 percent from 2016.

This year, many other regions in China, including Jiangxi, Liaoning, Tibet and Guangxi, have all enhanced their minimum salary. Guangxi increased its minimum by 20 percent.

Shanghai announced it will increase its monthly minimum salary standard by 5 percent to 2,420 yuan per month starting April 1.

China's R&D spending up 11.6 pct in 2017

February 13th, 2018China's spending on research and development (R&D) grew faster in 2017 as the country continued to push for innovation-driven development.

Preliminary calculations showed that R&D spending rose 11.6 percent year-on-year to 1.75 trillion yuan (about 280 billion U.S. dollars) in 2017, 1 percentage point higher than in 2016, the National Bureau of Statistics (NBS) said Tuesday.

The spending accounted for 2.12 percent of China's gross domestic product, 0.01 percentage points higher than the previous year.

Chinese enterprises spent more than 1.37 trillion yuan on R&D last year, up 13.1 percent from 2016, while R&D spending at government institutions and colleges increased 7 percent and 5.2 percent, respectively.

Some 92 billion yuan, or 5.3 percent of the total spending, was put into fundamental research in 2017, up 11.8 percent from a year earlier, the NBS said.

According to the 13th five-year plan for national science and technology talent development (2016-2020), China will increase its annual per capita spending on R&D to 500,000 yuan by 2020, up from 370,000 yuan in 2014.

China had 5.35 million people working in R&D at the end of 2015, the world's largest pool of R&D personnel.

Sales of FMCG surge 4.3%

February 7th, 2018China's sales of fast moving consumer goods, such as packaged food, beverage and cosmetics, recorded the highest annual growth in three years in 2017 at 4.3 percent, with online sales volume rising 29 percent, according to Kantar Worldpanel.

Retailers are adopting new methods to catch up with the digital transformation, with the combined sales volume of hypermarket, supermarket and convenience stores rising 2.6 percent, from 1.6 percent growth a year ago.

Most multinational and local retailers have strengthened their foothold with new store openings or business formats through tie-ins with Internet companies.

Sun Art Retail Group, which runs Auchan and RT Mart malls, remains the biggest player by sales, lifting its market share to 8.4 percent from 8.1 percent a year ago.

Yonghui recorded the fastest growth with new formats such as Super Species and community stores. It overtook Carrefour as the fourth largest retailer, with a market share of 3.3 percent.

About 60 percent of Chinese families have purchased fast moving consumer goods online, and in Beijing, Shanghai, Guangzhou and Chengdu, that figure is nearly 70 percent.

China embraces new opportunities in offline retail despite e-commerce development

January 29th, 2018

China's offline retail is embracing new opportunities as e-commerce is presenting innovative consumption experiences for the country, said People's Daily in a Monday report.

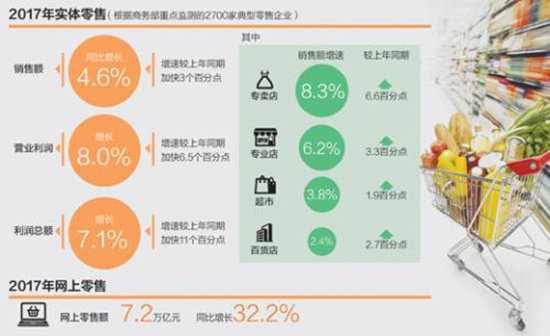

According to recent statistics released by China's Ministry of Commerce (MOFCOM), the sales of 2,700 key typical retail enterprises rose by 4.6% year on year in 2017, 3 percentage points higher than that of last year over the same period.

Convenience stores are a miniature that shows signs of the recovery of the retail industry. The overall business index of China's convenience stores was 71.28 in the fourth quarter of 2017, 2.03 higher than that in the third quarter, said a report issued by the MOFCOM.

The statistics of different businesses of typical retail enterprises showed that in 2017, the sales of specialty stores, pro-stores, supermarkets, and department stores increased by 8.3%, 6.2%, 3.8%, and 2.4%, respectively, 6.6, 3.3, 1.9, and 2.7 percentage points higher respectively than those of the first half of this year over the same period of time.

Online and offline retail have always been considered rivals to each other. Some people even attributed the previous fall of market share of the real economy to the diversion of e-commerce.

"Online and offline competition is not a 'win and die' situation, and 'survival of the fittest' is the only market law," said Li Keaobo, Executive Secretary General of Center for China in the World Economy under Tsinghua University.

After timely adjustment, offline retail still has the opportunity to win the market share because of its unique advantages in meeting consumers' demand.

The narrowing gap between online and offline prices is the primary reason for the recovery of offline business. "Now the prices offered at online platforms and department stores are almost the same," said a consumer named Cai Wei, adding that he prefers the latter since it features more credibility.

"China's online and offline retail are experiencing integration and common development," noted Ren Guoqiang, senior partner of the global strategy consulting firm Roland Berger. More Chinese retail enterprises have realized that innovation, enhanced operating capability, and the upgrading of consumer experiences are the only way of development, he said.

"But we still have to further improve the business environment for retail industry," said Li. According to him, the online-offline integration calls for a fair and orderly competition environment.

Currently, online retail sales account for 15% of the total retail revenue in China, and a well-built monitoring system would better guide the direction for its future development.

China's Hainan cuts red tape to attract foreign investment

January 25th, 2018Denis Koreshkov waited only one night before getting his business license in south China's Hainan Province.

The 34-year-old Russian engineer and his business partners were amazed at the administrative efficiency. The office of his company in Hainan Software Park in Chengmai County, which is undergoing fitment and equipment installation, will be put into use after Spring Festival, which falls on Feb. 16.

Koreshkov and his partners moved their computer technology company from Russia to Hainan last year and established the Hainan firm with a registered investment of 10 million U.S. dollars.

"China is a rising power in the IT industry and has a huge potential market," he said. His company has signed three cooperation projects in Hainan.

The Russian entrepreneur is among foreign investors benefiting from the favorable business environment in China.

The country has been making efforts to remove barriers to market access and requires local governments to create healthy business environment for fair competition.

To attract foreign investors, since October last year the approval of foreign enterprises in Hainan has only taken three days, compared with 18 days previously.

Hainan took the lead on online administrative approval in July 2017, enabling applicants to submit administrative approval affairs at home with a computer.

"A highly efficient government will cut the institutional and time costs for companies' development," said Wang Jing, head of the Hainan provincial government affairs service center.

"Streamlining administrative approval procedures will push the transformation of government functions and create a favorable soft environment for economic development," she said.

Wu Yusheng, founder of Tetranov International, a U.S. pharmaceutical company, also feels the benefits of such policies.

The registration and construction of his health product plant in Haikou, the provincial capital, only took five months.

"We have lots of investment projects around the world. The Hainan project is the fastest," Wu said.

To attract foreign capital, Hainan also identified 12 key industries, including tourism, Internet, medical treatment and bio-pharmaceuticals, and introduced preferential policies.

Due to the policies, the island province has become a hot spot for foreign investment.

In the past five years, 360 foreign-funded enterprises have been set up in the province, with contracted foreign capital reaching 25.4 billion U.S. dollars. In 2017, the island signed almost 40 foreign investment projects.